GoCardless

Break the cycle of failed payments

Half of all businesses see more than 7% of payments fail*, leading to bad debt, higher churn and loss of revenue.

Break the cycle with GoCardless, and collect over 97% of payments at the first attempt. Speak to us today to see how your business compares to all-important payment benchmarks.

Get the framework for optimising your recurring payments

Discover the 8 key dimensions needed to maximise the return from your payment strategy. From the customer acquisition funnel to payment operations, learn how all 8 dimensions combine into one framework for payment-led growth and efficiency.

Plus, get important payment benchmarks, so you can see how your business compares to the competition. All in under 10 minutes.

Payment failure has a big impact on your entire payment strategy

Increased churn

2 out of 3 businesses see their failed payments turn into churn more than 10% of the time*, and churn also leads to higher chargeback rates.

More bad debt

On average, businesses with B2C revenue see 16-20% their failed payments turn into bad debt, while B2B businesses see 11%-15% turn into bad debt.

$1million+ uncollected revenue

Enterprise businesses stand to lose over $1million in uncollected revenue** every year due to payment failures.

Thought leadership paper: Rethink your payment strategy to save your customers and bottom line.

GoCardless commissioned Forrester Consulting to conduct a study of 700 payment decision-makers in organisations with recurring revenue models. Forrester learned that recurring B2B payments are pushing firms to modernise their payment technology and update their payment operations.

View the full report to better understand the challenges and opportunities facing global enterprise businesses, and what they’re doing to rise to these challenges.

Benchmark your recurring payment strategy

Have a 15-minute payments health check with one of our team to benchmark your payment operations, and understand how GoCardless can help improve your key payment metrics.

Make recurring payments a success with GoCardless

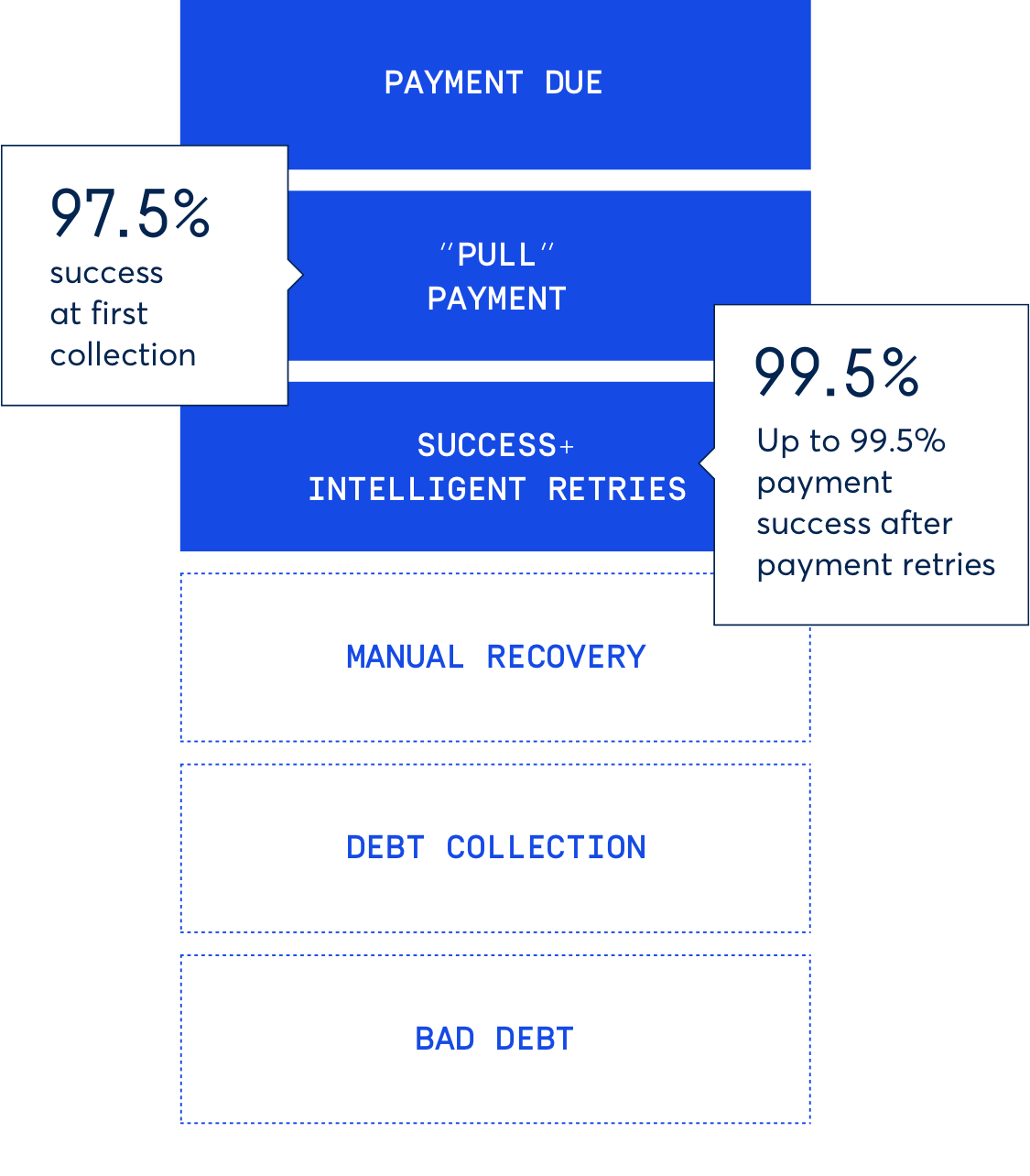

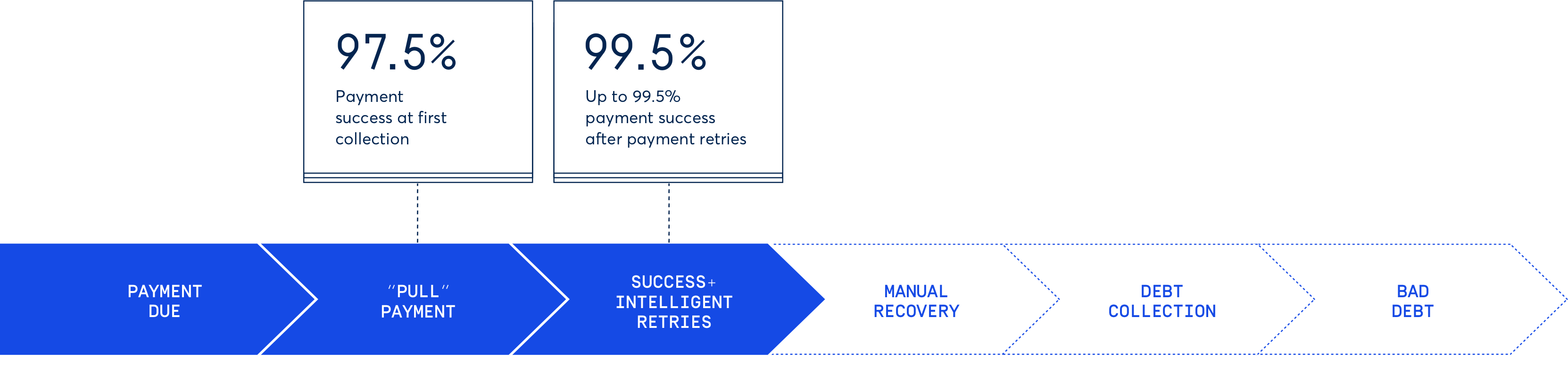

The average GoCardless payment failure rate at the first attempt is less than 3%. Optimise your payments even further, using Success+ to retry those that do fail.

Pull-based payment collection

GoCardless is built on bank debit (also known as Direct Debit), a pull-based, bank-to-bank payment method that allows businesses to pull payments directly from their customers’ bank accounts.

Lower churn rates

30% of churn is involuntary, stemming from failed payments. Maximise payment success with GoCardless and retain loyal customers for longer.

Intelligent payment recovery

Sit back and let Success+ retry payments on the optimal day to collect from each customer. Recover up to 76% of any payments that do fail with Success+.

Trusted by over 55,000 global businesses

GoCardless is used by over 55,000 businesses around the world, including global enterprises like DocuSign, The Guardian, 8x8, Box and Bridgestone. GoCardless processes $15bn+ annually, and has been funded by prestigious investors including Google Ventures and Salesforce Ventures.

We’ve seen payment failures drop from 3.6% to 0.48%. This 7.5x improvement helps ensure a seamless experience for our customers.

Elise Nunn, Head of Operations, Plum

Benchmark your recurring payment strategy

Have a 15-minute payments health check with one of our team to benchmark your payment operations, and understand how GoCardless can help improve your key payment metrics.