Payments - the last frontier of customer centricity

Last editedMar 20203 min read

Customer choice is powering business. It has become the not-so-secret ingredient in business success. A quick online search will return hundreds of stats like these:

Customer-centric companies are +60% more profitable than companies that don’t focus on customers. (SuperOffice, 2020)

The top 10 most empathetic companies increased their financial value more than twice that of the bottom 10 companies. (HBR, 2016)

80% of customers are more likely to do business with a company offering personalised service. (Epsilon, 2018)

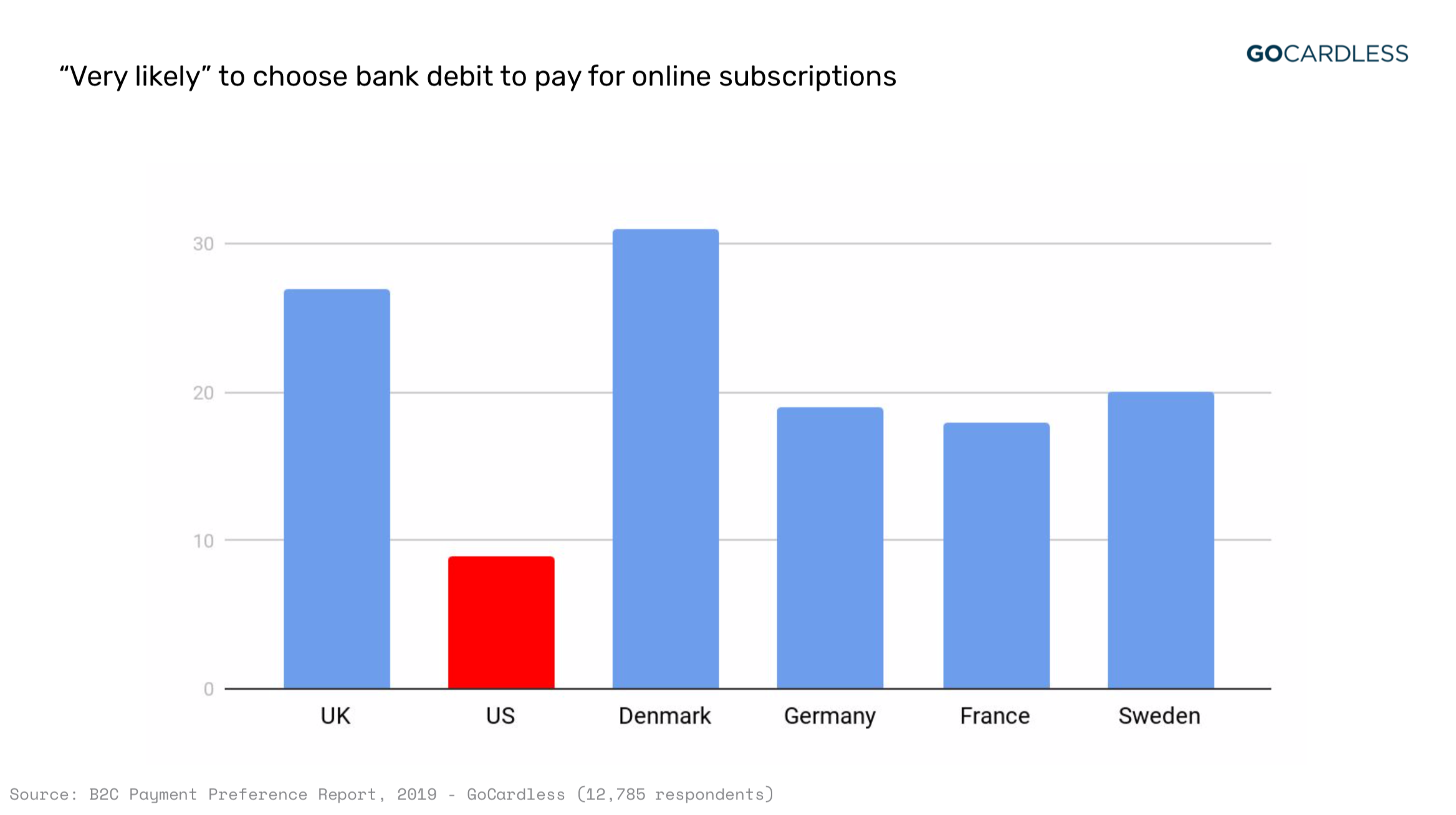

But have you ever asked: “I wonder how my customers in different countries actually want to pay?” What could be a more customer-centric question to ask yourself? Letting people and businesses pay in the way they want can make the difference between a customer won, and a prospect lost. Let's take one example to show what we mean. In a recent report by YouGov, commissioned by GoCardless, a third of consumers around the world said they are likely to choose bank debit to pay for online subscriptions. Yet of the 44 top global B2C subscription websites, only one (Audible in Germany) offers this method. The opportunity gap is clear. It's time you elevate payment from a financial afterthought to a core part of your customer centric strategy. This is the message when it comes to your global expansion plan. You can have done all the hard work ... localised your product features, recruited local sales and marketing teams, got yourself across the national regulations /compliance of the new markets ... and it could all be for nothing because you haven't considered how your target customers actually want to pay. If you want to be truly customer centric, in the complete sense of the term, you need to elevate payment right from the start.

Payment preference - a different picture in every country

But here's the rub. Payment preference differs in different countries, with different products, and whether you're selling to people or businesses. A payment method that works for you in the UK may not be suitable in Europe, or the US, or Australia. In 2019, GoCardless set about trying to understand this complex picture of payment preference, in a series of reports. We surveyed almost 18,000 businesses and consumers across 10 markets and multiple business models that use recurring payments.

![[Report] Global payment preferences for recurring B2B purchases](https://images.ctfassets.net/40w0m41bmydz/3Sx4oPTWqV3OFgftVGB7Oq/ea2fb2af6adb6a05d1c2de391e6396ff/global-payment-preferences-b2b-report-hero.jpg?w=1200&h=1510&fl=progressive&q=50&fm=jpg)

[Report] Global payment preferences for recurring B2B purchases

We surveyed 4,990 businesses across 9 markets to determine which payment methods businesses prefer for different use cases.

![[Report] Consumer payment preferences for recurring purchases: 2019](https://images.ctfassets.net/40w0m41bmydz/5Je7ZleGNzcKhGclfXoCn5/8f78b8fb18dca84c9adbc2dc46105c77/new-images_gatedcontent___images___cover_payment-preferences-for-recurring-purchases-2019-uk.jpg?w=1200&h=1484&fl=progressive&q=50&fm=jpg)

[Report] Consumer payment preferences for recurring purchases: 2019

12,785 consumers across 10 different markets share their payment preferences in 2019.

Let's start with consumer subscriptions.

In the UK the most likely way for people to pay for online subscriptions is bank debit - 27%. Yet look to the US and it's a very different picture - bank debit is the least likely online subscription payment method at just 9% popularity. In this regard the US is out of step with Europe. In four other European countries we surveyed, bank debit was the most likely payment option, to varying degrees.

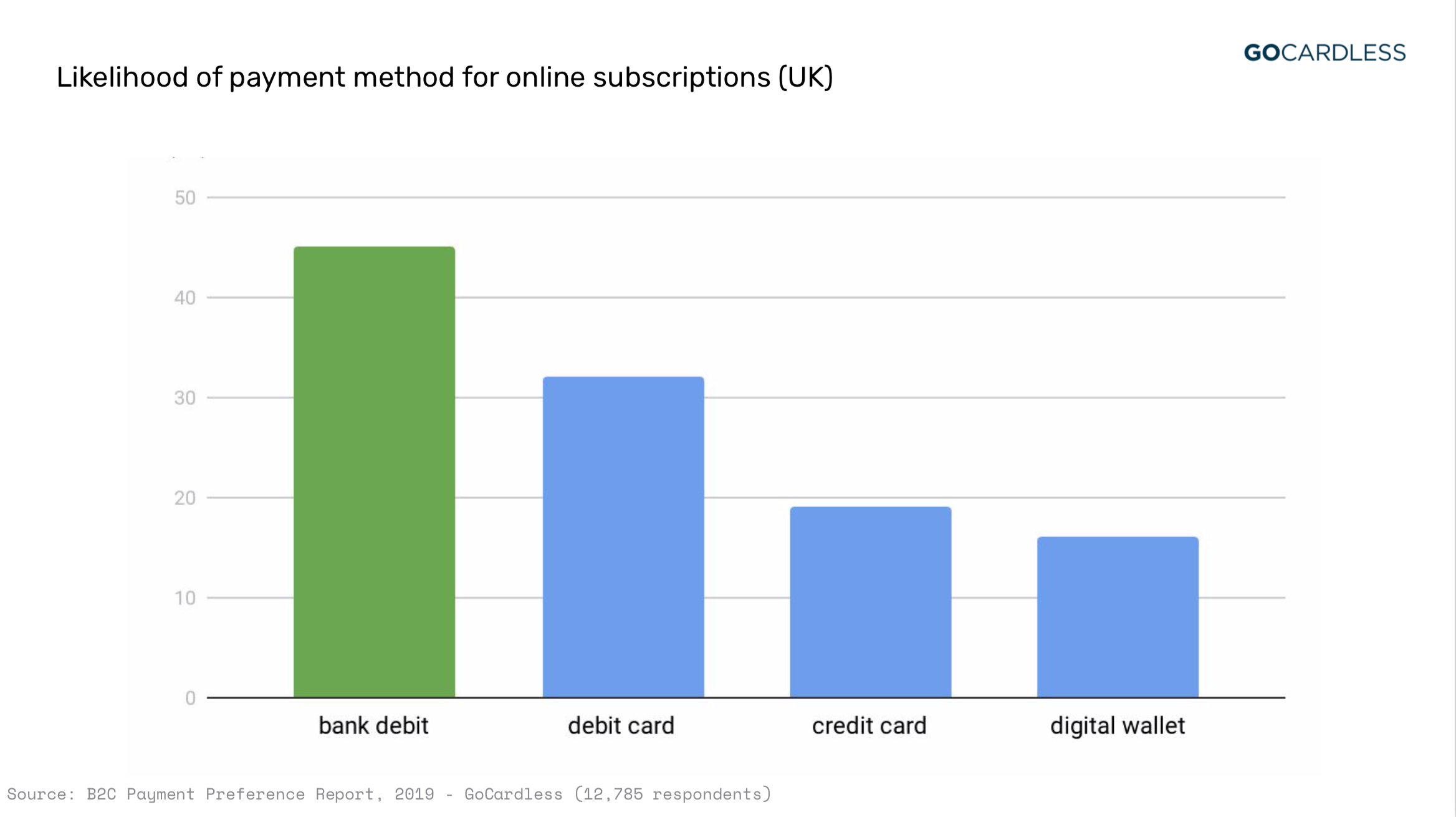

But it's really only when you look at the picture country by country that you can start to shape your payment strategy. Let's hone in on the UK, and broaden the scope from most likely to likelihood.

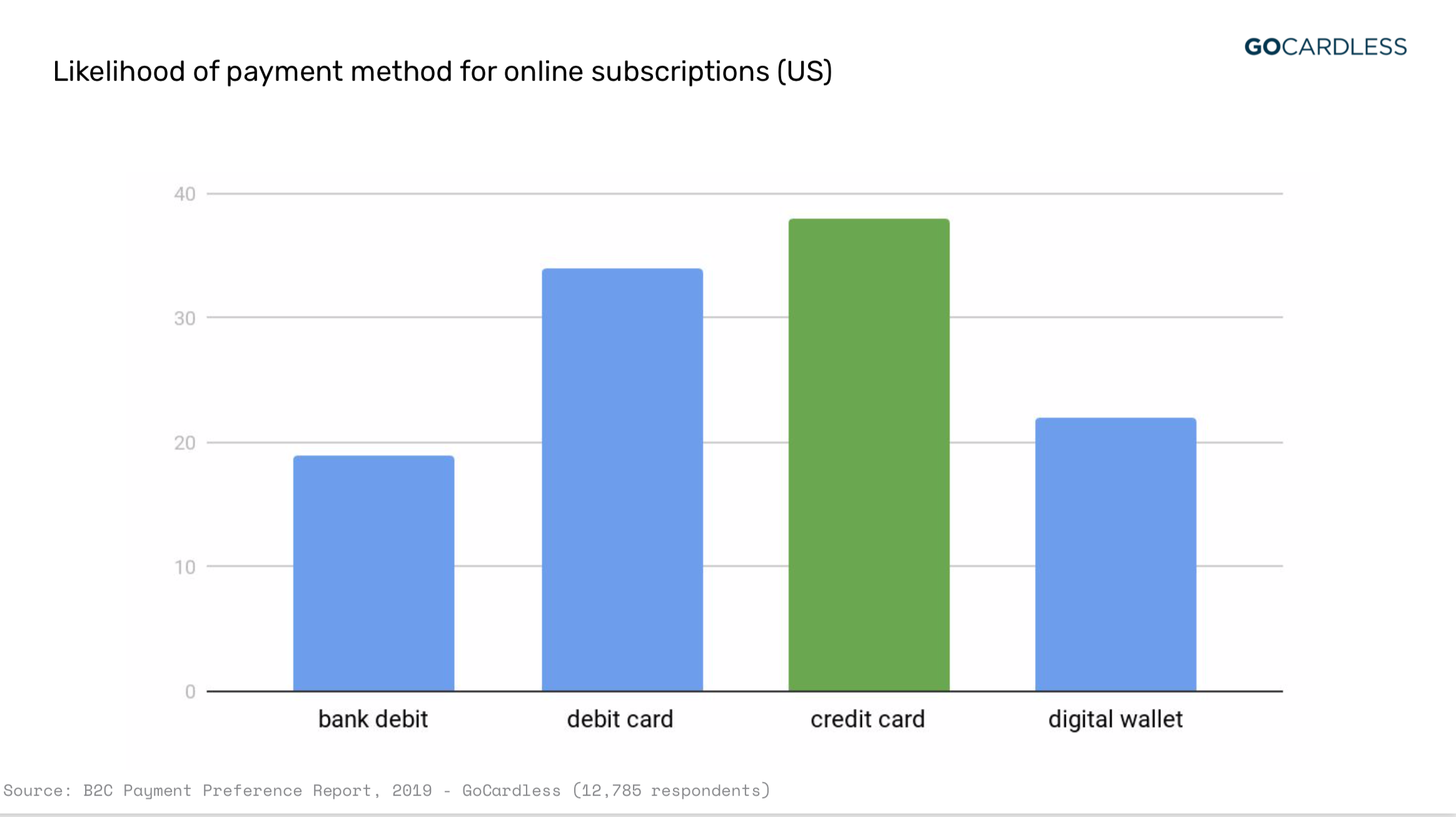

The clear message here - if you're offering digital subscriptions to consumers in the UK, bank debit should be your priority. When you look at the US through the same lens, it's cards that rule. Bank debit is the least popular way for consumers to pay for online subscriptions.

In Australia it's a much more level playing field - the message there being you need to offer more. In fact wherever there is a preference for a particular payment method, regardless of where it ranks against other methods, you should consider it, if you want to be truly customer centric.

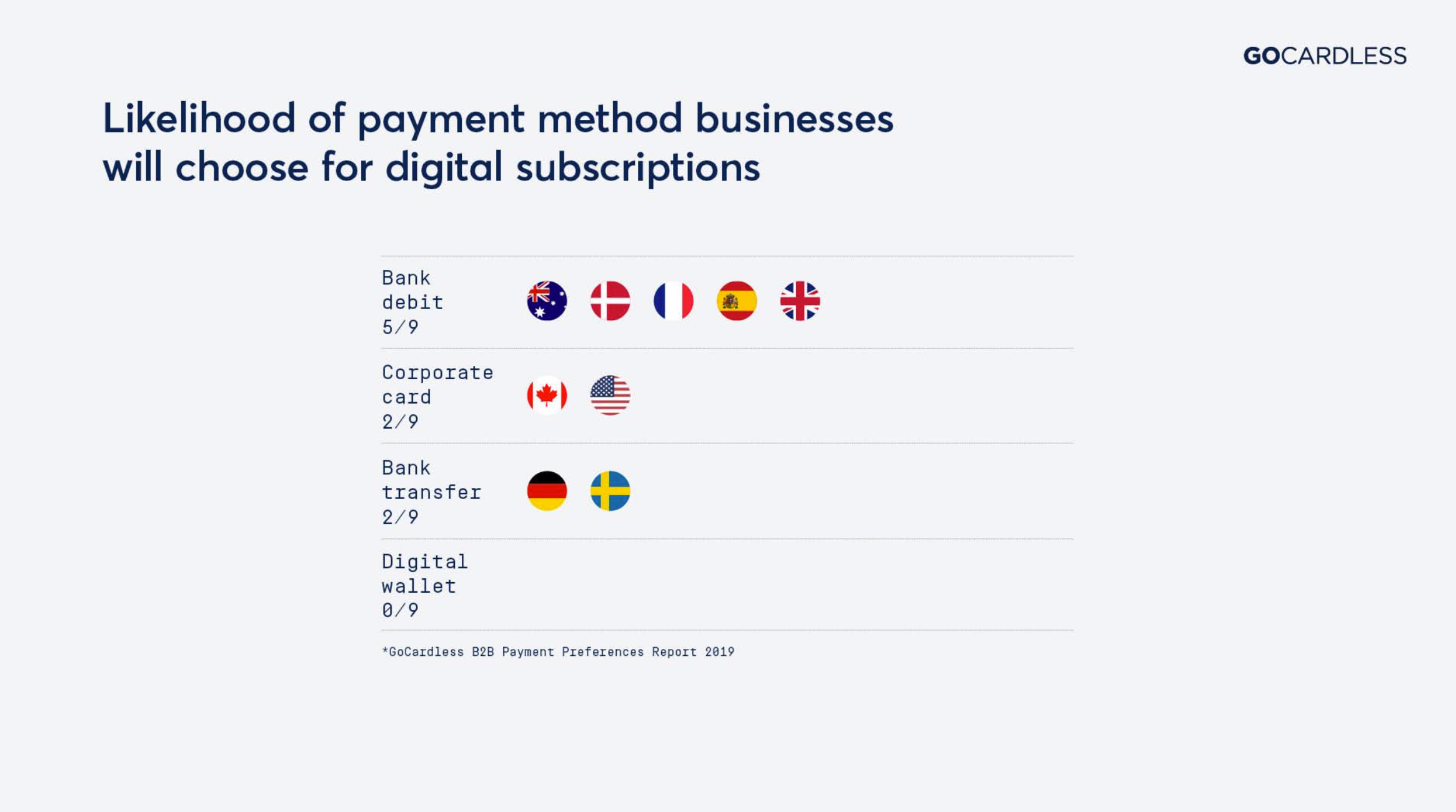

How does this all look in the B2B world?

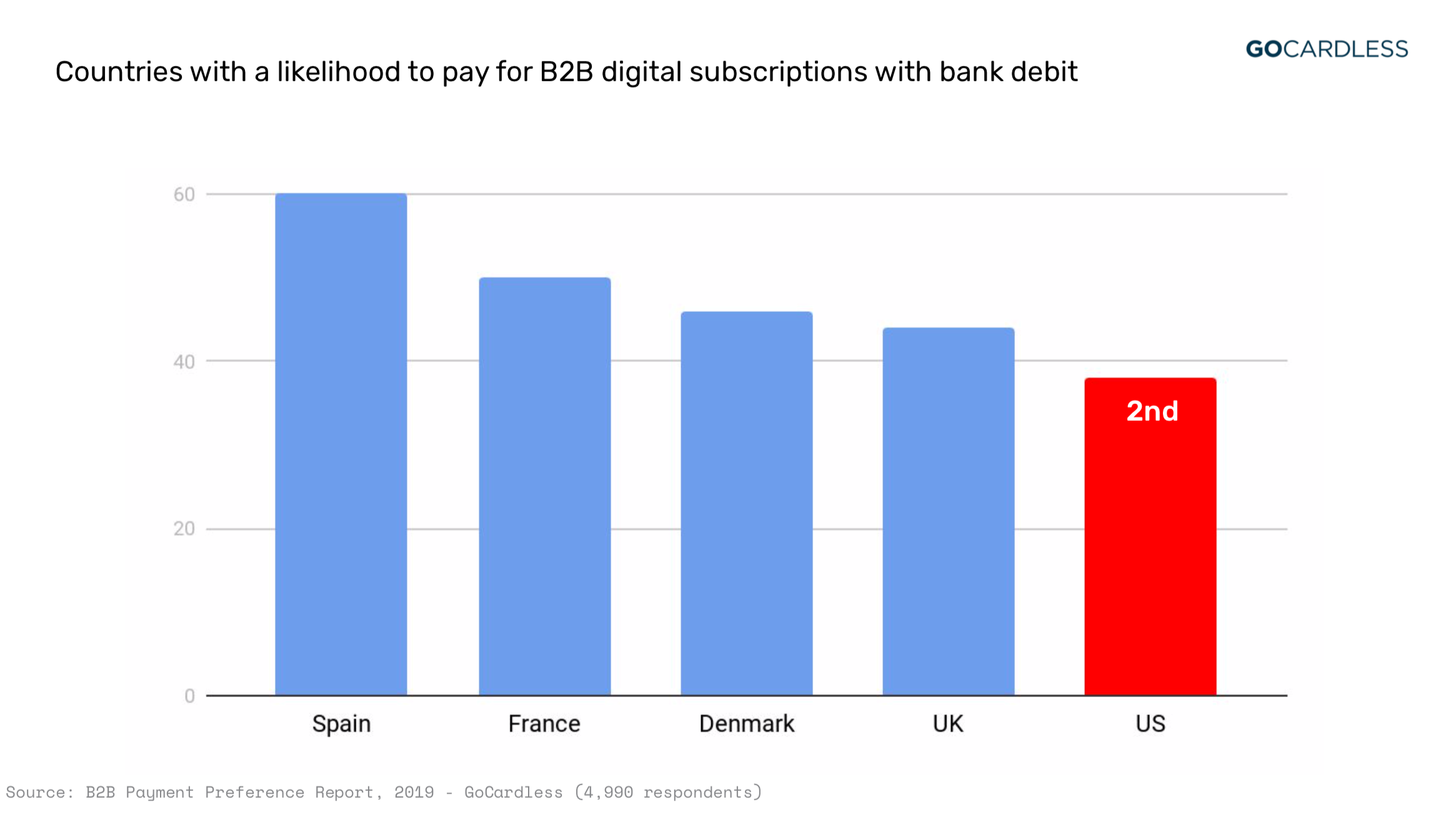

Globally for B2B bank debit is preferred for digital subscriptions (e.g. SaaS). It is the most popular method in Australia, and across four of the European markets we surveyed. (UK, France, Spain & Denmark). In the US, the preference for cards we saw in the B2C space is also the picture with B2B. However, what’s different is the much higher preference for ACH bank debit. In fact it is the second most preferred way for businesses to pay for digital subscriptions.

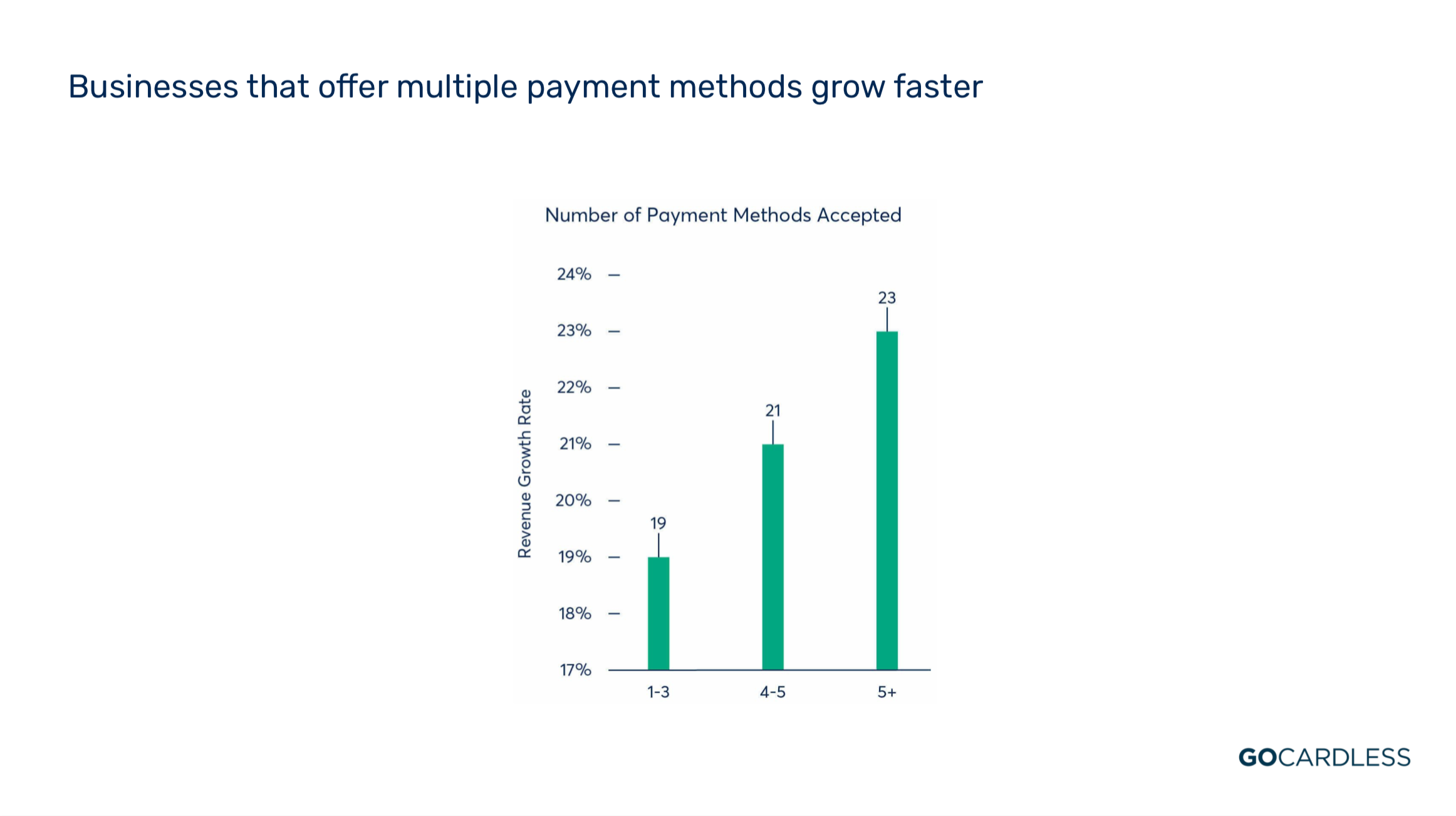

So the key message here, as the quote above reinforces, is that doubling-down on one payment method is unlikely to pay dividends. Just like with every other aspect of customer centricity, payments is about offering your customers choice. And the research shows that, when you do that, you grow.

“Bank debit is extremely prevalent in Europe. Our customers there demanded it... It’s not a one-size-fits-all approach. You need to understand how your customers want to pay in those new markets and find a payment provider that can support you in doing so.” (Evan Miller, Global Director of Billing and Collections, SiteMinder)

Choice = growth

Here's one example, which just takes a look at the impact of payment customer centricity for subscription businesses.

Only by exploring the data relevant for the countries you're targeting, and the business model you run, will you unearth the insights you need to create a truly customer centric payment strategy. As a start, watch our recent webinar, where we look into this data in a bit more detail, with the help of Paul Lynch, CEO of Chargify.

Webinar - Why your international expansion plan should prioritise payment preference

Notes:

> Bank debit refers to the process where a customer authorises a business to automatically take payments from their bank account. It can sometimes be referred to as: Direct Debit (UK); ACH, ACH payments, ACH debit (US); bank debit, direct debit (Aus); Pre-authorised debit (Canada); and also Direct withdrawal, pre-authorised payment.

Popular bank debit schemes include: Bacs (UK), ACH (USA), SEPA (Eurozone), BECS (Australia), Autogiro (Sweden), Betalingsservice (Denmark), PaymentsNZ (New Zealand), PAD (Canada)

> Respondents were asked about their preference for each payment method. Preference for each payment method is rated 1-10, with 1 being very unlikely to use & 10 being very likely. Preference expressed as a % of the likelihood to use each payment method. “Very likely” = 10, and likelihood = 8-10