Is Open Banking the biggest change in banking for a decade?

Last editedMay 20243 min read

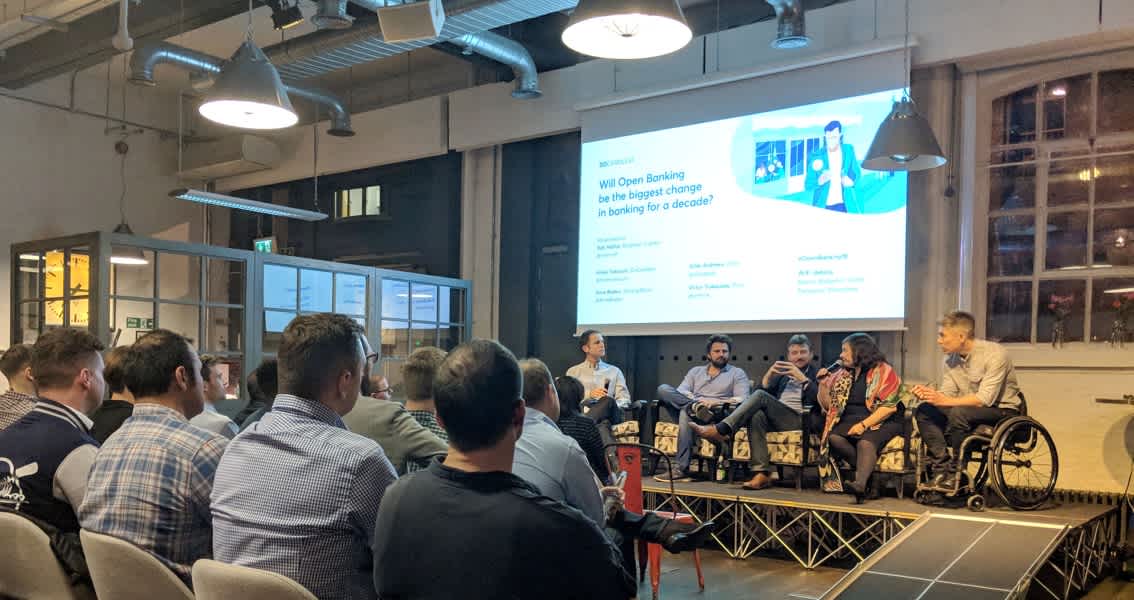

That was the question posed to the CEOs of Plum, Zopa, Starling Bank, and GoCardless last week, by Balderton Capital’s Rob Moffat at our panel discussion on the impact of Open Banking.

In this blog, we’ll cover the highlights of that discussion; including our panellists views on the current state of Open Banking and the opportunities for fintechs, as well as their predictions on what’s to come.

The current state of Open Banking

Services enabled by the Account Information Service (AIS) are the first off the blocks, though most license applications to date have come from fintechs in the lending space.

Zopa is one of those businesses. While, like many fintechs it has historically used Screen Scraping, new regulatory technical standards in Europe will stop that practice by September 2019.

So how are businesses like Zopa planning to use Open Banking APIs?

To reduce friction in the loan application process, explained Zopa Co-Founder and Chairman, Giles Andrews, for example, by automatically completing information for an applicant.

Going forward, Open Banking will create a world of ‘frictionless banking’, Giles added, and Zopa is also looking at how the APIs can help them make better lending decisions. Read more on the latter from Credit Kudos.

Meanwhile, GoCardless Co-Founder and CEO Hiroki Takeuchi, flagged that there needs to be “greater understanding” among regulators of the different use cases for AIS.

For example, rather than simply providing a 'dashboard' type service to aggregate account information for a user, GoCardless proposes to use the API to check whether a payer has sufficient funds, helping payers and businesses avoid failed payment fees.

Hiroki commented: “The level of understanding around AIS needs to change – when there is more understanding of the different use cases and value they can bring for a user, we’ll see more innovation.”

What about Payment Initiation Services?

Payment Initiation Services (PIS) are still in their infancy and GoCardless is among those who have acquired a license to provide such a service – meaning we will be able to initiate instant bank to bank ‘push’ payments for our customers.

“It’s still in the test phase,” said Hiroki, “we haven’t seen any real activity going through these rails. It’s possible at the moment for limited, one-off transactions, and there is talk of applying it to recurring transactions in the future.

“We’re reinventing the way people take recurring payments and there are lots of different ways we can use Open Banking and the related permissions to improve our services. We don’t really care about Direct Debit as a mechanism, we care about facilitating recurring payments – it’s about finding the best way possible to do that."

Adoption of PIS is likely to come once consumers have started to use AIS in a more meaningful way, suggested Hiroki: “From a consumer perspective there is more to be gained from AIS, since it opens up entirely new services, while PIS will improve the services they already use, for example making payments smarter and faster."

For both of these, he added, “friction in the user experience needs to come down before people will use it.”

Read more about how Open Banking might improve GoCardless services in this blog from GoCardless' VP Product, Duncan.

The opportunity for fintech

While Open Banking has different implications for each of our panellists, the opportunity for fintech overall is significant. “Fintechs are focused,” commented Hiroki, “and as a result, we are going to get a greater share of global financial services."

Is there a danger of Open Banking creating too many intermediaries, and so introducing more friction for the user, asked Rob Moffat. “Not anymore,” suggested Hiroki. “It used to be that you had to go to different buildings if you wanted to use different providers for your various financial needs. Now you just open up the apps on your phone, so it’s much easier.”

Sharing data with fintechs

Much has been made of the poor user experience of current Open Banking APIs, with published data showing the banks taking up to 23 seconds to provide data, and some banks still not providing data at all.

Since Open Banking in the UK doesn’t dictate design or usability standards, it’s up to the banks to create the right user experience.

Anne Boden, CEO of Starling Bank, pointed to legacy infrastructure in the banks, a fear of litigation and huge cost-base pressures, as the main obstacles. “The big banks are full of smart people who want to do the right thing but it’s incredibly difficult to get anything done,” she explained.

“To put it into context, I had a £950 million IT budget when I worked in one of the big banks, but I still couldn’t get anything done. That’s why we built Starling on APIs from day one...

“People in banks are also scared that their data will be launched into the world of tech and end up in Shoreditch, and they will be subject to huge legislation and claims….They also face huge cost-based pressures – fintechs are raising customer expectations around user experience and the banks needs to respond... but this results in more cost for them.”

Will Open Banking lead to meaningful change?

Our panellists agreed that the API economy overall is creating meaningful change in banking, but, added Hiroki: “In order for Open Banking to work, the banks need to get the implementation right and the regulators need to enable a wider variety of use cases.”

More specifically, the value for GoCardless customers will come, said Hiroki, “when all the banks enter the arena – for payments, it won’t be enough to be able to process payments for some banks and not others.”

So when will change come? In 3 to 4 years “we’re going to see exciting things in London,” predicted Anne. “Open Banking will make an impact, but it will take a while. We need to keep pushing the big banks/guides/posts/traditional-banks-embrace-open-banking/ to speed up innovation.”