GoCardless and GoProposal combine to enable radically different accounting for Amakari

Last editedMay 20213 min read

Kick-ass cloud accountant (check his LinkedIn if you don’t believe us) Dayle Rodriguez and his team at Amakari, the accounting firm he founded in September 2020, are on a mission. With the right advice from their accountant, he believes it’s possible for everyone to enjoy a four or even three day working week as standard.

To deliver on this goal, Dayle’s vision is to maximise time spent focused on achieving his customers’ objectives by leveraging automation to provide a “radically proactive” service. And drawing on his background as a web developer, he has a unique perspective on how the explosion of cloud-based tools in the accounting space can help him.

“SMEs need more than tax, cash flow and compliance advice from their accountant,” says Dayle. “They need guidance on acquiring and retaining clients, measuring metrics for success and even fostering the right company culture.”

“The only way to deliver this without massively increasing costs is to automate the must-have operational and compliance services, in order to maximise time spent on the human element of being an accountant. That is, connecting clients’ business goals to their personal ones – which is what gives the numbers real meaning, after all.”

GoCardless and GoProposal: “It just works”

In pursuit of this mission Dayle has assembled a tech stack in which GoCardless’s integration with partner solution GoProposal plays a leading role.

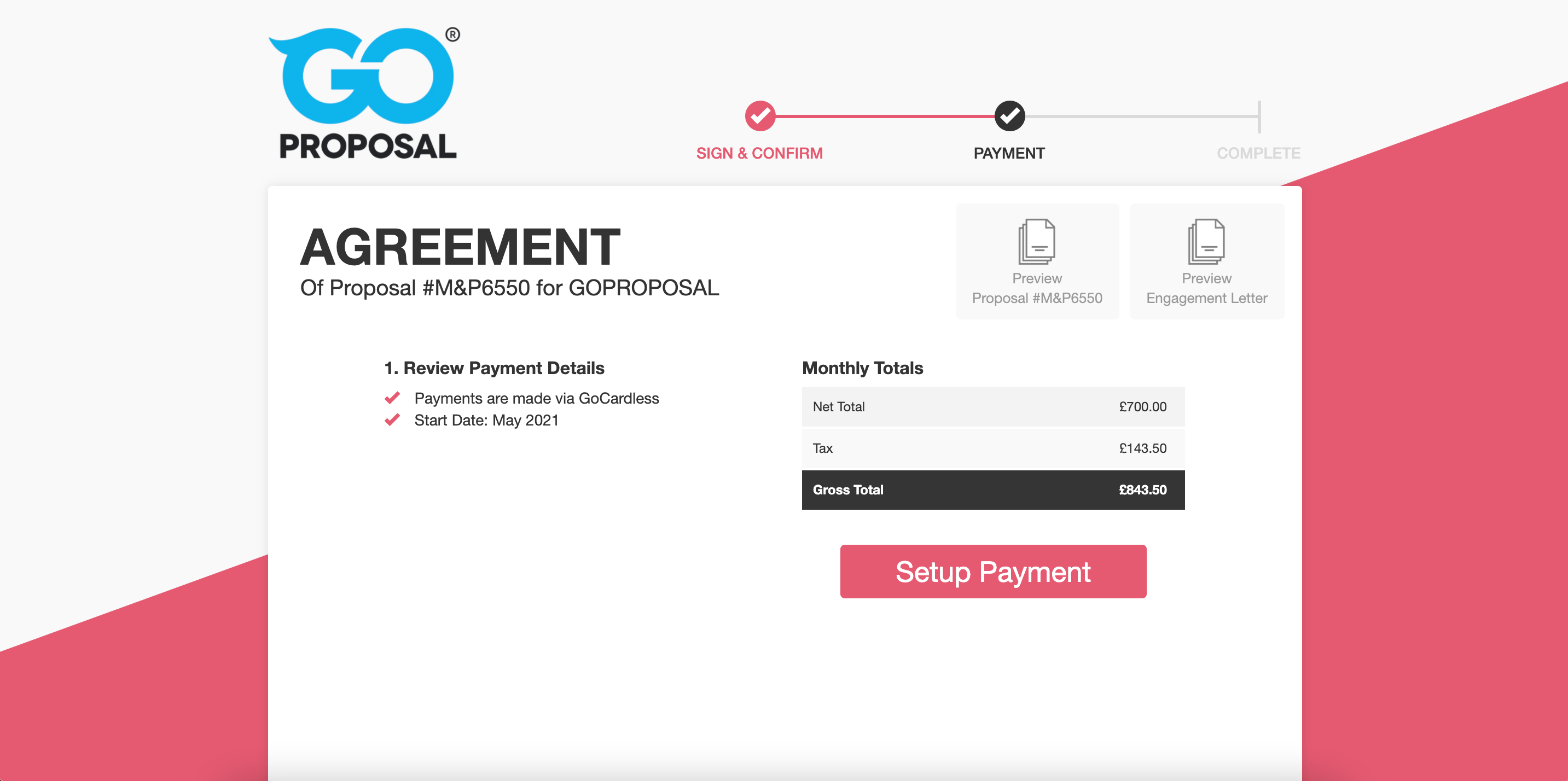

GoProposal enables Amakari to automate and standardise the creation, delivery and approval of customer fee proposals. This enables Dayle, in his own words, to create “a simple, consistent and scalable pricing structure, in which clients know exactly what they’re getting.”

The GoCardless integration then allows for the proposals’ recipients to approve and set up recurring payments in the same workflow. “As an accounting firm, we know cash flow is king so we don’t underestimate the power of integrating payments with proposals,” says Dayle. “Operationally it works like a dream, making conversion super convenient for customers. And once the proposal is signed our systems automatically know that the recurring payment has been set up and when it’s due. That cashflow is secured and easily accounted for in our reporting.”

As well as the conversion and cash flow benefits, Dayle also values the visibility offered by GoCardless into payments trends and issues, and the opportunities that creates for proactive customer engagement.

“The weekly and monthly revenue reports are a valuable layer of insight into our business and our customers,” says Dayle. “These include easy-to-read reports on repeat Direct Debit requests, that mean you can check-in with suppliers or customers to figure out why payments failed in plenty of time and before it becomes a major issue.”

The top line, according to Dayle, is that: “The integration between GoProposal and GoCardless provides the one thing every entrepreneur wants from technology. As a start up, I just want – need, actually – things to work. With this integration, once set up everything functions exceptionally well with minimum intervention. And they’re always innovating and improving, so the value gained keeps increasing.”

Drop-in Payment Pages create a seamless customer experience

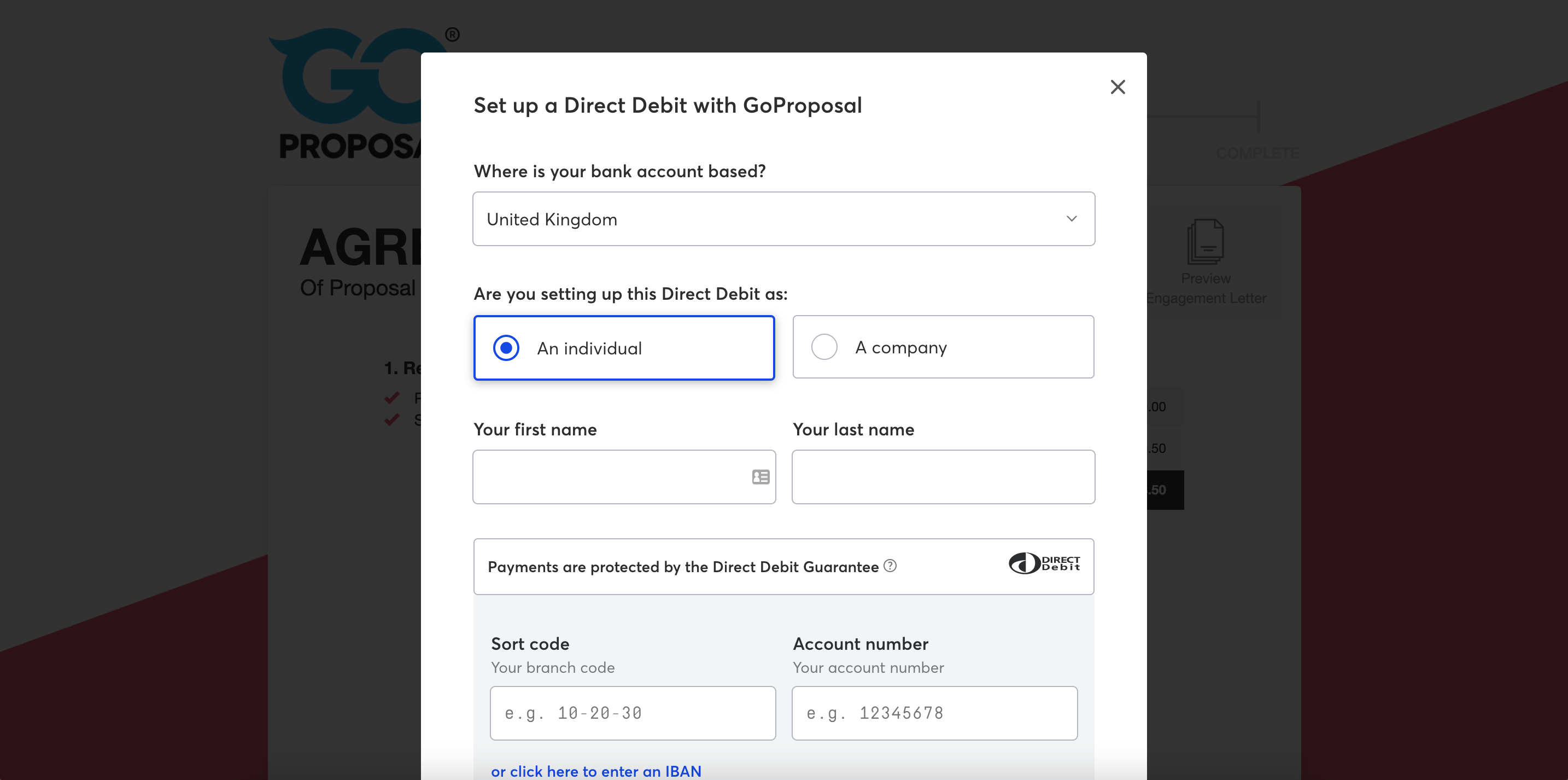

Among the most recent examples of these continuous improvements is Drop-in Payment Pages from GoCardless, which GoProposal has adopted in order to make enterprise-grade payments experiences available to companies of all sizes.

For organisations without custom GoCardless integrations, it was previously necessary to redirect customers to a GoCardless domain to finalise payment set up. Drop-in Payment Pages changes all of that by enabling payment set up to take place on the merchant’s site or in their platform, with next to no development work required. This makes for a great customer experience, increased conversion rates and lower cart abandonment. Indeed, Drop-in Payment Pages are still in early access but some merchants are already reaping the benefits; one has reported a 22% uplift in conversion since their implementation.

As GoCardless product marketer Lily Rogers, explains: “Most merchants self-serve their development function. To help them remove the friction of taking payers off site, these merchants can now just ‘drop in’ – literally copy and paste – a new code snippet to their existing checkout flow.”

Ivo Nunes, Lead Developer at GoProposal, worked on the integration. He says: “The integration itself was incredibly straightforward and the documentation was great. Now, with Drop-in pages, the payments set-up process is right in the middle of the proposal acceptance process.”

Since Drop-in Payment Pages were enabled by GoProposal, Dayle has been delighted at the improved customer experience. “We previously heard that customers were disoriented by the redirect from GoProposal to GoCardless,” he says. “With my web developer hat on, we now have an optimal experience that makes more sense for customers and saves us time on explaining that aspect of the on-boarding process.”

Automation with purpose

Greater automation and the smoother flow of information is welcome news for Dayle, who is reminded of the power of technology by the words of his grandmother.

“When my grandparents came to this country very few people had washing machines,” he says. “Looking at our generation, my grandmother says to me ‘how can you be so busy all the time when you all have washing machines now?’”

“She has a point: technology and automation is great but we don’t use it well enough, often enough. When solutions are thoughtfully integrated based on the needs of their users, like GoCardless and GoProposal are, we should take the opportunity not to remove humans from processes, but add more humans to the right processes and activities. The ones that add the most value.

We’re always improving at GoCardless, which is why we’ve built open banking functionalities into our platform. Read our customer story with Cuckoo Broadband to find out more.