What the gig economy means for the self-employed

Last editedJan 20203 min read

The world of work is changing. An ever increasing number of people are becoming self employed and are responsible for generating their own work - and getting paid for it.

Over the last decade the number of self employed people in the UK has risen 24%, from 3.9 million to 4.7 million.

Intuit predicts that 40% of all American jobs will be 'gig-economy' based by 2020.

These changes have been facilitated by technology, with smart devices and ubiquitous wifi making it easy for individuals to transact in the digital economy.

On top of this, 'gig economy' platforms such as Deliveroo, Uber and AirBnB are providing freelancers with the opportunity to top up their income with short term contracts and one-off jobs.

Gig economy assignments and longer form freelancing opportunities have clear benefits such as flexible hours and the opportunity to strike a better work/life balance. But they also have their own set of unique challenges, including getting paid on time and the lack of workers rights.

In this blog, we take a look at some of these pros and cons in more detail.

Flexibility

Working as a freelancer means you can set your own working hours and choose how much or how little you want to take on.

Success can be defined on your own terms - whether you want to double down on all opportunities available to maximise income or pick and choose work depending on how lucrative it is, or whether it fits your lifestyle.

Raising a young family while in a PAYE job may result in negotiating with your employer around flexi time; being a full time contractor empowers individuals to be their own boss and only take on work during days and times agreeable to them.

Lower taxation

One of the main reasons people choose self employment is to have more control over their personal taxes:

Unlike salaried positions, contracting or transcating in the gig economy does not require individuals to have to pay Class 1 National Insurance Contributions (NICs). In some instances these can be as high as 12% of an employee’s salary.

Self employed workers have to pay Class 2 NICs (£2.95 a week if profits are higher than £6,205) and Class 4 NICs (9% on profits between £8424 and £46,350 and 2% on profits over £46,350).

Last year the Government temporarily announced a policy to close the gap in NICs made between the self employed and the employed.

The spring 2017 budget initially included plans to increase Class 4 NICs from 9% to 11%. However, the Government were quickly forced to quickly u-turn when this was interpreted as disincentivising entrepreneurship.

Dip into the gig economy while you build up your client base

Building up an income from scratch for a full-time freelancing career is tough. Winning new work might take up the bulk of a freelancer’s time.

During these early stages, gig economy platforms can be a great way to top up your income, while you wait for more lucrative contract work to follow.

Alongside general courier, taxi and property rental gig economy companies, there are also more specialist platforms which enable people to monetise their expertise on an ad hoc basis.

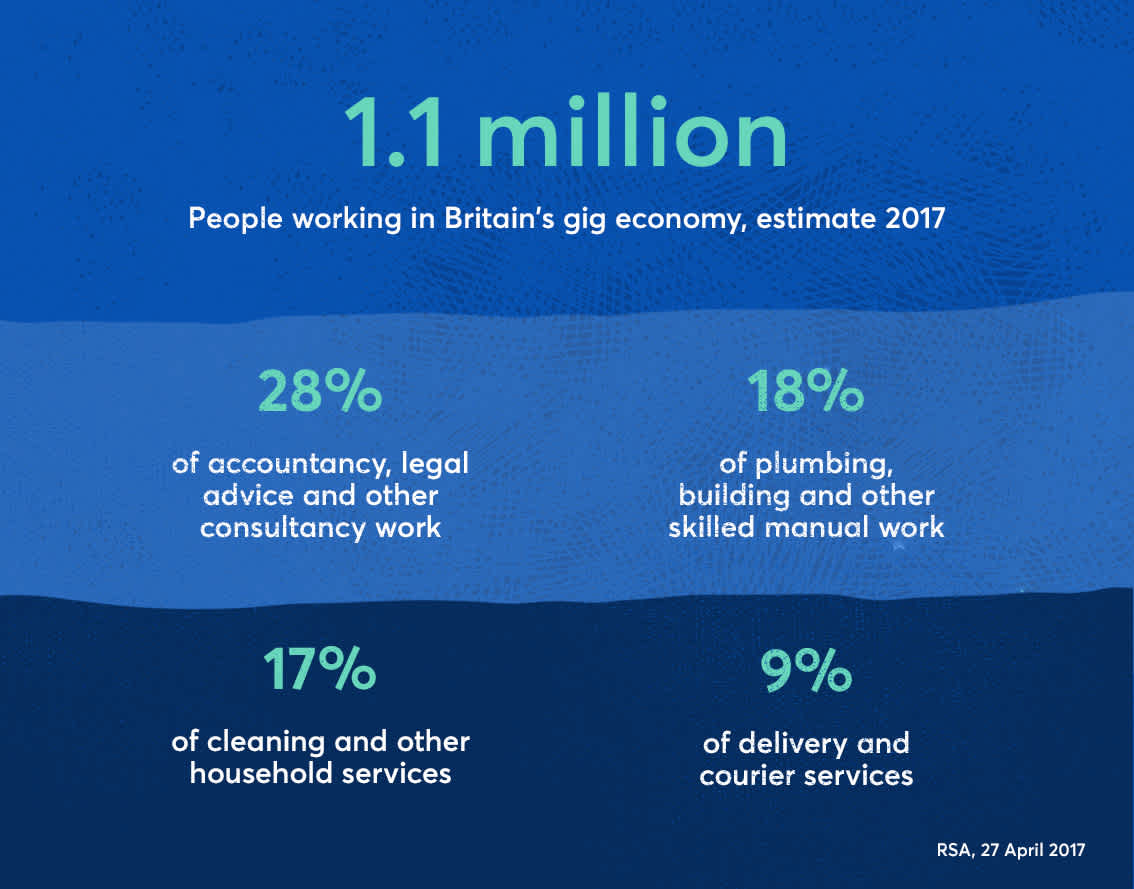

Fiverr, UpWork and People Per Hour allow you to sell a range of skills, including web development, graphic design and copywriting. Some platforms also encompass work traditionally associated with conventional white collar jobs, like accounting, legal advice and other consultancy work.

Gig economy platforms remove the need to chase payments

Late payment is a common problem for long term contractors and freelancers. Recently released data by Sage revealed that 17% of all invoices to SMBs in the UK and Ireland are paid late.

Savvy sole traders are overcoming this by using tools like GoCardless to automate cash collection. Related administration is pain free due to GoCardless integrating directly with most well-known cloud accounting packages including FreeAgent, Xero, Sage, QuickBooks, KashFlow, QuickFile and Zoho.

Gig economy workers may not need to chase up payments at all, with online gig economy platforms collecting revenue on behalf of sellers via an escrow system - but they will need to give up a cut of their earnings.

In a recent report by The Institute For Employment Studies a gig economy worker commented that these platforms "chase the money if you don’t get paid" and vet companies to make sure that they are genuine, but "they do [take] quite a bit chunk. I think it’s about 12 per cent.”

Benefits and workers rights

Loss of benefits like paid holiday and and sick pay, and a lack of workers rights is one of the main drawbacks to working in the gig economy or as a freelancer.

Self-employed individuals are also limited in their ability to challenge against forms of discrimination or poor working conditions.

There are a number of active court cases with contractors and gig economy workers challenging the status of their working engagement. The Independent Workers Union (IWGB) are currently challenging the courier company Citysprint to file holiday claims stretching back 20 years.

“Despite the myth peddled by employers that gig economy jobs are flexible, many of us are spending more time at work than full-time employees. That’s why with this case we are not only trying to claim back what we are owed but securing paid holidays going forward,” said IWGB Vice-President Maggie Dewhurst.

The Government recently announced plans to overhaul employment rights for the gig economy. Business Secretary Greg Clark said: “We will be enforcing the rights that people have and are entitled to... We want to embrace new ways of working, and to do so we will be one of the first countries to prepare our employment rules to reflect the new challenges.”

This proposed action by the government to adapt policy to modern working practices is encouraging - though we're yet to see if it will result in tangible action.

Meanwhile, the fight against Britain's late payment culture, which hits freelancers and SMEs the hardest, continues. You can read our recent update on the impact of Duty to Report legislation here.