The best bookkeeping and invoicing software

Last editedJun 20254 min read

In 2025, whether you’re a personal trainer, builder, or a landlord, sometimes the thought of managing invoices, tracking expenses, and reconciling accounts can conjure thoughts of endless spreadsheets and mounting paperwork. This is currently the reality for many, as 28% of small businesses surveyed in a new report from GoCardless say they are forced to use short-term financing to cover everyday costs, because their payments are delayed. However, the right bookkeeping and invoicing software can transform these daunting tasks into efficient processes, offering crystal-clear insights into your cash flow and freeing up valuable time. Read on to find out which bookkeeping and invoicing software is right for your business in 2025.

Do small businesses need accounting and bookkeeping software in 2025?

Put simply, yes. While it might seem like an added expense or complexity, for any small business, dedicated accounting and bookkeeping software is no longer a luxury. These platforms automate manual data entry, significantly reducing the risk of human error. Bookkeeping platforms provide real-time financial updates, making it easier to track profitability, manage outstanding invoices, and forecast future cash flow for your business. Beyond daily operations, the right accounting software simplifies tax preparation, ensures compliance and saves you potential headaches down the line. It allows you to make informed decisions, driving efficiency and sustainable growth.

How much time do small businesses spend on invoicing and accounts?

Without dedicated software, the time spent on invoicing and accounts can be staggering. Businesses often dedicate hours each week solely to manual invoice creation, chasing late payments, reconciling bank statements, and categorising expenses. GoCardless found that in the UK, small businesses spend, on average, 6.7 hours per month chasing late payments but this was nearly halved to 3.5 hours (-48%) when they switched to GoCardless.

This isn't just about the direct time spent; it's also about the opportunity cost – hours that could be invested in value-added activities like sales, customer service, or product development. This is especially important in a small business where your accounts team might also be your customer service team and your sales team. Automating these processes with dedicated bookkeeping and invoicing software frees up resources, allowing you to focus on what you do best: growing your business.

Best bookkeeping and accounting software in 2025

The market for bookkeeping and accounting software has many solutions for small businesses, whether you’re a sole trader, a landlord or a builder or anything in between. When reviewing options in 2025, remember to consider factors like scalability, reporting capabilities, and integration options.

Here are some popular choices that stand out for their features and intuitive UX:

FreeAgent is ideal for UK freelancers and micro-businesses; one of their better features is its direct submission capability for UK tax returns (self-assessment, VAT, Companies House). Its user-friendly design and potential free access via major banks make it easy to recommend for smaller businesses.

Sage is perfect for businesses seeking scalable accounting solutions with a full suite of features to manage complex financial operations and growth. It's ideal for businesses needing advanced inventory, project costing, or more traditional accounting depth.

Xero has a clean and simple interface and an extensive ecosystem of connected apps, Xero is a favourite among many small businesses looking to grow.

QuickBooks: It has extensive third-party app integrations and robust reporting tools. Providing a flexible, scalable solution for managing everything from basic bookkeeping to complex inventory and payroll for sole traders to enterprises.

Again, you’ll need to review each to see which one is the best fit for your business. Let’s show you what you should look out for.

Best bookkeeping and accounting software for small business

What bookkeeping and accounting software is best for small businesses? For small businesses, the ‘best’ software often comes down to simplicity, affordability, and essential features.

You'll want a platform that offers:

easy invoicing,

straightforward expense tracking,

bank reconciliation,

and clear financial reporting (so you know your profit & loss from your EBITDA).

Choosing software that matches the nuances of your specific industry and offers relevant integrations will keep things simple for you.

GoCardless customer story - Pure & Clean

Find out how GoCardless has helped Pure & Clean reduce late payment debt and save 4 days a month in payments related admin.

Why it's key to add a payment provider to your bookkeeping and accounting software

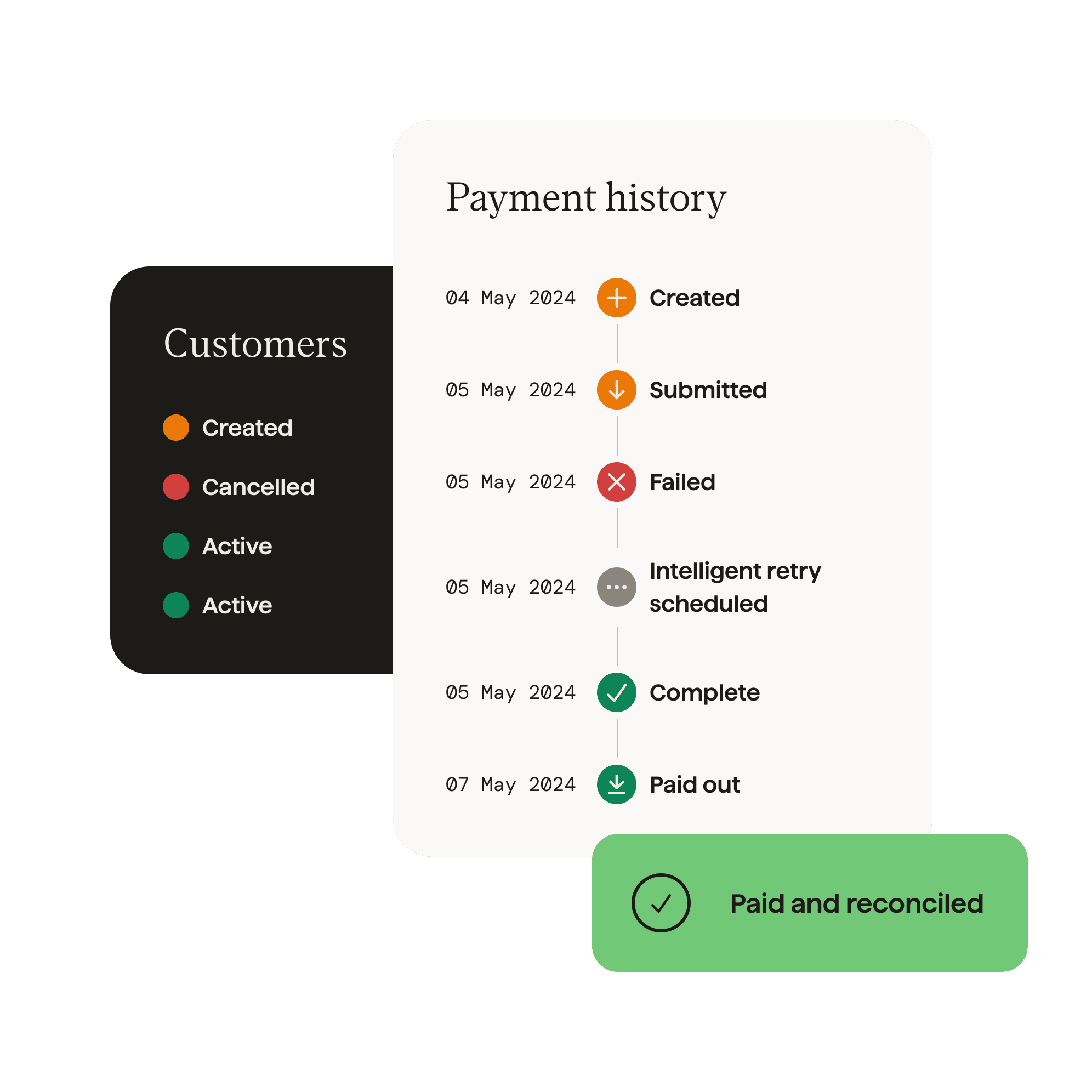

Having great bookkeeping and accounting software is a good first step, but its full potential is unlocked when seamlessly integrated with the right payment provider. This integration is not merely a convenience; it’s a strategic advantage that can dramatically improve your cash flow and reduce your admin burden. One of the benefits of using payment providers for small businesses is that they connect directly with your accountancy software, and transactions are automatically reconciled. This eliminates manual data entry, drastically reduces errors, and ensures your financial records are always up-to-date, saving you hours each week. Imagine payments from your customers automatically matching up to their invoices in Xero, QuickBooks, or Sage, with GoCardless, it’s really that simple. For business owners like gyms or landlords relying on recurring payments, a solution like Direct Debit ensures timely collections that are directly linked to your accounts. However, it’s also good to have a backup for situations where a payment might initially fail, Instant Bank Pay offers a swift, secure way for customers to repay instantly, improving recovery rates and speeding up cash flow.

This seamless connection between your accountancy software and payment solution creates a single source of truth for your finances. This really helps in a small business where there may not be a dedicated accountant.

How much time should it take to reconcile invoices and payments?

Research from Tide found that the average UK SME spends 30 hours a month chasing late payments. But how much should it really take you to reconcile invoices and payments? Recent GoCardless data suggests that in the UK, small businesses spend around 5.6 hours per month reconciling invoices. However, for small businesses that switch to GoCardless to collect payments this time goes down to just 2.8 hours. It’s important to note that time spent chasing payments is likely to increase as you scale without the right invoicing software or payment provider to help you.

Choose your invoicing software wisely

In 2025, the choice of bookkeeping and invoicing software will likely impact your business's efficiency and overall financial standings. While popular platforms offer excellent features, the key to success lies in selecting a software that not only meets your core accounting requirements but also integrates with your unique business needs and seamlessly with your payment processes. Together, this ultimately provides you with the data you need to scale your business while saving you time by automating tasks and removing unnecessary errors.

Seamless accounting integrations

Discover how GoCardless can help you simplify your accounting and payments today. With our easy-to-use platform and seamless integrations, it’ll be easier to keep track of your cash flow and growth.