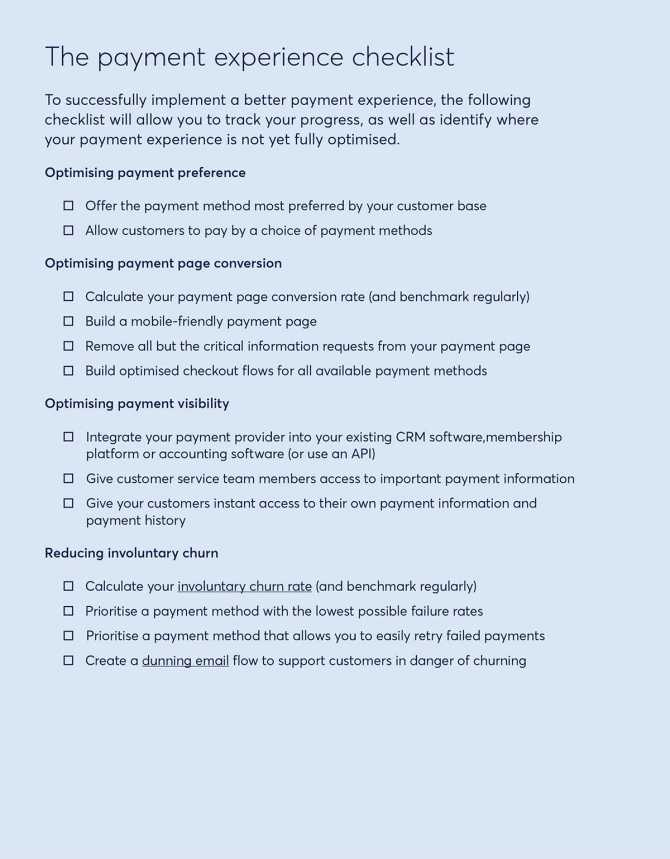

The payment experience cheat sheet: a guide for recurring revenue businesses

Use our handy cheat sheet to make sure your payment experience is fully optimised for the requirements of your customer. Learn how to maximise payment success, get better insights into your process and reduce churn.

Inside this guide

Payment experience is the combination of customer touchpoints that lead to a payment taking place. The sum of all these touchpoints will contribute to the customer’s overall perception of your brand.

But how can you leverage payment experience to help you collect recurring payments and build customer loyalty?

Get the recurring payment experience cheat sheet to find out how to:

Optimise for the payment method your customers prefer

Increase your payment page conversion rate

Use data and payment insights to provide a better customer experience

Reduce churn and increase customer lifetime value