Last editedOct 20223 min read

Preference matters. It’s so important that it can make or break a potential sale.

Don’t give potential customers the payment methods they prefer and you risk losing them altogether. But provide preferred payment methods that other B2B SaaS companies don't, and it can even drive growth.

Payment preference is the competitive advantage you may not be using. It’s the missing piece in your growth engine. But how do you know what payment method your customer wants? In partnership with YouGov, we surveyed almost 5,000 businesses worldwide to find out how they prefer to pay for digital subscriptions, a category closely aligned with B2B SaaS. Here are the five most compelling insights for B2B SaaS companies:

1. Direct bank payments are the way to pay

Bank debit, often referred to as Direct Debit in the UK, is a bank-to-bank payment mechanism, where the seller pulls funds from their customer’s bank whenever those funds are due, under a single, upfront authorisation.

It’s the most preferred digital subscription payment method in five of the nine markets we surveyed.

For B2B digital subscriptions, bank debit is preferred by 44% of UK respondents. The ubiquitous credit card is only preferred by 34%. In Germany, the gap is even wider, with 52% preferring bank debit, while 36% prefer credit card (although bank transfer is most popular in Germany, at 54%). Spain has the highest preference for bank debit, at 60%. It is also the most preferred method in France, Australia and Denmark.

“We want our global customers to have access to simple and easy payment methods when purchasing DocuSign. We’re delighted to be working with GoCardless to offer bank debit as a payment option throughout the UK and Europe, to ensure customers are able to complete quick and easy transactions with DocuSign.” - Robin Joy, Senior Vice President of Digital, Demand and Web Sales, DocuSign

2. Cards still hold favour in US

While bank debit rules in other major markets, the US and Canada still have the strongest preference for corporate credit cards. In the US 54% of businesses would be likely to pay by credit card, while in Canada it’s slightly higher at 55%.

Even in these markets where bank debit is not traditionally used for B2B SaaS purchases, it is still the 2nd most preferred payment method. 38% of US businesses and 43% of Canadian businesses would be likely to use bank debit to pay digital subscriptions.

3. One-size-doesn’t-fit-all

The challenge of taking payments internationally is so profound it’s affecting business’ decision on whether or not to go global. In a recent YouGov survey of 741 business decision-makers, 73% said their business would be more successful if it had greater access to international markets; but 39% think the complexity of international payments is holding their business back from expanding internationally.

The temptation might be to take the easy route and offer just one payment method. But this global approach can turn potential customers away. For even the most preferred payment methods, a portion of your customers will be unlikely to pay by that method. And that picture varies by country. Even in America, the spiritual home of the credit card, 19% of businesses would be unlikely to pay for digital subscriptions with a card.

![[Report] Global payment preferences for recurring B2B purchases](https://images.ctfassets.net/40w0m41bmydz/3Sx4oPTWqV3OFgftVGB7Oq/ea2fb2af6adb6a05d1c2de391e6396ff/global-payment-preferences-b2b-report-hero.jpg?w=1200&h=1510&fl=progressive&q=50&fm=jpg)

[Report] Global payment preferences for recurring B2B purchases

We surveyed 4,990 businesses across 9 markets to determine which payment methods businesses prefer for different use cases.

4. Digital wallets aren’t a fan favourite

While bank debit is the clearly preferred in Europe and Australia, and credit cards are still the frontrunner in US and Canada, it’s important to consider what your first ‘alternative’ payment method should be, i.e. your available 2nd choice for those who don’t prefer your main payment method.

It can be easy to default to digital wallets, but the data across all nine markets shows that digital wallets are the most disliked method for digital subscriptions. In the USA 44% of businesses would be ‘unlikely’ to pay for digital subscriptions by digital wallet. In mainland Europe it’s 41%, in Australia it’s 21% and in the UK it’s a staggering 52% - the highest globally.

5. More payment methods means more customer wins

As the appetite for digital subscriptions grows, your customers will continue to demand choice. As the report shows, this extends to payment methods too. While it would be unrealistic to offer every possible payment method, it’s worth offering the #1 preference to as many potential customers as possible.

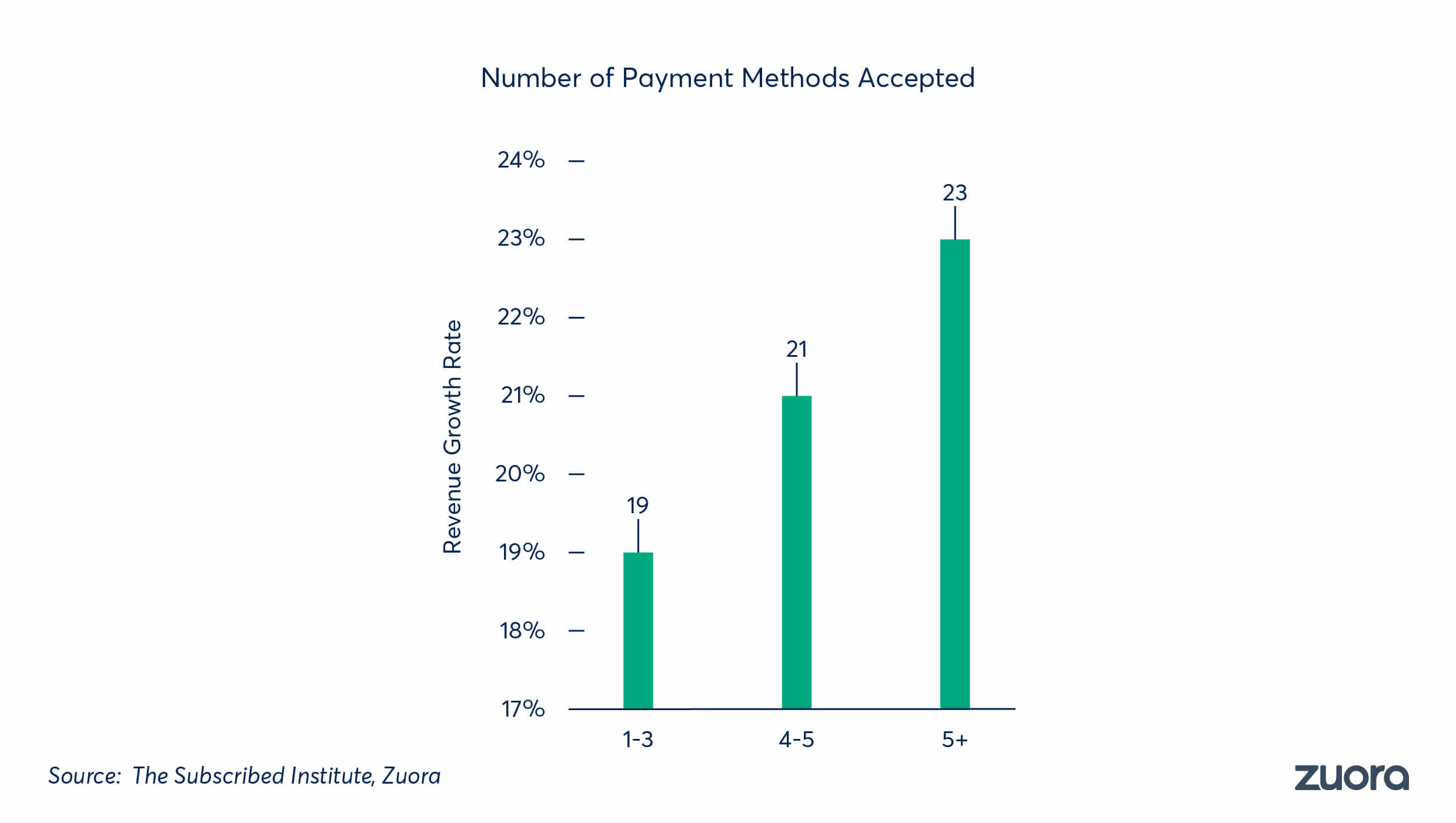

As research from Zuora’s Subscribed Institute shows, businesses offering more payment methods grow faster. Companies that accept more than five payment methods grow, on average, 4% faster than those that accept three or fewer.

Download the full B2B recurring payment preferences report for free, and get all the insights for the markets you operate in.

Better business with bank payments

Turn payments into a competitive advantage for your SaaS business with GoCardless, the first global network for recurring payments.

Find out how we can help your business reduce involuntary churn, minimise operational costs and make collecting recurring payments around the globe simple. Or speak to one of our recurring payment experts about the payment challenges you’re facing.