How do customers want to pay for their household energy bills?

Last editedMay 20213 min read

The payment method consumers choose to use - we call this payment preference - can have a huge impact on both customer acquisition and retention for an energy business. Therefore, the payment method(s) your business offers is an important consideration for any payments function.

In this article we will help to answer:

How do your customers want to pay for their household energy bills?

What is consumer payment preference and why is it so important?

Do customer preferences meet your business objectives?

Does being more customer-centric in your payments strategy pay off?

So, how do your customers want to pay for their household energy bills?

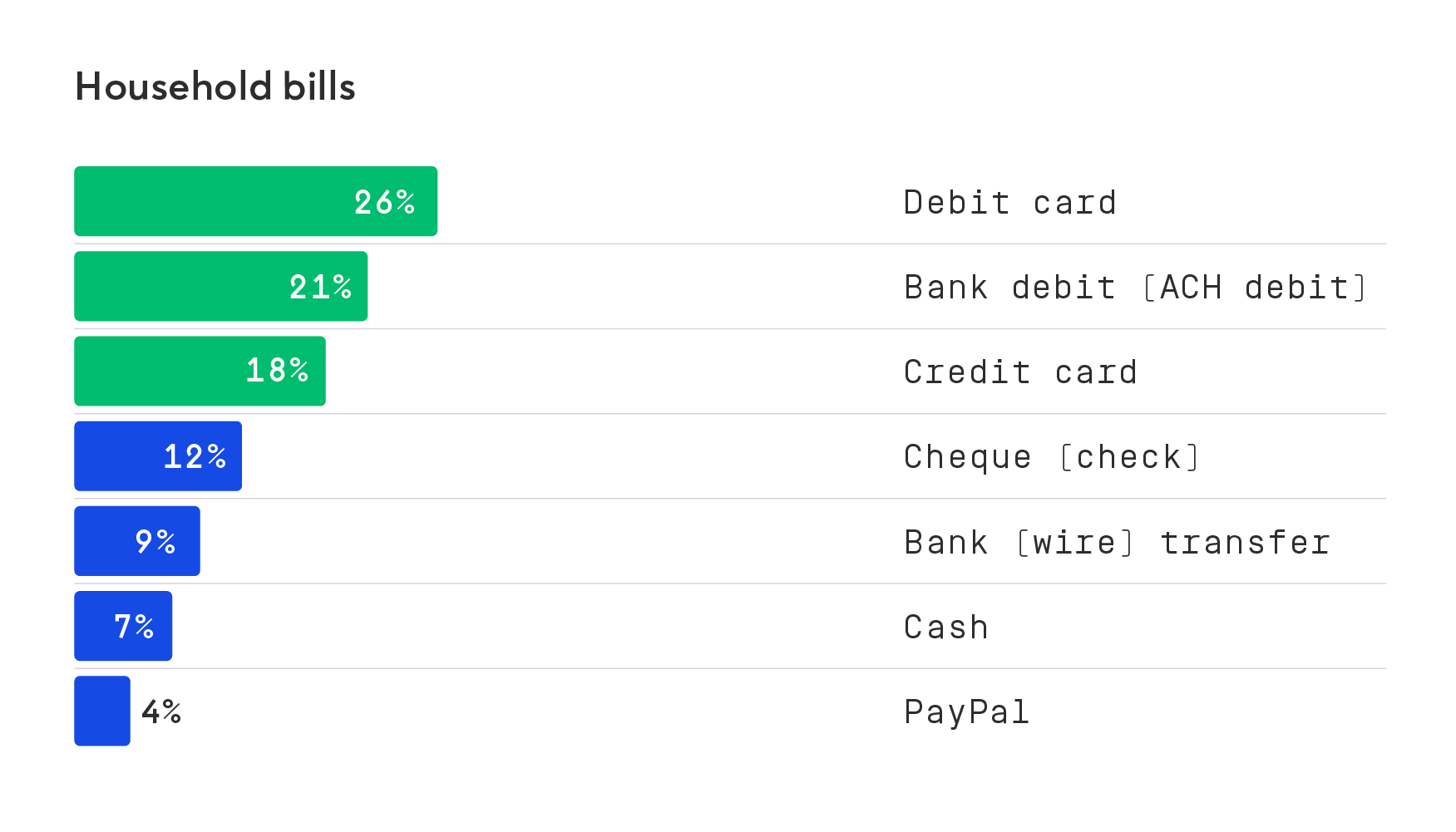

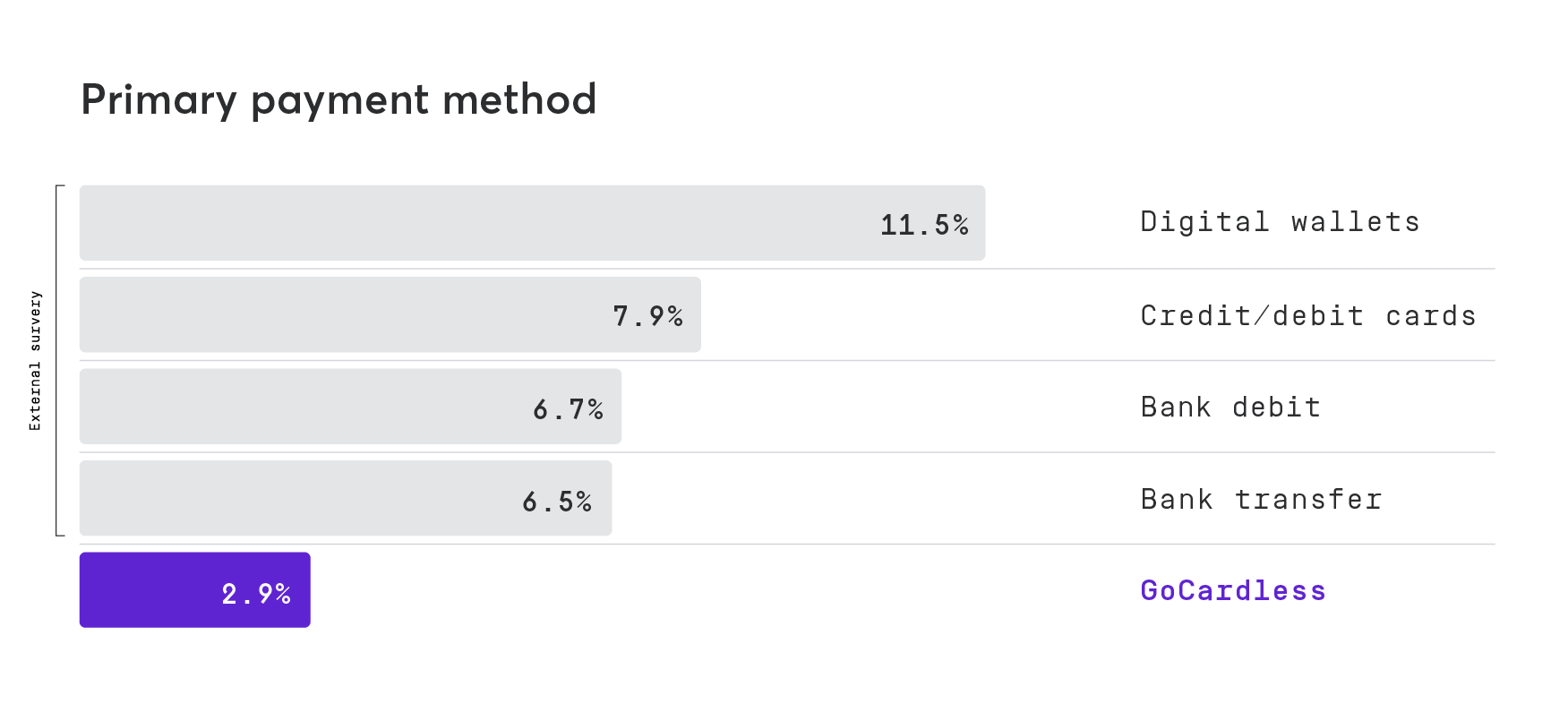

A 2021 YouGov survey of over 15,000 consumers, commissioned by GoCardless, identified debit card and ACH debit as the most popular ways to pay for household bills after debit card in the US.

As 21% of US consumers choose to pay their household bills with ACH debit, there is clear consumer demand for ACH debit as a recurring payment method.

A similar picture can be seen across the globe. For instance, the local equivalents of ACH debit were the most popular payment methods for household bills in the UK, Australia, Germany and France. Meanwhile, in Canada and New Zealand, the local equivalents of ACH Debit were the second most popular payment methods. This shows global demand for these bank-to-bank payment methods, an important fact to consider when thinking about international expansion.

Businesses that do not offer consumers the option to pay with ACH debit reduce their chances of winning new customers. As ACH debit is so popular in the US, businesses should also be looking to create a frictionless payment experience when new customers are registering, in order to maximise customer acquisition.

In fact, bank debit was one of the most popular choices for consumers to pay for household bills across all the countries examined. In a study commissioned by GoCardless in July 2020, we asked over 8,100 consumers across the USA, the UK, France, Germany, Denmark, Sweden, Canada, Australia, New Zealand, why they chose to pay for a recurring invoice by bank debit. These were the top three reasons given:

“This was the default option”

“Paying this way gives me peace of mind”

“I had these details to hand”

Because bank debit is a ‘pull-based’ payment method, it’s not surprising it is one of the most convenient ways to pay for recurring payments for consumers. Bank debit offers safety, flexibility and automation.

What is consumer payment preference and why is it important?

When we discuss consumer payment preference we mean the number of customers who choose a payment method. Customers like to pay in different ways, so there is not a single payment method that will please every customer. However, customers often opt for methods that are trusted, convenient or easy to use.

Why should energy suppliers cater to preferred payment methods?

Introducing new payment methods and managing and maintaining these options can be a complex, costly and time-consuming process, especially for a large or scaling business. However, by offering payment methods that suit a wider range of existing or potential customers your business will be able to retain and win more customers.

By offering preferred payment methods to your customers you will reduce friction in the payment process, making their buying experience smoother. Nonetheless, if you don’t offer a preferred payment method, you run the risk of payers dropping out of the payment process and going to a competitor that does offer their preferred payment.

Does consumer preference for ACH debit meet your business objectives?

Although ACH debit is preferred by most consumers, it’s important to consider the benefits ACH debit could have for your business as a payment method. ACH debit is a pull-based method, meaning you have control of when you collect payments from your customers and can easily be automated.

As a bank-to-bank payment method, ACH debit avoids the costly transaction fees associated with credit cards and ACH debit typically has a lower payment failure rate - which often becomes involuntary churn - than many of the other payment options.

As an energy business, it’s likely that you will need to collect one-off payments for account top-ups or chasing failed payments. Although you can collect one-off payments with bank debit, it can be a painful experience for both the consumer and the merchant.

That’s why we developed Instant Bank Pay. You can now collect one-off payments from customers in the UK with an instant bank-to-bank payment powered by open banking. Instant Bank Pay empowers recurring revenue businesses to collect one-off payments in conjunction with bank debit. Providing a seamless experience for customers with all the benefits of a bank-to-bank payment.

Instant Bank Pay

Complement your recurring payments with a simple, convenient way to collect one-off payments powered by open banking.

Does being more customer-centric in your payments strategy pay off?

By being customer-centric and catering to consumer preference to pay by ACH debit, your business could reap many benefits including; improved customer acquisition, retention and efficiencies in your payment operations, giving your business a competitive advantage.

For a deeper dive into which method(s) consumers choose to pay for their household bills across the globe, read our report: Consumer Payment Preferences in 2021.