Open banking in the UK vs Australia

Last editedMay 20234 min read

Open banking is a global initiative with over 87% of countries currently having some form of open banking API available. However, this doesn’t mean that every country is in sync, with some still being in the early stages of rolling out schemes. As 2021 marks a milestone for open banking in Australia, we’ve decided to take a closer look at some of the key differences between open banking in Australia and the UK.

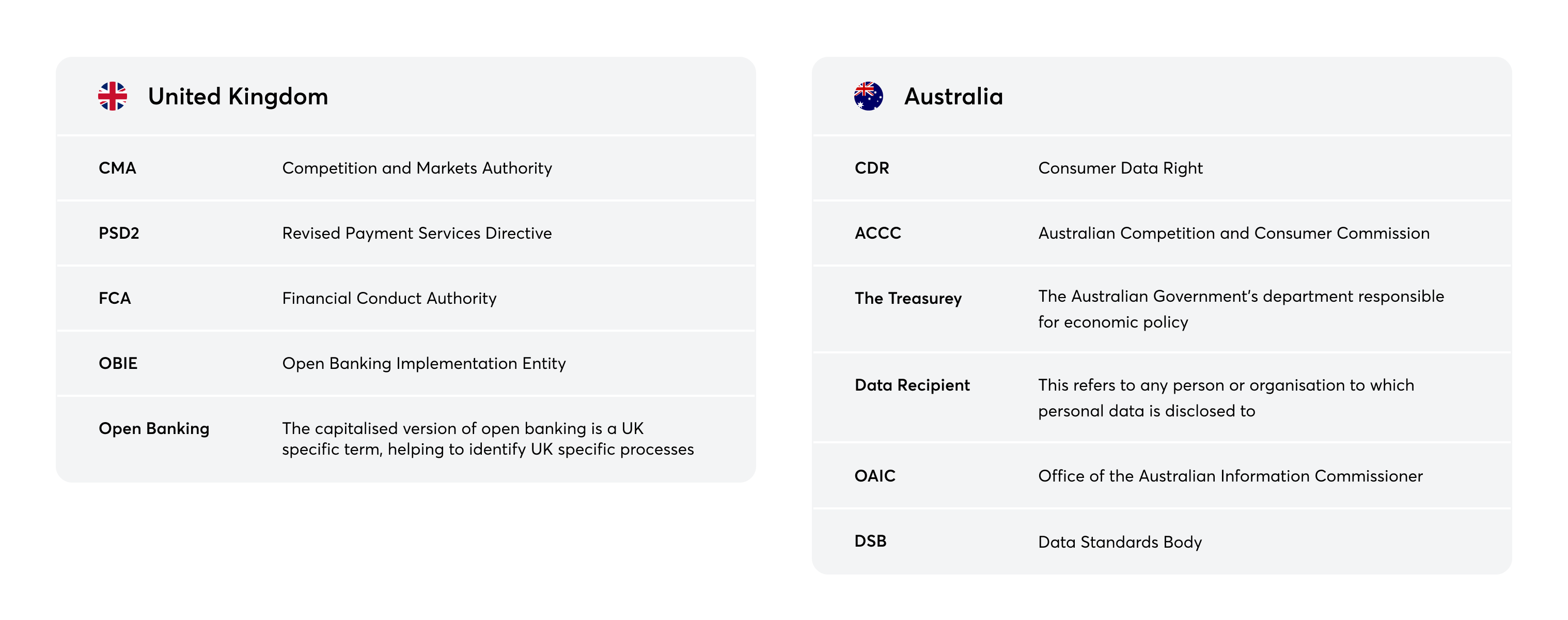

Glossary

The goal of open banking

What’s similar:

For both the UK and Australia, the main goal of open banking is to encourage competition, drive innovation, improve operational efficiency and provide consumers with better experiences.

This hasn’t happened a moment too soon either with credit cards rapidly falling out of favour. Due to the COVID-19 pandemic, credit card issuers have been more cautious when approving new credit cards, leaving the younger generations struggling to obtain credit cards. As a result, the number of new credit card accounts has fallen by 65%. However, even post-pandemic the use of credit cards is predicted to decline. Millennials and Gen Z consumers have 14% fewer credit cards compared to adults over the age of 35. There are several factors behind this, including that these generations are tech natives and more financially conscious, staying away from payment methods that could lead to debt.

It isn’t just consumers that want to move away from credit cards. In the UK, Brexit has meant that previous European Union caps on credit and debit card interchange fees no longer apply. Mastercard has already announced an increase to their interchange rates of 0.3% to 1.5% - an astounding 400% increase that is guaranteed to impact businesses across the UK. Overall, it’s clear that the impending death of credit cards has left a gap that open banking technology has the potential to fill in both the UK and Australia.

What’s different:

Whilst the overall goal of open banking is the same, the background of how the two countries reached this point is slightly different. In Australia, open banking was ignited by a review commissioned by the Treasury. The review’s outcome concluded that ‘open data’ would be a viable way to boost productivity and competition across industries. The review also presented an onus on the concept of reciprocity, noting that a system in which both data holders and data recipients participate fully would have “more vibrant and dynamic” results.

In the UK, Open Banking was driven by a regulatory push after the CMA reviewed competition, or lack of, in the banking sector. This led to the CMA establishing the Open Banking Implementation Entity (OBIE), a company that has the role of developing and enforcing the implementation of standards. OBIE is governed by the CMA and funded by the UK’s nine largest banks and building societies, including Barclays, Danske, HSBC and Santander.

Regulatory Environment

What’s similar:

Open banking infrastructures and those who use them are tightly regulated in both the UK and Australia. In the UK, Open Banking is governed by the CMA. Any third-party providers who want to participate in Open Banking are also required to be authorised by the FCA who, once approved, will add them to the FCA Register and continue to regulate their activities.

In Australia, the first iteration of open banking is known better as CDR. The CDR was created by the Australian Treasury to give consumers greater access and control over their data. The ACCC watches over CDR and is also responsible for granting accreditation to any organisations that wish to become an accredited data recipient.

What’s different:

Currently in the UK, open banking regulation focuses specifically on payments and financial services, whereas in Australia the regulations also look at non-financial services. How is this possible? Because the CDR has been set up as a data policy initiative, it focuses on data rather than the sector or transaction type, allowing it to cover financial and non-financial services. The CDR will initially focus on banking, however, there is already talk of working groups looking into additional sectors, including utilities and telecoms.

The current state of open banking

What’s similar:

Technically speaking, there is now some form of open banking infrastructure in both markets. In the UK, open banking legislation came into place in 2018 and coincided with the launch of EU regulation PSD2 - a regulation that complements open banking as one of its aims is to harmonise the operations of payment services in the European Economic Area (EEA). At the moment, only the top nine largest banks and building societies are obligated to share data via open banking. However, that hasn’t stopped a long list of other financial institutions from getting involved, plus there are currently over 40 open banking apps and products for businesses currently live and listed on the Open Banking app store.

In Australia, July 2020 marked the soft rollout of the first open banking initiative, the Consumer Data Right (CDR). The launch marked a significant moment in Australian banking, with the big four banks (who combined hold 80% of the market share) having to start sharing product reference data with accredited data recipients. In the first six months six organisations, including neobank 86,400, gained accreditation. Whilst this number may seem low, the slow uptake has been blamed on a complex CDR accreditation framework and not low interest.

It’s worth noting that another key similarity between the two markets is their appetite for continuous development and pushing open banking technologies into the mainstream. In the UK, the OBIE has launched a consultation on Variable Recurring Payments (VRPs) - VRPs allow customers to safely connect authorised payments providers to their bank account so that they can make payments on the customer’s behalf - kick-starting the next stage of open banking development. Over in Australia, the roll-out of CDR has happened in conjunction with the launch of the New Payments Platform (NPP). NPP provides the ability to make real-time payments 24/7 - something that consumers have embraced with Australia having seen a 130% uptake in the volume of real-time payments made in the past year. Combining the attributes of open banking and NPP has helped to bring new payment technology to the forefront and raise consumer confidence, helping to pave the way for additional customer-centric services.

What’s different:

To put it simply - the timelines. Despite some initial delays, Australia’s open banking initiatives are now being rolled out in phases. A year after its launch in 2020, the CDR entered into its next phase with non-major authorised deposit-taking institutions (ADIs) joining the big four banks in becoming data holders. This means that authorised ADIs will need to share data on savings and transaction accounts and card data if requested. This phase’s implementation will continue into February 2022, by which point it’s expected that ADIs will also have to start sharing data on personal home loans, investment loans, asset finance and retirement savings accounts.

Although there is clear progression in Australia, it is happening slowly and financial technology has yet to be dramatically impacted. This is unlike the UK, which is currently one of the countries leading in open banking. In 2019, a year after Open Banking launched in the UK, GoCardless was actually the first to collect live Variable Recurring Payments with Open Banking. Whilst there is still room for general consumer awareness, currently, more than 2.5 million UK consumers have now used open banking-enabled products.

The next few years will be very telling for the Australian and UK markets, with a clear need to encourage open banking adoption in order to see the technological progress that open banking can offer. GoCardless operates in both markets and in 2020 completed a $95million funding round which we are putting towards accelerating our global open banking strategy, combining bank debit with open banking for the ultimate account to account experience.