Get paid via instalments with GoCardless for Xero

Last editedFeb 20203 min read

Getting paid shouldn’t be painful, so today we’re making it even easier to collect payment for your Xero invoices.

Over the last few years we’ve had many requests for a way to collect instalment payments via GoCardless for Xero. We’re thrilled to announce that we’re releasing this functionality in the GoCardless for Xero product today.

What are the benefits of offering instalments to your customers?

1. Your customers will spend more

By spreading the cost of your goods and services out over time, your customers are likely to be willing to spend more money with you. According to online payments platform, Klarna, offering instalments can increase an average order value by as much as 55%.

2. You’ll acquire more customers

Potential customers for high-cost goods and services take a lot more into consideration before committing to a supplier. Breaking the cost of lump-sum purchases and invoices into more manageable amounts can prevent potential customers from being deterred by the cost.

3. You’ll make it easier to get paid

Cost-sensitive customers may be unwilling to pay via smoother payment methods like bank debit for larger-value invoices. However, by accepting payment for these via instalments, you lower any perceived risk they may have and are more likely to have them opt in, making payment simple and automatic.

4. You’ll strengthen customer relationships

Breaking the cost of purchases into smaller, more manageable amounts also helps you offer your customers a more bespoke service than competitors, giving your business an advantage. Instead of requesting upfront payment, you can create a personalised payment plan for your customer, delivering them a better customer experience, and retaining them as a loyal customer for longer.

“Accepting payments via instalments helps our clients spread the cost of their course over a timeframe that suits them and means we don't have to set up separate invoices for each payment… which is a huge time saver for us...”

Shane Broadberry, Director, IACT

Want to take the pain out of getting paid?

Payment preferences research shows that bank debit is the preferred method for paying business-to-business instalments. In the UK, 47% of businesses want to pay instalments via bank debit, compared to just 28% via corporate card.

Offering Instalments with GoCardless for Xero

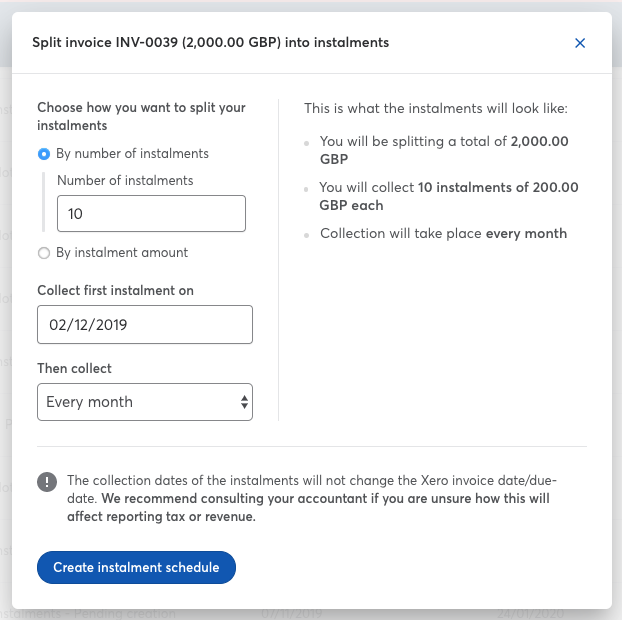

As of today, you can use the Instalments feature in GoCardless for Xero to split a single Xero invoice amount into multiple GoCardless payments.

You’re able to customise the number of instalments you’d like to offer, and how frequently you want them collected (e.g. monthly, weekly, etc.). Once set up, the status of your invoice will be updated to show the number of outstanding instalments.

“It's great that [the] GoCardless product has now expanded to include so many features beyond the core Direct Debit. GoCardless for Xero has made an incredible difference to our business and our clients. Now being able to control instalment options around one off invoices for ad-hoc work means we can easily help our clients spread costs, taking the worry away.”

Jonathan Bareham FCA, Director and Co-founder, Raedan

Learn more about how instalments work in GoCardless for Xero

Spend less time and hassle on payments admin with instalments

Previously, we’ve seen businesses resort to sending separate, recurring invoices in order to offer instalments. This has the downside of creating additional admin and payment notifications for both the business and their customers, with multiple invoices to send out, pay and reconcile.

Now you can simply split a single invoice into multiple instalments with GoCardless for Xero. The customer is notified just once at the start of the schedule, and each payment will be allocated to the invoice when it’s collected, until the full balance of the invoice is paid.

“This is a great option that could help manage the overdue invoices as we can now offer different options to the customers that struggle with payments. We tested this feature with one customer and it was all perfect, the payment was collected as scheduled and there were no issues with the reconciliation.”

Mayra Badcott, Accounts, Torbay Olympic Gymnastics Club

Ready to take the pain out of getting paid?

Start offering instalments with GoCardless for Xero today.

Already using GoCardless for Xero?

Read about switching to GoCardless for Xero when you use Dashboard subscriptions or plans.

Do you already have dashboard subscriptions set up?

If you already have subscriptions set up on the GoCardless dashboard, but would like to move these over to instalments through GoCardless for Xero, we can assist with that.

Contact our support team here and we’ll assist with cancelling your subscriptions in the GoCardless dashboard, so you can set up these payments again as Instalment schedules in GoCardless for Xero.

We can ensure that your customers will not be notified of the cancellation.