Report reveals growth and cash flow are priorities for UK agencies

Last editedJun 20242 min read

A new report by The Wow Company has revealed the biggest business challenges that agencies currently face across the UK. The sector is currently worth billions of pounds per year to the UK economy with 94% of agencies expecting to grow in 2016.

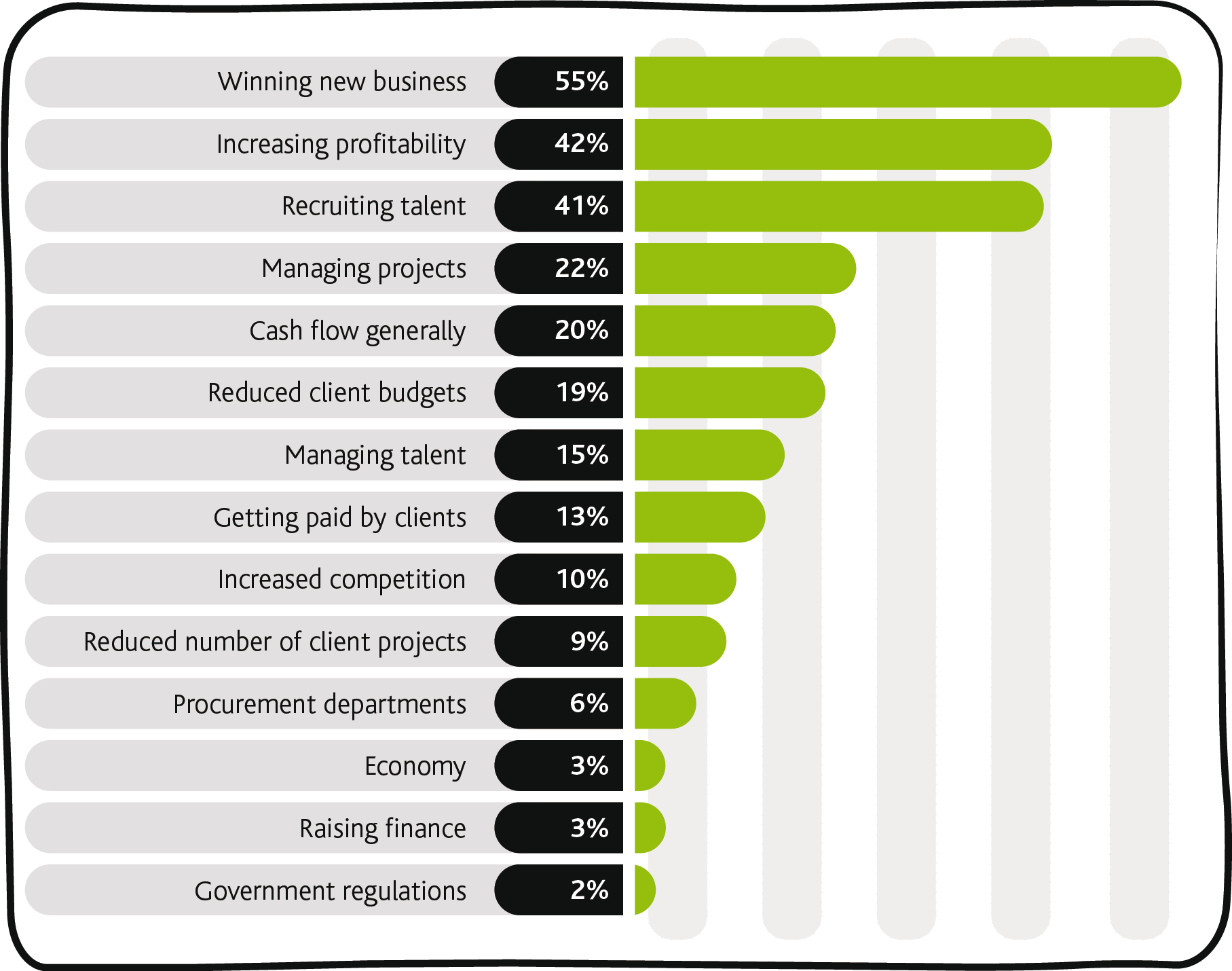

The annual report, which surveyed hundreds of agencies from across the UK, looked at a variety of topics from pitching to pricing. Agencies said their biggest challenge was figuring out how to grow their business. This included winning new business (55%), increasing profitability (42%) and recruiting new talent (41%). Feeding into this, poor cashflow (20%) and getting paid by clients (13%) were also listed amongst the top challenges faced.

This year’s BenchPress report had an interesting section on payments, and we thought it would be worth sharing some of the most interesting results.

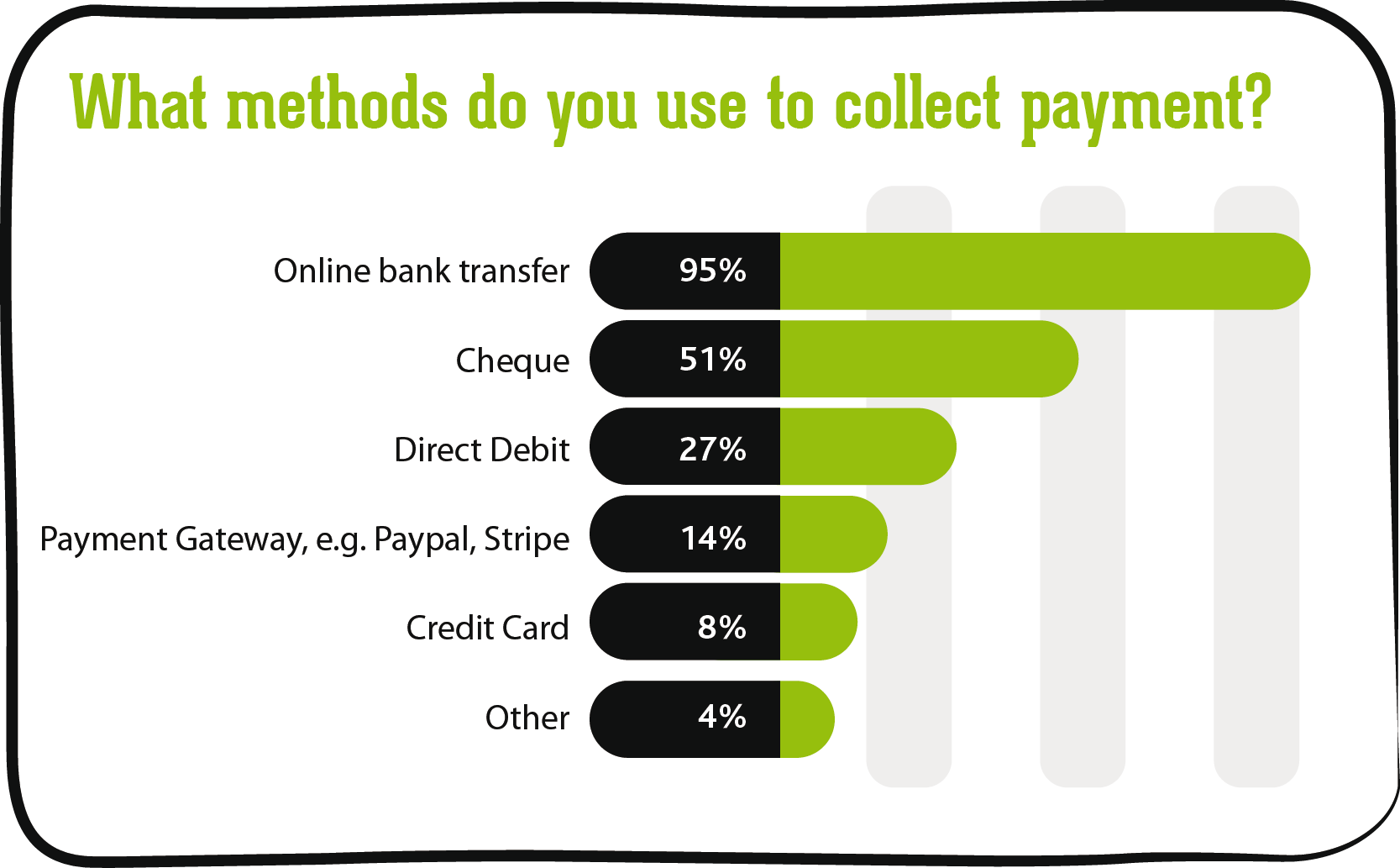

The majority of agencies questioned (95%) were using bank transfer for payments, and over a half (51%) were using cheques. Both bank transfer and cheques depend on the customer deciding when to pay an invoice. With the majority of agencies relying on these payment methods it’s unsurprising that so many are concerned about cash flow.

Direct Debit is becoming an increasingly popular option with more than a quarter of agencies currently using it. Using GoCardless to take Direct Debit payments means agencies can have full control of payments, making sure they get paid on time, thus helping to maintain a healthy cash flow.

Interestingly, those agencies taking payments by Direct Debit also benefitted from shorter payment terms. More than half had a payment term of 14 days or less. This compares to just a third of those using other payment methods.

Growth over the next 12 months

It appears that having more confidence in cash flow gives agencies the freedom to focus on growth. According to the report, over half of agencies using Direct Debit forecasted growth of over 25% over the next year. In contrast, less than a third of agencies using other payment methods reported the same growth expectations. Getting paid on time can lead to an increase in business confidence, thus giving agencies more time to concentrate on running the business, rather than chasing up payments.

The report found that digital agencies are most widely utilising Direct Debit for their payments. Known to be early-adopters, it’s no surprise to see those working in tech are embracing the benefits of Direct Debit more than any other industry.

Agencies using GoCardless

GoCardless is already working with almost 4000 agencies; helping them to maintain a healthy cash flow. Using Direct Debit can have a huge impact on how quickly agencies get paid, and with GoCardless it has never been easier. Linking with all the major accounting packages, including Xero, GoCardless makes it really easy to get setup & manage payments.

In the report, Claire Love of digital agency LWS Marketing shares her experience of using GoCardless:

“In just four months, we moved 50% of our recurring payments to Direct Debit after we discovered GoCardless. This has had the biggest impact on the company I’ve seen in 8 years - boosting cash flow, morale and ease of admin. Our average debtor days have reduced from 122 days to just 7 days.

We are about to start phase 2 of the rollout, with a goal to reach 80% by explaining to clients how it will make their lives easier too. To help with this, we now always mention at the outset that our fees are based on signing a Direct Debit and state this clearly in our proposals. I can’t imagine life without GoCardless now - it’s made a massive difference.”

Using GoCardless to process payments adds a whole bundle of benefits to agencies and their customers, adding to the value and quality of service being delivering. GoCardless’ simple, automated payment process takes away the hassle of late payments, helping agencies to overcome the challenge of cash flow. It’s also quick and simple to get set-up online and there are very low fees saving agencies (and their customers) both time and money.