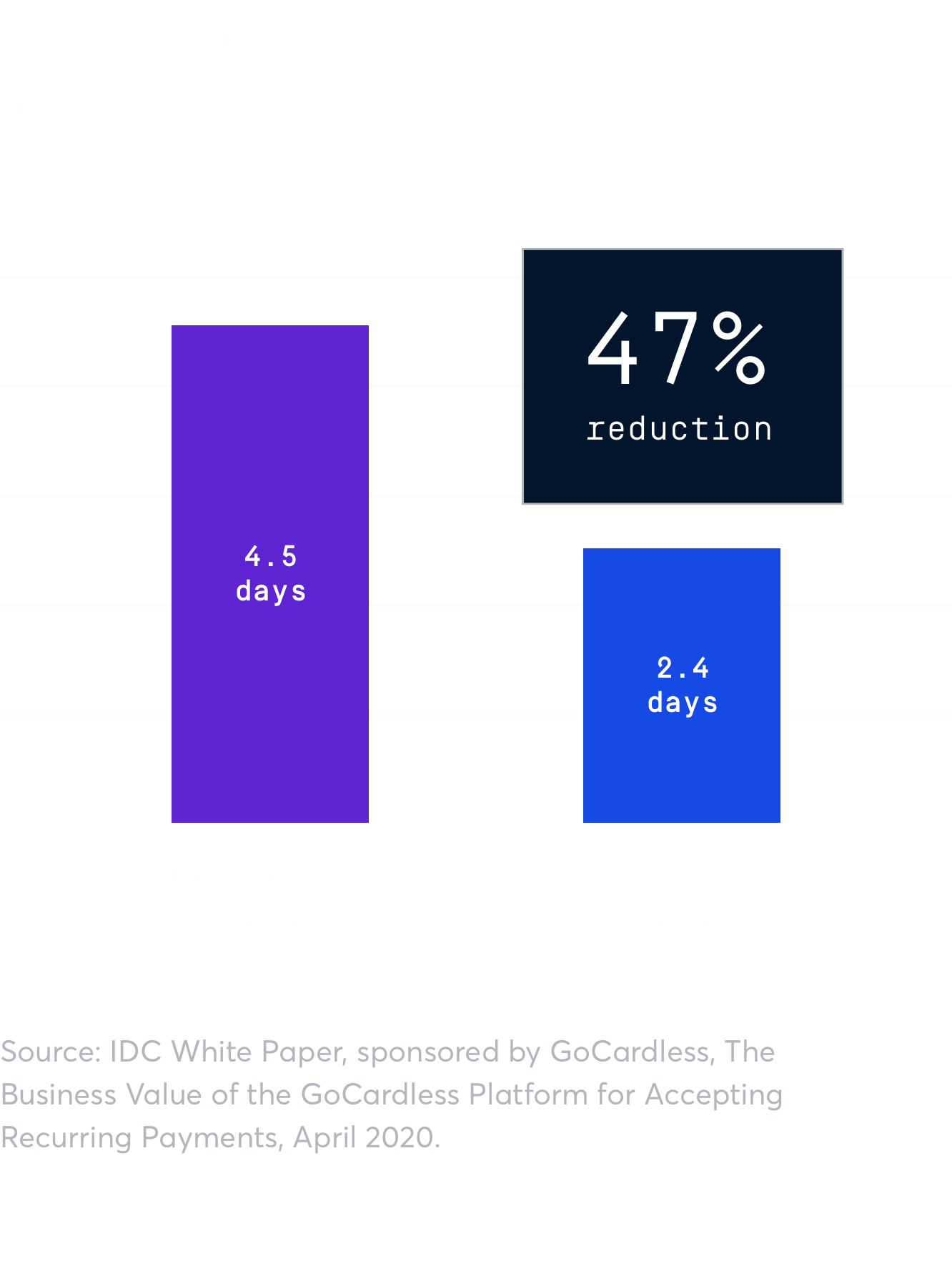

Reduce time to receive payments

Reduce the time to receive payments by 47% with GoCardless, and minimise your debtor days by taking full control of when payments are made.

Your high DSO is stopping you from growing

A high DSO and a growing list of outstanding receivables limits your brand’s ability to invest for the future.

Everything just works… It’s now a one- or two-touch billing process, once a month. We don’t need to think or worry about it anymore."

John Heggs, Finance Manager, intY

Gain full control over payment collection

GoCardless is built on bank debit, a pull-based payment method. This puts you in control of when payments are collected, giving you full oversight of your accounts receivable.

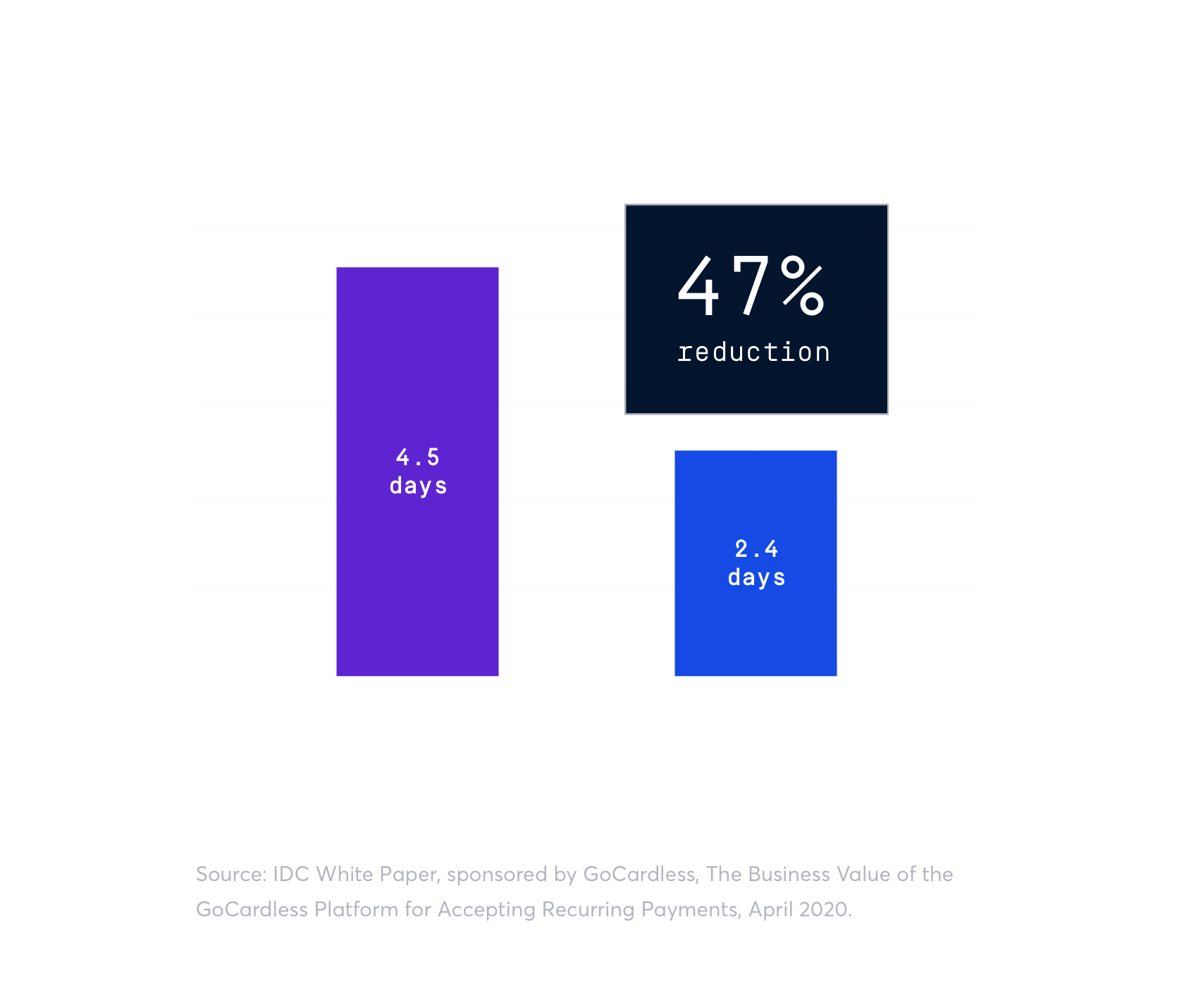

47% reduction in payout timings

An IDC White Paper sponsored by GoCardless found that businesses experience, on average, a 47% reduction in payout timings with GoCardless.

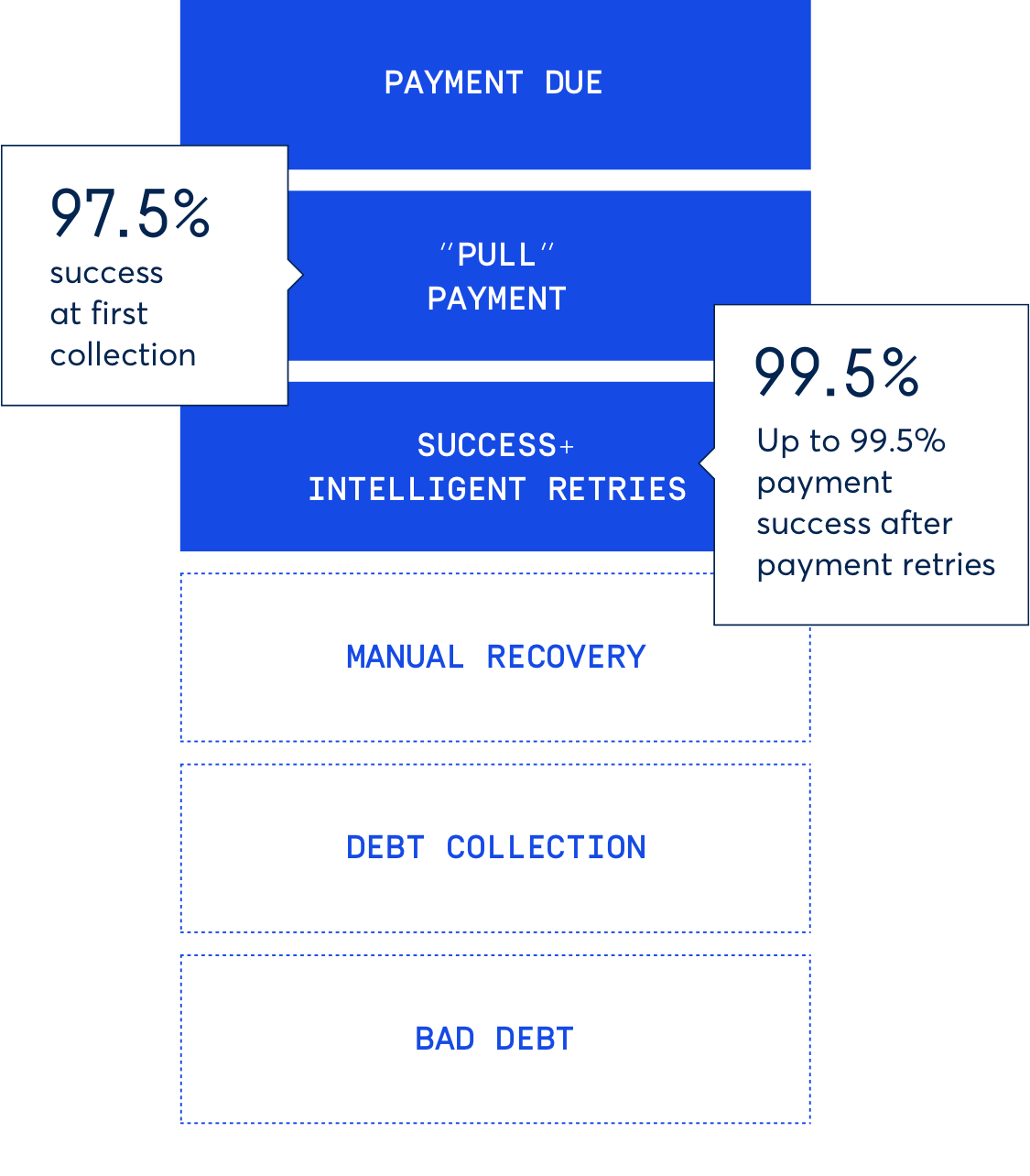

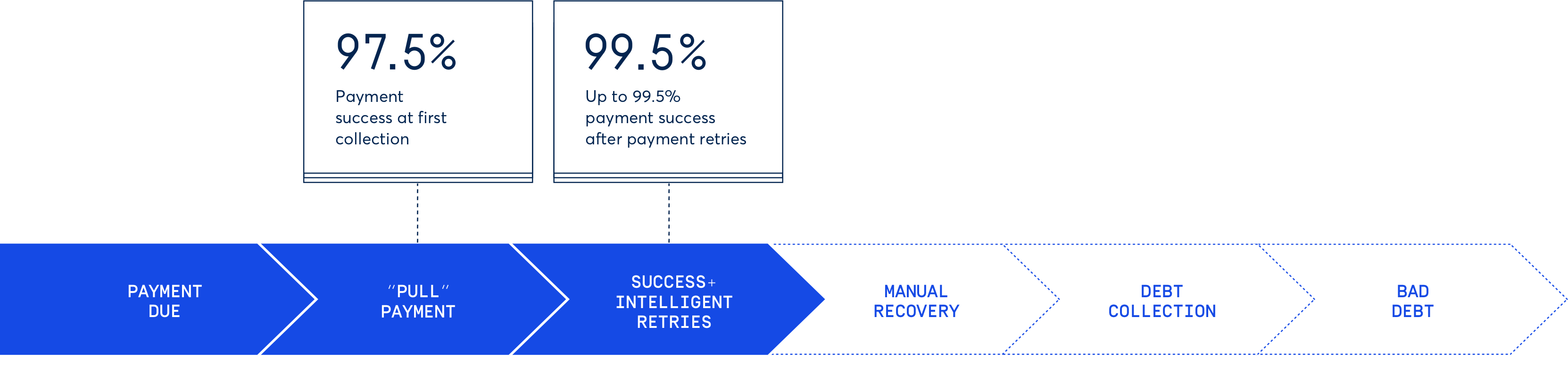

Fewer failures means more money

With GoCardless, 97.3 - 99% of payments are successfully collected the first time. Success+ boosts that to 99.5%, with failed payments automatically retried on the best day for each customer.

Automate or not. It’s up to you.

Get paid sooner by setting up automated, recurring payments. But you can also use GoCardless to easily collect instant, one-off payments.

How GoCardless works

Flexible integration options

API integration

Our RESTful API is designed for a simple integration, which requires minimal investment of resources and connects seamlessly to your business.

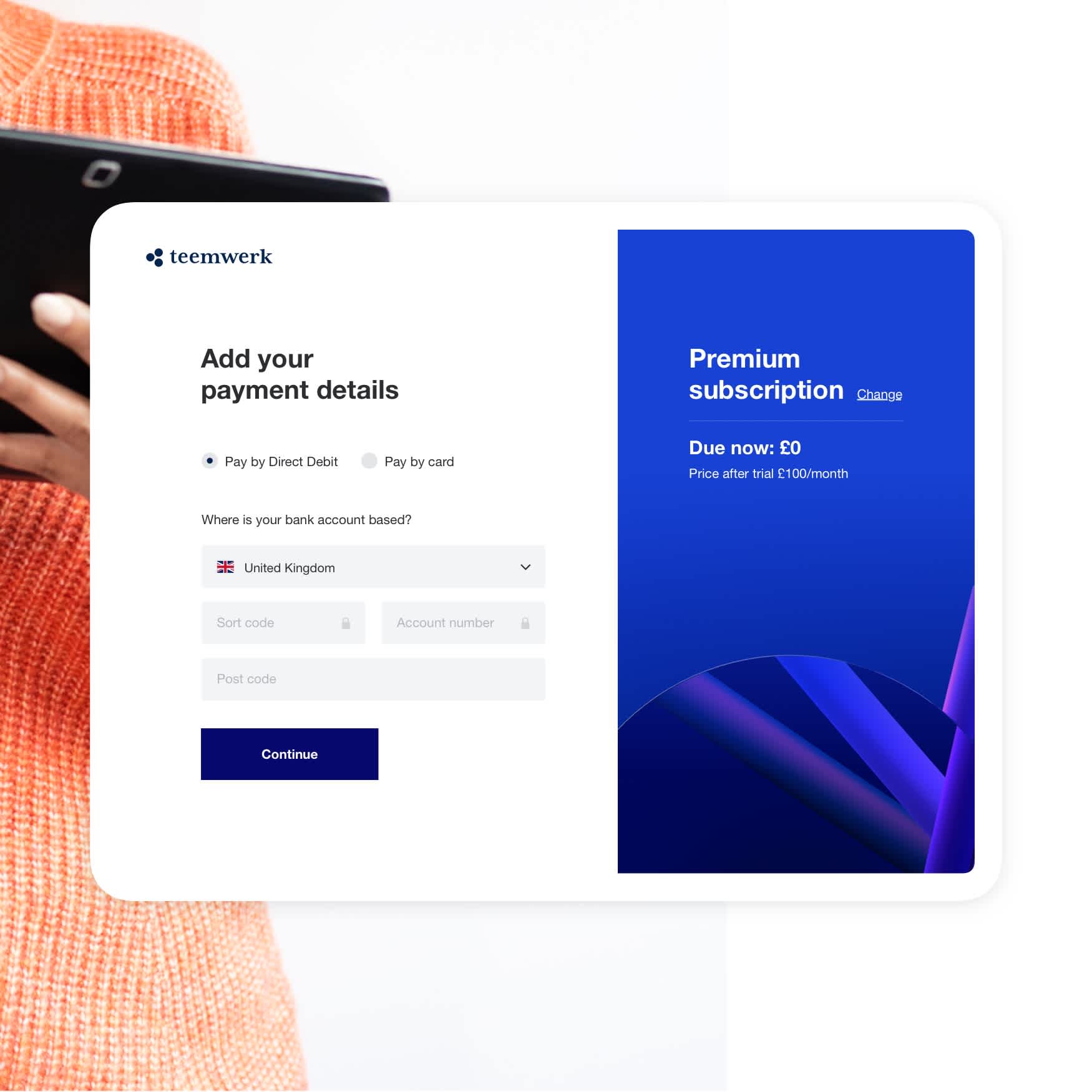

Pre-built payment page

A best-in-class, customisable checkout flow, easily embeddable on your website. Localised for over 30 countries. Optimised for improved conversion.

Secure payment link

Start using GoCardless straight away, with pre-built payment flows and automated notifications.

// Code example for creating a subscription

$client = new \GoCardlessPro\Client(array(

'access_token' => 'your_access_token_here',

'environment' => \GoCardlessPro\Environment::SANDBOX

));

$client->subscriptions()->create([

"params" => ["amount" => 40,

"currency" => "AUD",

"name" => "Premium Subscription",

"interval_unit" => "monthly",

"day_of_month" => 1,

"metadata" => ["order_no" => "ABCD1234"],

"links" => ["mandate" => "MA123"]]

]);# Code example for creating a subscription

import gocardless_pro

client = gocardless_pro.Client(access_token="your_access_token_here", environment='sandbox')

client.subscriptions.create(params={

"amount": "40",

"currency": "AUD",

"name": "Premium Subscription",

"interval_unit": "monthly",

"day_of_month": "1",

"metadata": {

"order_no": "ABCD1234"

},

"links": {

"mandate": "MA123"

}

})

]);# Code example for creating a subscription

@client = GoCardlessPro::Client.new(

access_token: "your_access_token",

environment: :sandbox

)

@client.subscriptions.create(

params: {

amount: 40,

currency: "USD",

name: "Premium Subscription",

interval_unit: "monthly",

day_of_month: 1,

links: {

mandate: "MD123"

}

}

)import static com.gocardless.GoCardlessClient.Environment.SANDBOX;

String accessToken = "your_access_token_here";

GoCardlessClient client = GoCardlessClient

.newBuilder(accessToken)

.withEnvironment(SANDBOX)

.build();

import com.gocardless.services.SubscriptionService.SubscriptionCreateRequest.IntervalUnit;

Subscription subscription = client.subscriptions().create()

.withAmount(40)

.withCurrency("USD")

.withName("Premium Subscription")

.withIntervalUnit(IntervalUnit.MONTHLY)

.withDayOfMonth(1)

.withMetadata("order_no", "ABCD1234")

.withLinksMandate("MD123")

.execute();var subscriptionRequest = new GoCardless.Services.SubscriptionCreateRequest()

{

Amount = 40,

Currency = "USD",

Name = "Premium Subscription",

Interval = 1,

IntervalUnit = GoCardless.Services.SubscriptionCreateRequest.SubscriptionIntervalUnit.Monthly,

Links = new GoCardless.Services.SubscriptionCreateRequest.SubscriptionLinks()

{

Mandate = "MD0123"

}

};// Code example for creating a subscription

const constants = require('gocardless-nodejs/constants');

const gocardless = require('gocardless-nodejs');

const client = gocardless('your_access_token_here', constants.Environments.Sandbox);

const subscription = await client.subscriptions.create({

amount: "40",

currency: "USD",

name: "Premium Subscription",

interval_unit: "monthly",

day_of_month: "1",

metadata": {

order_no: "ABCD1234"

},

links: {

mandate: "MA123"

}

});![[en-GB] nwe-code_summary_block- primarydark](https://images.ctfassets.net/40w0m41bmydz/5kIKu7t2kTxWsbNH7lEGwl/53c6f1aaa8494a2d9f01655eea00b6f5/code-example-en-gb.png?w=670&h=670&q=50&fm=png)

![[en-GB] nwe-code_summary_block- primarydark](https://images.ctfassets.net/40w0m41bmydz/5kIKu7t2kTxWsbNH7lEGwl/53c6f1aaa8494a2d9f01655eea00b6f5/code-example-en-gb.png?w=670&h=670&q=50&fm=png)

Built for security and scale

ISO27001 certified

Our security has been audited and certified with this globally-recognised, international standard.

GDPR compliant

Our global data risk management programme is built to strict GDPR standards. And applies best practices to help protect personal data.

Trusted by global businesses

GoCardless processes $20bn+ annually, and has been funded by prestigious investors including Google Ventures and Salesforce Ventures.

Compliance built-in

We handle the complexities of payment processing across 30+ countries in a single integration.

Trusted by over 60,000 businesses globally

Ready to reduce your time to get paid?

Speak to a payment expert to learn how you can optimise your payments strategy.