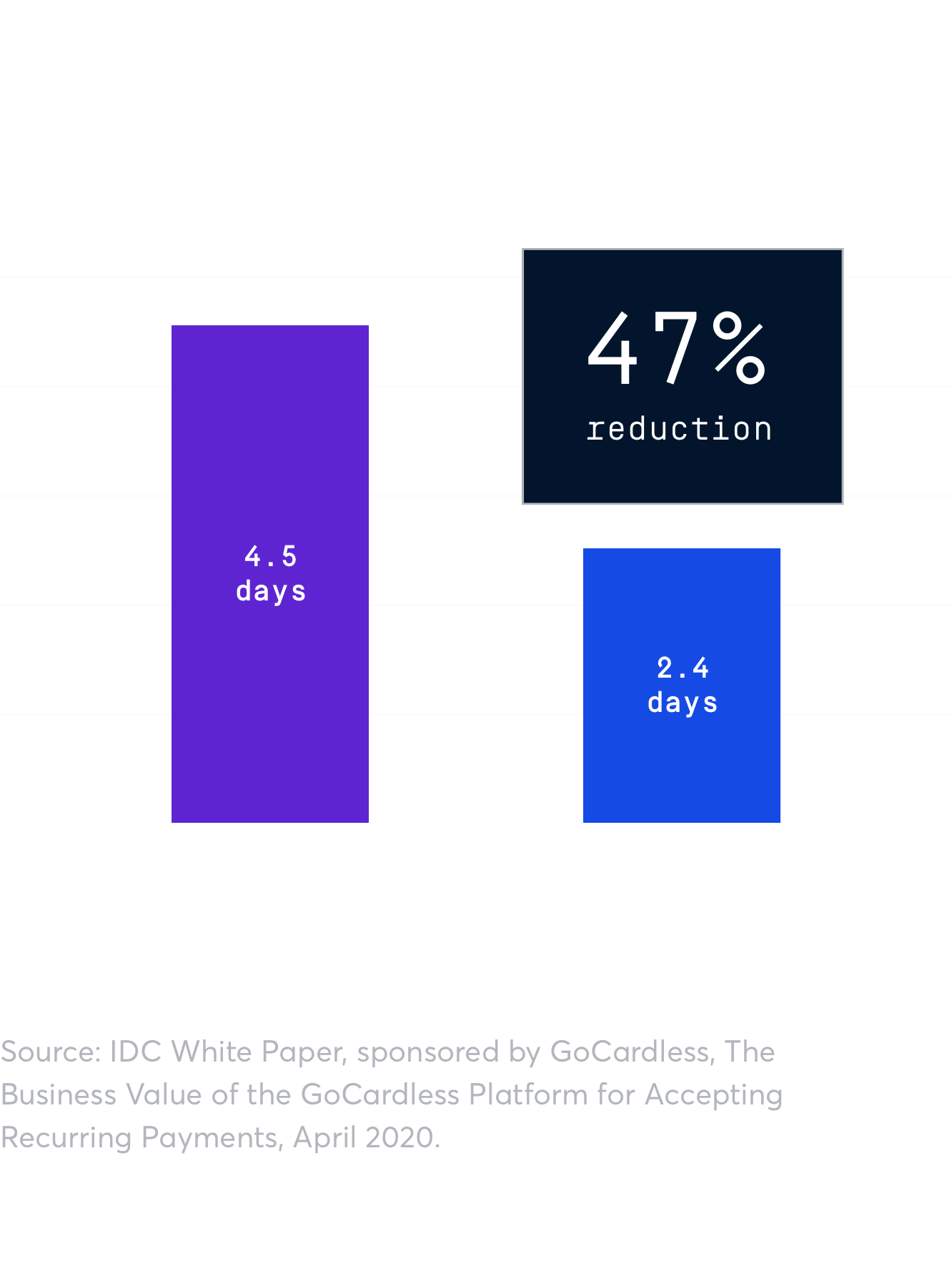

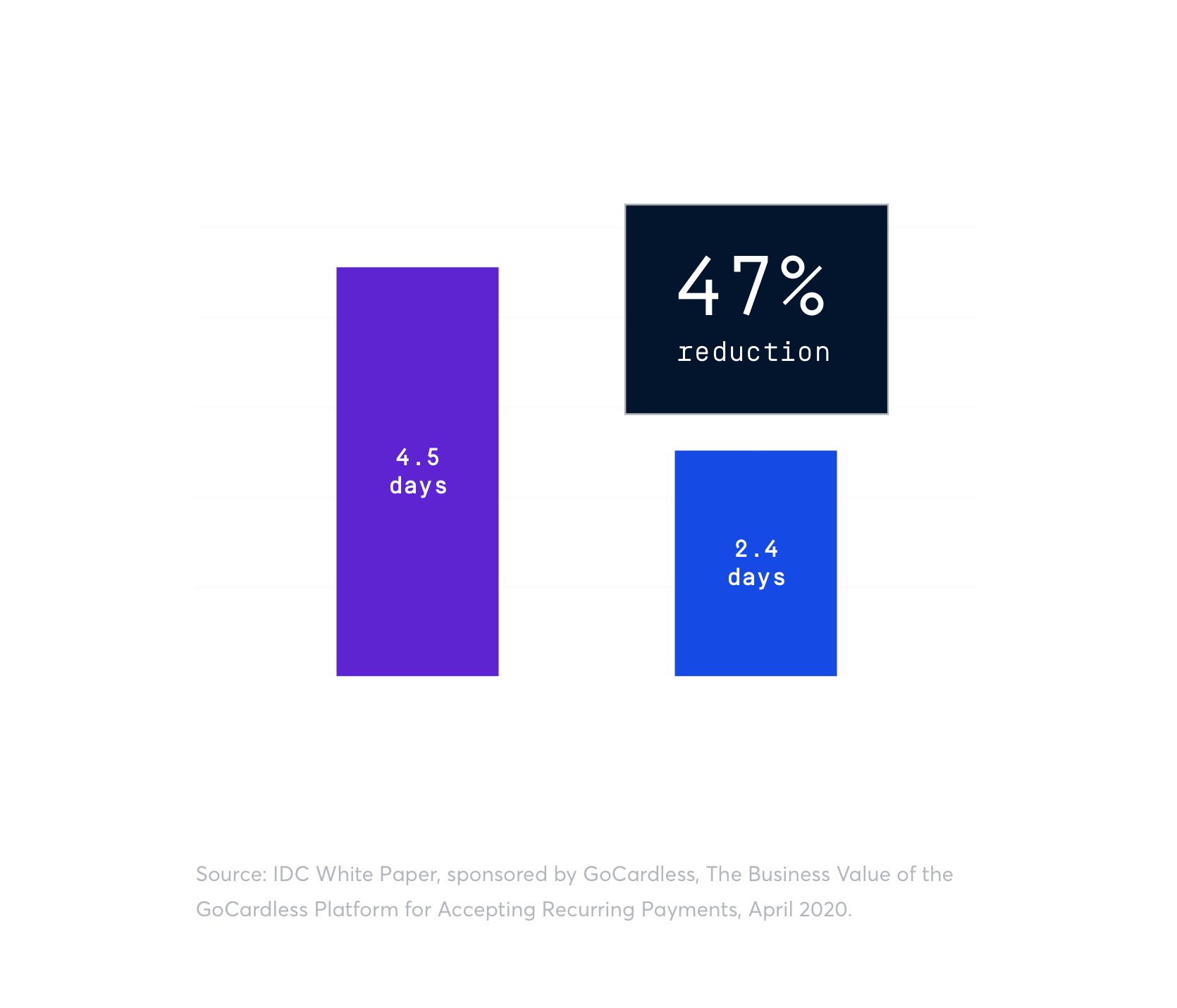

Reduce time to receive payments

Reduce the time to receive payments by 47% with GoCardless, and minimise your debtor days by taking full control of when payments are made.

Your high DSO is stopping you from growing

A high DSO and a growing list of outstanding receivables limits your brand’s ability to invest for the future.

Everything just works… It’s now a one- or two-touch billing process, once a month. We don’t need to think or worry about it anymore."

John Heggs, Finance Manager, intY

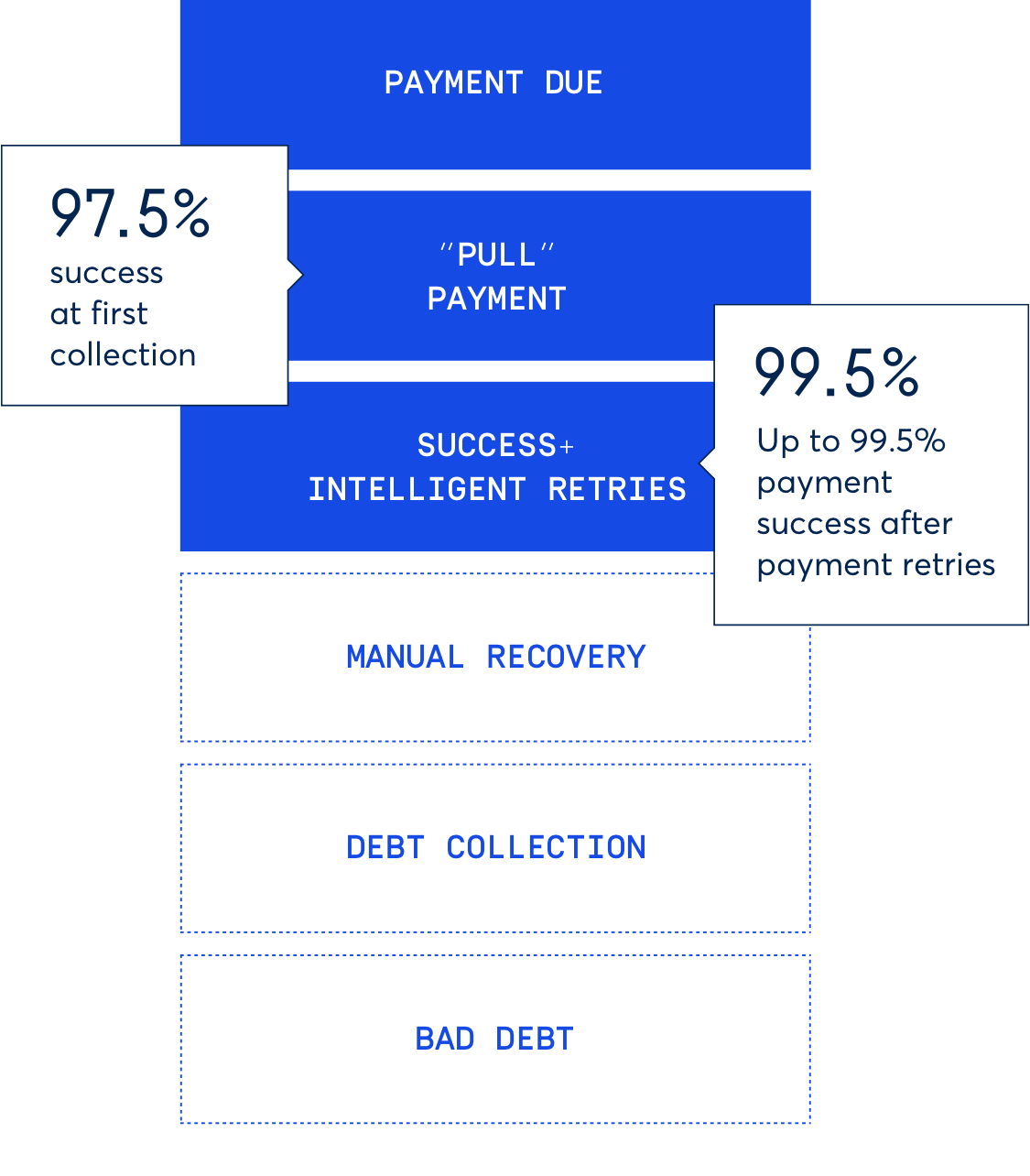

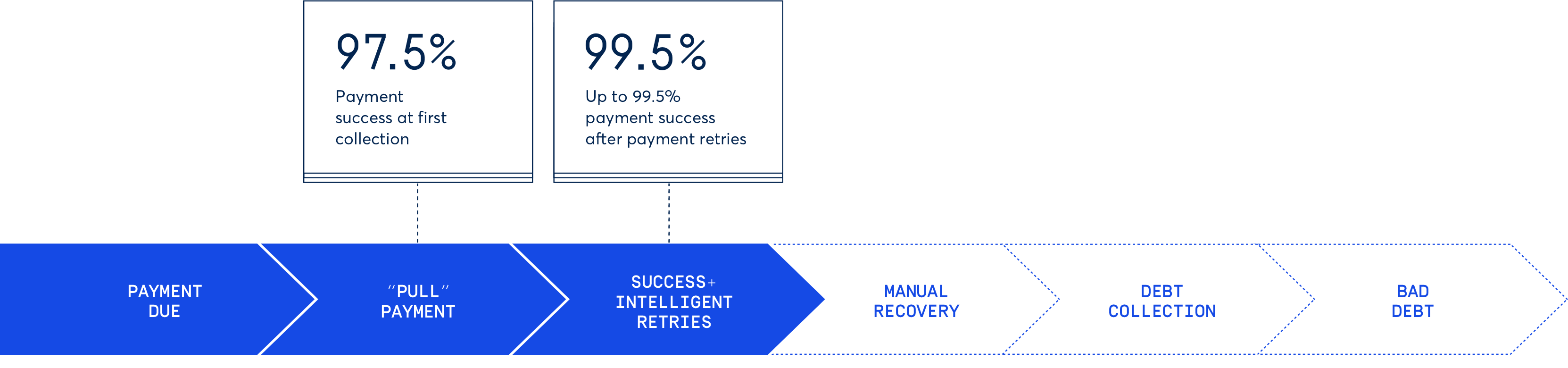

Gain full control over payment collection

GoCardless is built on bank debit, a pull-based payment method. This puts you in control of when payments are collected, giving you full oversight of your accounts receivable.

Pull-based payment collection

GoCardless is built on bank debit, a pull-based, bank-to-bank payment method that allows businesses to collect payments directly from their customers’ bank accounts.

Low payment failure rates

With GoCardless, around 97.3% of payments will be collected successfully first time around. With real-time reporting, you’ll know instantly when a payment does fail so you can act fast.

Intelligent retries

Recover up to 76% of any failed payments with Success+, which retries payments on the optimal day to collect from each customer.

How it works

Flexible integration options

API integration

Our RESTful API connects seamlessly to your business, requiring only minimal investment of resources.

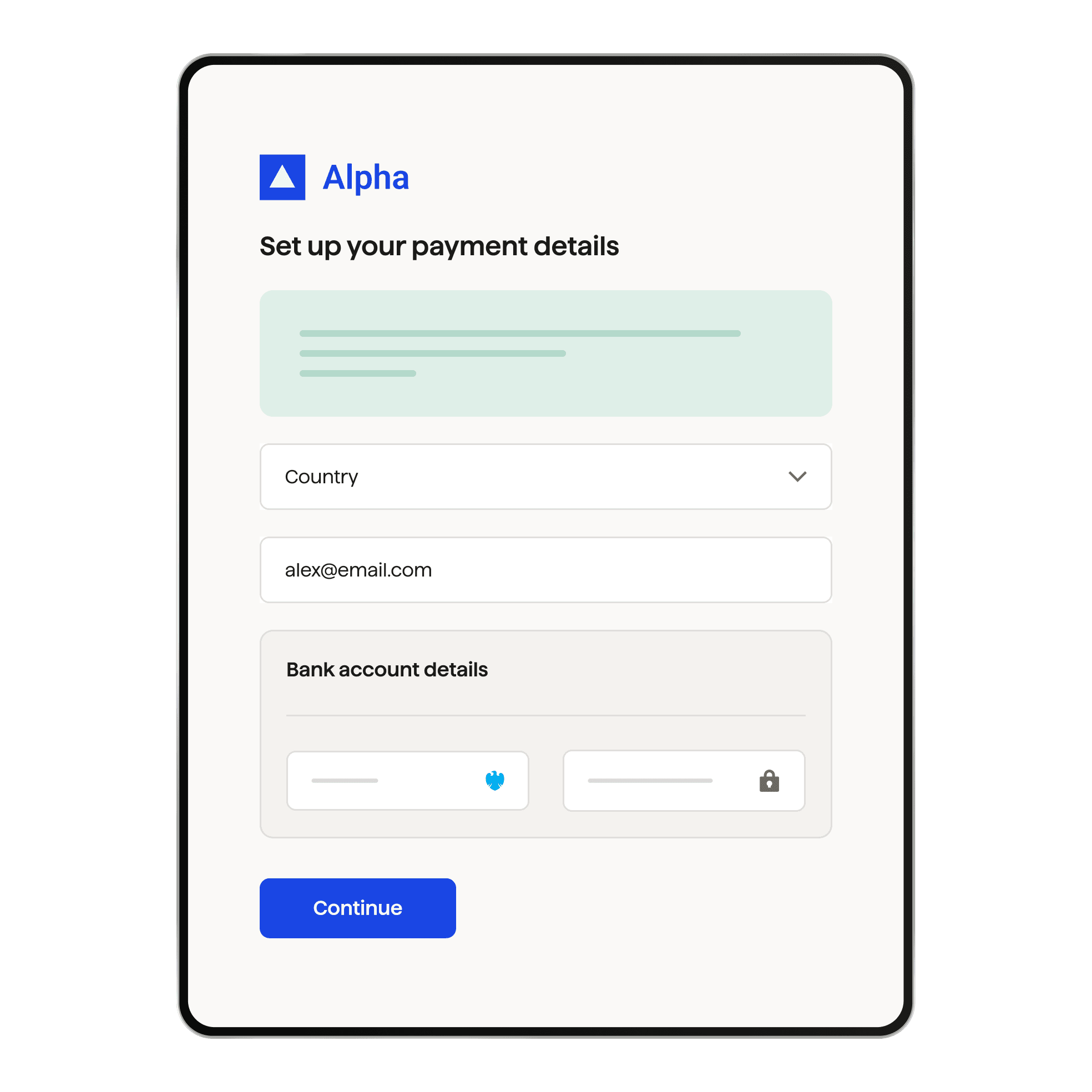

Pre-built payment page

Embed a customised checkout flow into your website. Our best-in-class checkouts are localised for over 30 countries and optimised for greater conversion.

Secure payment link

Start using GoCardless straight away, with pre-built payment flows and automated notifications localised for over 30 countries.

// Code example for creating a subscription

$client = new \GoCardlessPro\Client(array(

'access_token' => 'your_access_token_here',

'environment' => \GoCardlessPro\Environment::SANDBOX

));

$client->subscriptions()->create([

"params" => ["amount" => 40,

"currency" => "AUD",

"name" => "Premium Subscription",

"interval_unit" => "monthly",

"day_of_month" => 1,

"metadata" => ["order_no" => "ABCD1234"],

"links" => ["mandate" => "MA123"]]

]);# Code example for creating a subscription

import gocardless_pro

client = gocardless_pro.Client(access_token="your_access_token_here", environment='sandbox')

client.subscriptions.create(params={

"amount": "40",

"currency": "AUD",

"name": "Premium Subscription",

"interval_unit": "monthly",

"day_of_month": "1",

"metadata": {

"order_no": "ABCD1234"

},

"links": {

"mandate": "MA123"

}

})

]);# Code example for creating a subscription

@client = GoCardlessPro::Client.new(

access_token: "your_access_token",

environment: :sandbox

)

@client.subscriptions.create(

params: {

amount: 40,

currency: "USD",

name: "Premium Subscription",

interval_unit: "monthly",

day_of_month: 1,

links: {

mandate: "MD123"

}

}

)import static com.gocardless.GoCardlessClient.Environment.SANDBOX;

String accessToken = "your_access_token_here";

GoCardlessClient client = GoCardlessClient

.newBuilder(accessToken)

.withEnvironment(SANDBOX)

.build();

import com.gocardless.services.SubscriptionService.SubscriptionCreateRequest.IntervalUnit;

Subscription subscription = client.subscriptions().create()

.withAmount(40)

.withCurrency("USD")

.withName("Premium Subscription")

.withIntervalUnit(IntervalUnit.MONTHLY)

.withDayOfMonth(1)

.withMetadata("order_no", "ABCD1234")

.withLinksMandate("MD123")

.execute();var subscriptionRequest = new GoCardless.Services.SubscriptionCreateRequest()

{

Amount = 40,

Currency = "USD",

Name = "Premium Subscription",

Interval = 1,

IntervalUnit = GoCardless.Services.SubscriptionCreateRequest.SubscriptionIntervalUnit.Monthly,

Links = new GoCardless.Services.SubscriptionCreateRequest.SubscriptionLinks()

{

Mandate = "MD0123"

}

};// Code example for creating a subscription

const constants = require('gocardless-nodejs/constants');

const gocardless = require('gocardless-nodejs');

const client = gocardless('your_access_token_here', constants.Environments.Sandbox);

const subscription = await client.subscriptions.create({

amount: "40",

currency: "USD",

name: "Premium Subscription",

interval_unit: "monthly",

day_of_month: "1",

metadata": {

order_no: "ABCD1234"

},

links: {

mandate: "MA123"

}

});![[en-AU] nwe-code_summary_block](https://images.ctfassets.net/40w0m41bmydz/5kIKu7t2kTxWsbNH7lEGwl/04f10f5d003d108ba7ad3f07df034e5b/code-example-en-au.png?w=670&h=670&q=50&fm=png)

![[en-AU] nwe-code_summary_block](https://images.ctfassets.net/40w0m41bmydz/5kIKu7t2kTxWsbNH7lEGwl/04f10f5d003d108ba7ad3f07df034e5b/code-example-en-au.png?w=670&h=670&q=50&fm=png)

Built for security and scale

ISO27001 certified

Security protocols across our business, services and products have been fully audited and certified with this globally recognised standard.

GDPR compliant

The GoCardless global data risk management program is built to strict GDPR standards and uses privacy best practice to help protect and respect personal data.

Trusted by global businesses

GoCardless processes $13 billion+ annually, and has been funded by prestigious investors including Google Ventures and Salesforce Ventures.

Compliance built-in

We handle the complexities of bank debit across 30+ countries in a single integration.

Trusted by over 60,000 businesses globally

Ready to reduce your time to get paid?

Speak to a payment expert to learn how you can optimise your payments strategy.