DocuSign improves conversions by 10%

DocuSign offers GoCardless as a key payment option globally to win more customers. Integrating with GoCardless has resulted in increased customer retention compared to credit cards and PayPal and a higher average selling price than other payment methods.

In short, GoCardless has become a key payment method option for DocuSign. And wherever we offer GoCardless, customers convert better.”

Beverly Tu, Director of eCommerce Growth, DocuSign

Diversify your payment options with GoCardless

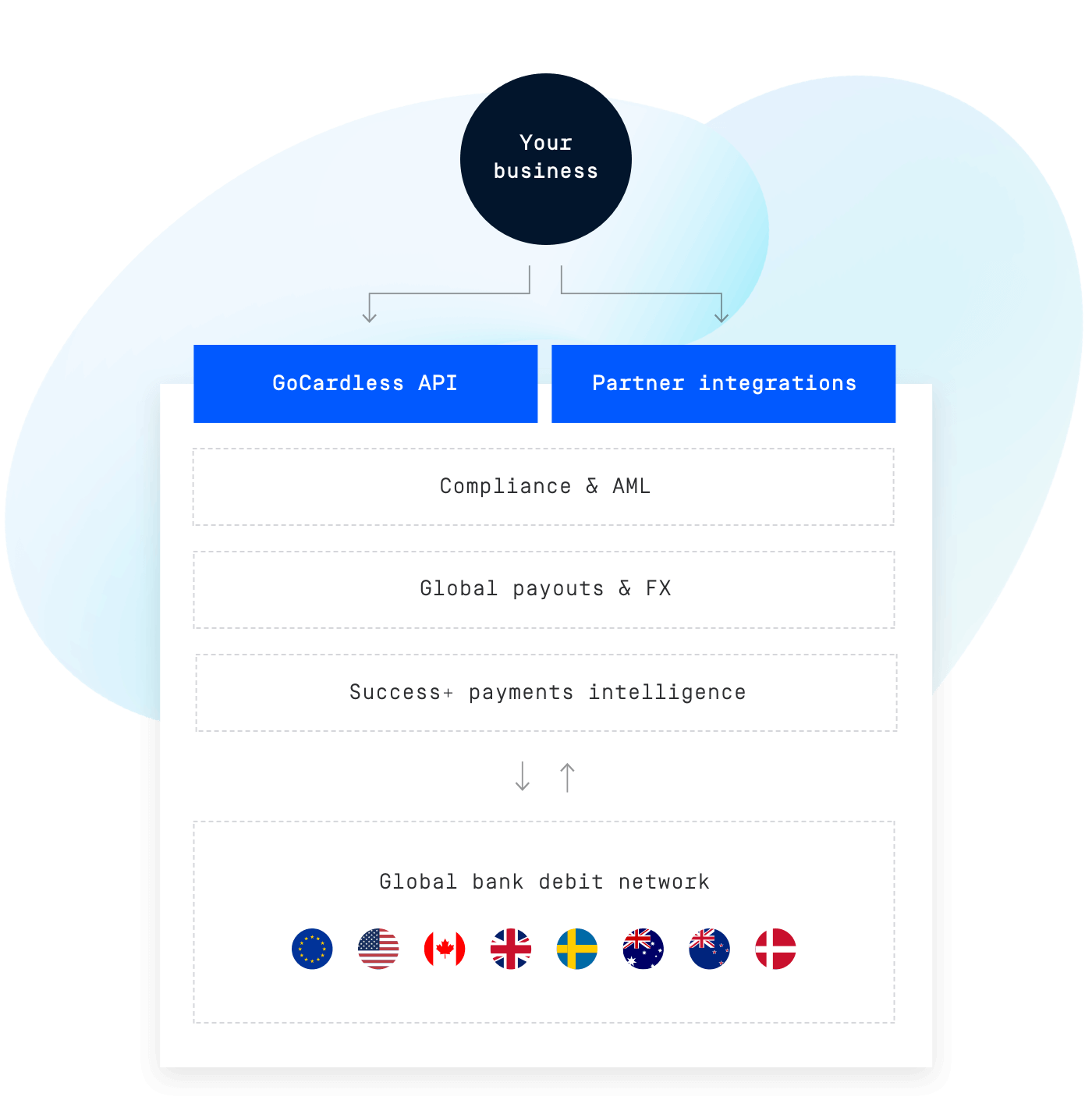

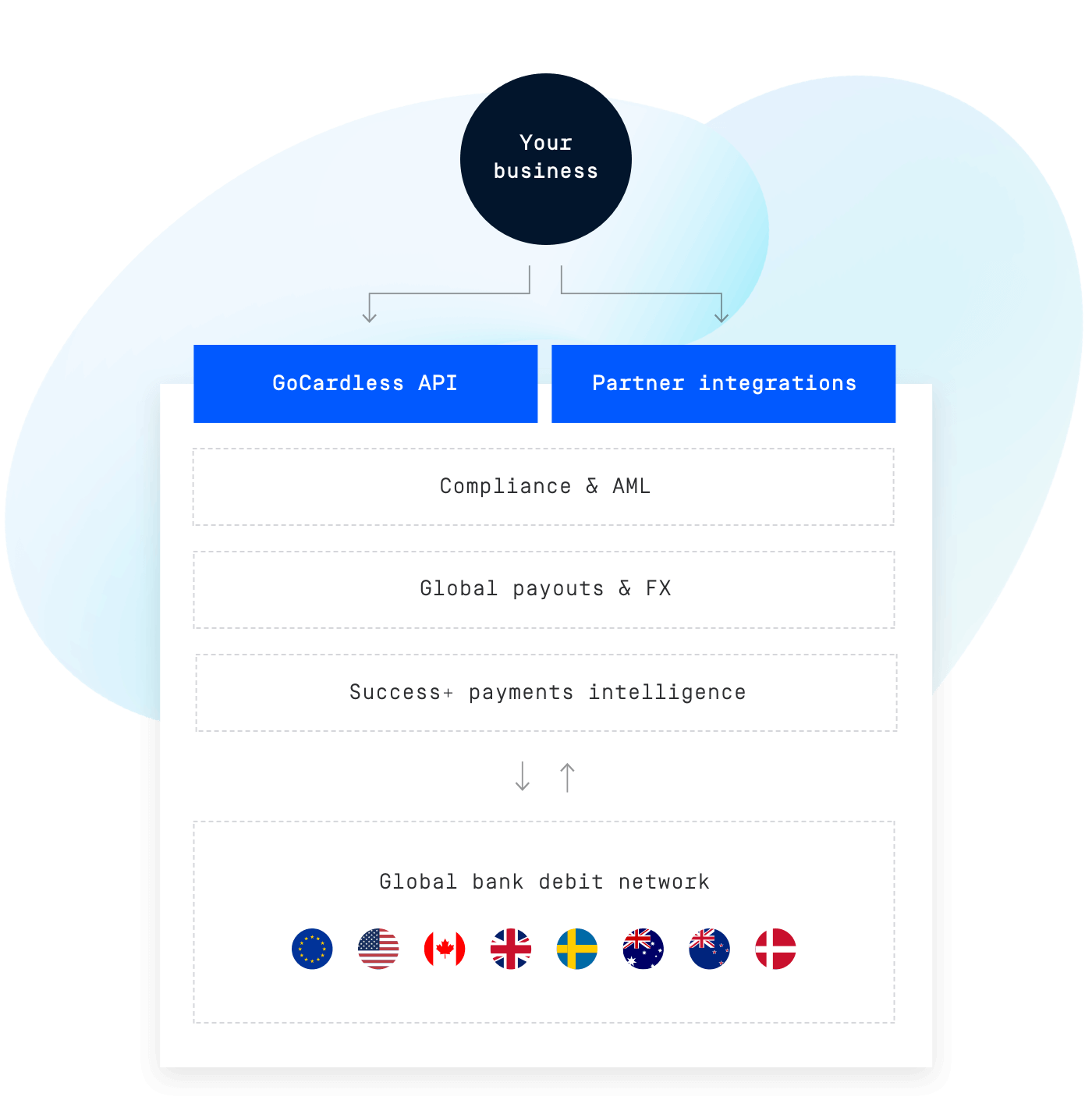

Collect payments using bank debit and bank-to-bank payments in more than 30 countries with GoCardless. Bank debit compliments your payment strategy to create a best-in-class checkout experience.

GoCardless helps you:

Use local payments with a global reach

GoCardless has created the first global network designed for recurring payments. Offer bank debit in 30+ countries, including; the UK, Eurozone countries, the US, Canada, Australia and New Zealand.

Lower payment failure rates

With GoCardless, around 97.3% of payments are collected successfully first time. With real-time reporting, know instantly when a payment does fail so you can take action.

Integrate with your existing systems

Connect GoCardless to your global tech stack with our extensive list of partner integrations, including; Salesforce, Zuora and Chargebee. Or use our API.

Built for security, scale & success

ISO27001 certified

Security protocols across our business, services and products have been fully audited and certified with this globally-recognised international standard.

GDPR compliant

The GoCardless global data risk management programme is built to strict GDPR standards and applies privacy best practices to help protect and respect personal data.

Trusted by global businesses

GoCardless processes $13bn+ annually, and has been funded by prestigious investors including Google Ventures and Salesforce Ventures.

Compliance built-in

We handle the complexities of bank debit across 30+ countries in a single integration.

Trusted by over 60,000 businesses globally

Leverage payer preferences to your advantages

Speak to a payment expert to learn how you can optimise your payments strategy.