GoCardless launches GoCardless Protect+ to help businesses fight fraud and retain revenue

Last editedOct 20222 min read

The introduction of its second ‘payment intelligence’ product comes as merchants facing economic headwinds look for ways to address lost revenue

New York, 24 October 2022 -- GoCardless, a global leader in bank payment solutions, has launched GoCardless Protect+, an end-to-end fraud prevention solution that detects fraudulent activity and protects merchants from potential losses through enhanced payer verification, 24/7 fraud monitoring and chargeback challenges. With GoCardless Protect+, merchants will be able to improve their overall percentage of successful payments, significantly reduce the costs associated with managing payer fraud and protect both their revenue and reputation.

With 62% of US businesses citing fraud as a ‘top threat’ and 91% saying the current economic conditions motivate them to reduce the amount of revenue they lose due to fraud, the introduction of GoCardless Protect+ offers an alternative to existing fraud prevention options, which many merchants find frustrating due to high costs (27%), the time required to administer (26%) and poor customer experience (21%).

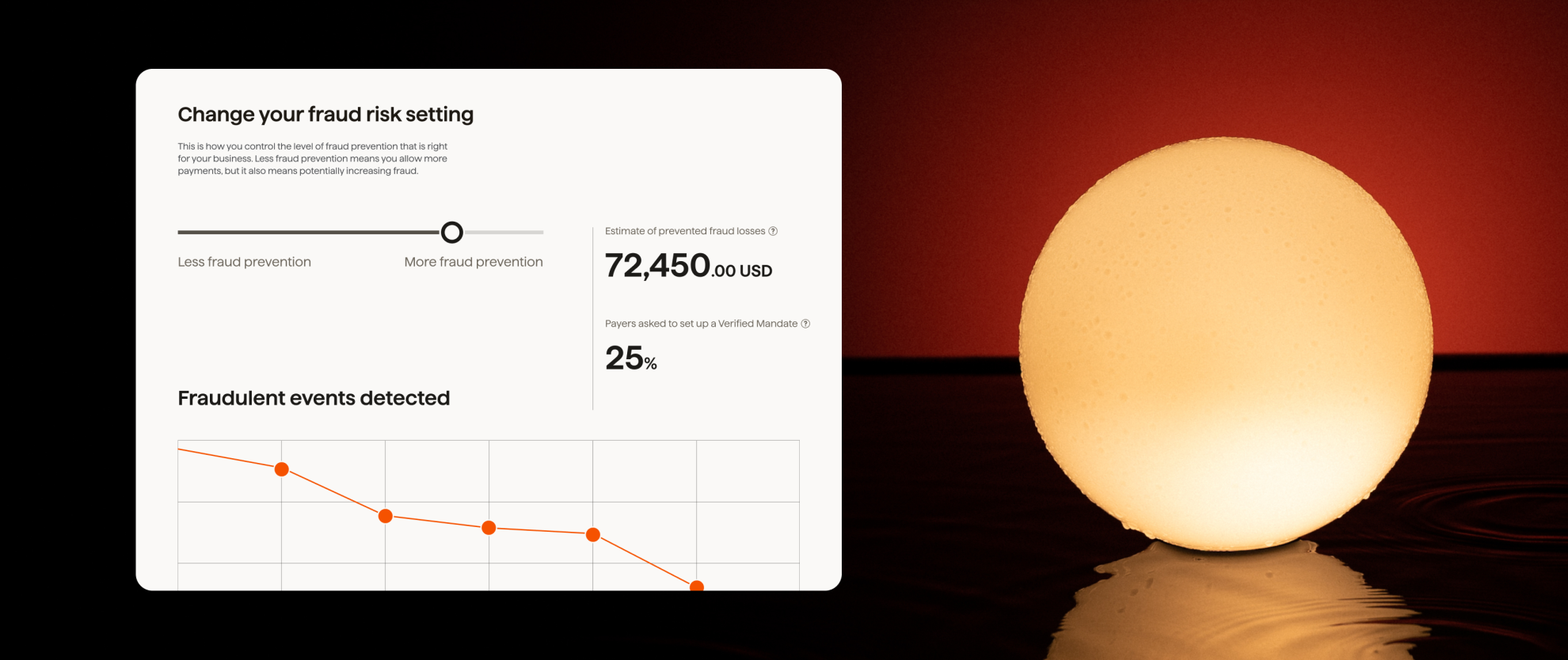

GoCardless Protect+, the second ‘payment intelligence’ product from the fintech, combines data from the billions of transactions processed on its global bank payment network with custom parameters set by merchants to match their risk appetite. It detects and prevents three types of fraud:

Identity fraud, when a fraudulent payer uses stolen or purchased bank account details (that may be valid or invalid).

No intent to pay, when a fraudulent payer uses their own bank account, but has no intention to pay for the goods or services received.

Unfair chargebacks, when a fraudulent payer uses their own bank account, but submits a chargeback after receiving the service or goods.

The launch of GoCardless Protect+ comes as US businesses face a particularly challenging time. 96% of merchants reveal the cost of running their business is higher than it was a year ago and a similar proportion (90%) are actively looking to cut costs. The most popular tactic to improve their financial position over the next six months is to renegotiate more favourable terms with suppliers, with 51% saying it’s “one of the first things” they’d consider. This is followed closely by addressing sources of lost revenue, such as finding ways to increase conversion or reduce revenue lost to fraud (48%).

Duncan Barrigan, Chief Product Officer and Chief Growth Officer at GoCardless, said: “We’re excited to launch GoCardless Protect+ to help businesses not only weather the current macroeconomic climate, but also put themselves in a stronger position for the future. GoCardless Protect+ identifies fraudulent payers and stops them in their tracks, protecting a company’s reputation, revenue and the experience for genuine payers. And because Protect+ is built into our global bank payment network, you can manage your payments and protect against fraud, all on one platform.”

Clare Bennett, Product Manager at Capital on Tap, said: “We’ve been closely involved in the development and pilot of GoCardless Protect+. We believe it will be a vital part of our payment strategy in the years ahead, helping to ensure we protect our revenue to power our growth."

GoCardless Protect+ is the second product in the 'payment intelligence' suite from GoCardless, a set of services which use proprietary machine learning models to optimise the way companies collect and retain their bank payments -- ensuring more successful payments, lower failure rates and less fraud. The first payment intelligence product, Success+, automatically optimises failed payment retries. Since launch, Success+ has helped businesses recover, on average, 70% of payments that initially fail.

Notes to Editors

The research cited in this study was conducted in two waves:

A aurvey of 500 recurring-payment businesses in the US, administered online through Attest during February 2021

A survey of 500 business decision-makers in the US, administered online through Attest during September 2022