Last editedApr 20235 min read

A word about words...

You’ll hear Bank Debit referred to by a lot of different names. In the US, it’s often called ACH debit, because the Automated Clearing House (ACH) network is used for electronically moving money between bank accounts here.

In much of Europe, they call it Direct Debit. You’ll also hear ‘bank-to-bank’.

But there’s no difference. These terms all refer to the same thing. Essentially, bank debit is a ‘pull payment’ system whereby creditors are authorized to debit a customer's bank account directly at regular intervals.

The choice for SaaS

And here in the US, bank debit is becoming increasingly popular. It moved financial transactions worth more than $55 trillion in 2019, an increase of 8 percent from the previous year.

That’s partly because SaaS companies are finding bank debit to be the ideal vehicle for the repeat transactions at the heart of their business model:

Bank debit transactions don’t go through the card networks such as Visa or Mastercard and therefore don’t incur those carriers’ costs. Instead, they are backed by the banks that we all use every day.

And they are a remedy to payment failure, the greatest challenge of SaaS billing:

Forrester research reports that “Payment failures create serious implications that become increasingly difficult to overcome, including cost of payment recovery, bad debt and customer churn”.

Why does bank debit matter for SaaS businesses?

Better renewals, less churn

For any SaaS business, payments are a crucial component. To go all the way through the process of a new customer, onboarding them with a trial, converting them into a willing payor - and then losing them at the final hurdle of payment – is the worst possible outcome for your business: all the effort, none of the payback!

Bank debit has high transaction success rates, which supports both the crucial first transaction and subsequent renewals. Since SaaS businesses typically achieve breakeven only after 5-12 months, repeated payment transaction success is an essential driver of profitability.

Automate your processes with digitization

Checks and wire transfers are both still in use, particularly for higher value purchases in B2B contexts. But new research conducted by Forrester for GoCardless says that “most (70%) B2B decision-makers are embracing bank debit more than check payment, which stands at 64%. With technology advancements in digital payments, checks are becoming burdensome for US firms to use”. Bank debit is highly automated. And in the SaaS world, where the cost of every expected interaction must be considered at scale, end-to-end digital processes are invaluable.

Online ACH payments have grown 15.5% in Q2 2020. Checks on the other hand are down, 8.4% YoY Q1 in 2020 *Source Nacha

For lower budget SaaS products, purchases usually take place with no human interaction at all. These payments will be unsupervised, and must work optimally.

At higher price-points, a customer success team may be involved, but they will always be constrained for time and judged by their efficiency.

Either way, automation of payments cuts the cost of the sales process, and reduces scope for errors. In a recent IDC study, a GoCardless client reported: "With GoCardless, we've made our operational footprint for validating payments more efficient and accurate because it's all done in a fully automated way." IDC found that a lower cost per transaction and staff efficiencies combined to enable a 56% lower cost of accepting transactions on average.

Lower direct costs

The median internal cost for processing ACH payments is just $0.29. This is usually dramatically more economical than a credit card transaction. Scale up across thousands of transactions and the value of cheaper payments to the SaaS business model is clear.

Meet your customers on their own terms

We’ve already seen that bank debit is becoming increasingly popular. To ensure that payments are not an insurmountable hurdle for SaaS customers, you must offer payment solutions that are ideal for their needs. Bank debit is an important addition to the payments armory: it is convenient, trusted (using the banks in which customers already have faith), and supports ongoing payments.

Despite the disruption caused by COVID, ACH transactions grew by 7.1% YoY in Q1 2020

Measuring up: Bank debit vs other payment methods

Bank debit is not right for every transaction, and you should work out which payments model is right for you - in some cases, it may make sense to support more than one. Here are all the main payment methods compared:

|

|

Bank Debit |

Credit Card |

Wire Transfer |

Check |

|---|---|---|---|---|

|

Cost |

Low cost - no card network fees and handling fees of 0.5-1.5%. |

Typically 2-4% of transaction amount. |

On average, $25 per transaction |

Costly to handle, especially in the event of errors. |

|

Scalability |

Scalable: high volume businesses generally pay less. |

Scalable: high volume businesses generally pay less |

Little scalability |

No scalability |

|

Risk of customer loss |

Low. Automated and frictionless. |

Moderate. Frictionless – but a source of involuntary churn as cards expire |

High. Manual process requires intervention. |

High. Manual process requires intervention. |

|

Customer Experience |

Simple and leverages trust built up with bank |

Simple (but linked to debt) |

Complex and expensive |

Slow and requires effort |

|

Timing |

Can take 3+ days to appear in your account |

Almost instant |

Almost instant |

Long cycle, and deeply manual |

|

Accessibility |

Open to anyone – business or consumer – with a bank account |

Many are not approved for credit cards, many more are uncomfortable using their cards – especially online. |

Open to anyone – business or consumer – with a bank account. |

Open to anyone – but also very open to fraud. |

Because of its low cost base, bank debit is particularly compelling for subscription and SaaS businesses, where repeat transactions create dramatic economies of scale.

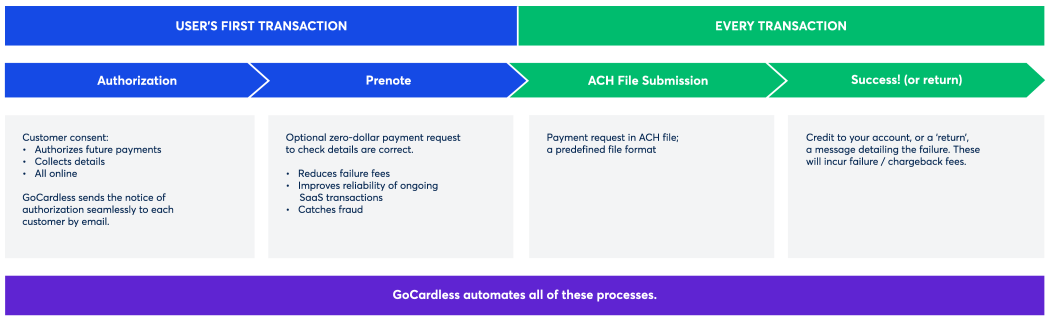

The process: a typical transaction

Transactions with bank debit follow a simple, secure and predictable process. Here’s what a typical transaction looks like:

Handling returns: keeping risk and cost low

Yes, as with all payment types, there are returns. When making bank debit payments, customers are protected by ACH rules and also through Federal Regulation. These protect your reputation, too. The rules govern:

Your obligation to engage with customers in a dispute

Your duty to investigate errors and the speed of your response

And your record-keeping to resolve disputes satisfactorily

There is an established ‘red flag’ system for businesses hitting e.g. 15% total returns.

But in practice, a very low number of bank debits are returned – particularly if you follow best practices for taking bank debits. Returns are, of course, bad for business. You can reduce the risk of your customers requesting returns by:

Giving customers ample advance notice of a payment (GoCardless does this automatically)

Providing clear contact information and easy to reach customer service, so that issues can be resolved before they are escalated to the bank

Processing cancellation requests without delay

Bank debit presents a consistently lower rate of transaction returns – mainly because (unlike credit cards), bank accounts don’t expire. This eliminates a key cause of service churn in subscription or SaaS businesses. Plus, there is one universal set of rules observed by all banks, which makes exception-handling easier.

Getting Started: Your ACH journey

Most businesses unlock bank debit facilities through a Payment Services Provider. A good payments provider, like GoCardless will provide all the expertise you need to reduce the effort and expense of taking bank debit payments;

Cutting per-transaction costs: protecting your margin

Automating complex processes: so you can concentrate on your core business

Delivering a seamless customer experience: meeting client expectations and delivering choice

Extending your global footprint: ideal for SaaS expansion

Independent analysts IDC report that ACH via GoCardless generates a 56% lower average cost per transaction and 12% more efficient customer support teams.

And so protecting your recurring income stream, all without disrupting your existing billing and financial management systems – GoCardless integrates seamlessly with your current finance operation and won’t require any refactoring of existing processes.

Workflow benefits of a payments provider

No need for a direct contract (origination agreement) with your bank or the admin of your own ACH Company ID

Customers notified automatically ahead of future payments

Handling the entire payment collection process for each transaction:

Easy and fully compliant online debit authorization forms

Generation of prenotes

Perfectly formatted ACH files for every transaction

Fast collection - GoCardless has optimized the ACH debit collection process to collect funds as fast as possible

Minimization of returns – and compliant and stress-free management when they do occur

Manage all payments using a simple online tool, or integrate with the GoCardless REST API.

Handling of annual compliance audits of physical and digital security

Secure storage of authorizations and transaction records

Simple execution of mandated customer communications (for e.g. changes to amounts or dates of payment for recurring payments)

Next Steps

Find out more about the application of bank debit to your SaaS business with the latest independent research from Forrester.

If you’re worried about the cost of incomplete and failed payments, you’re not alone - over half of US payment decision makers surveyed by Forrester said that “7% or more of their payments have failed in the last 12 months.” Given the expense of finding, onboarding and trialing customers to SaaS services, these failed payments represent the worst possible financial outcome.

However, the research also examines the collective experience of US companies in deploying recurring payment solutions. It finds how payment success is linked to customer retention, cuts costs and supports business objectives like international expansion.

Learn more: read “Recurring Payment Friction in the US”