Epson improves conversion by 80%

Epson offers GoCardless globally to meet customer preference and increase conversions.

They’ve seen an 80% increase in conversions of ‘pending’ customers in two key regions and 40-50% of new customers completing their transactions as a result.

“Those who consider payment methods to be an auxiliary part of the proposition couldn’t be more wrong, a choice of payment method matters as much to customers as a choice of services.”

Mauro Bartoletti, Head of Digital Programs, Epson Europe

Diversify your payment options with GoCardless

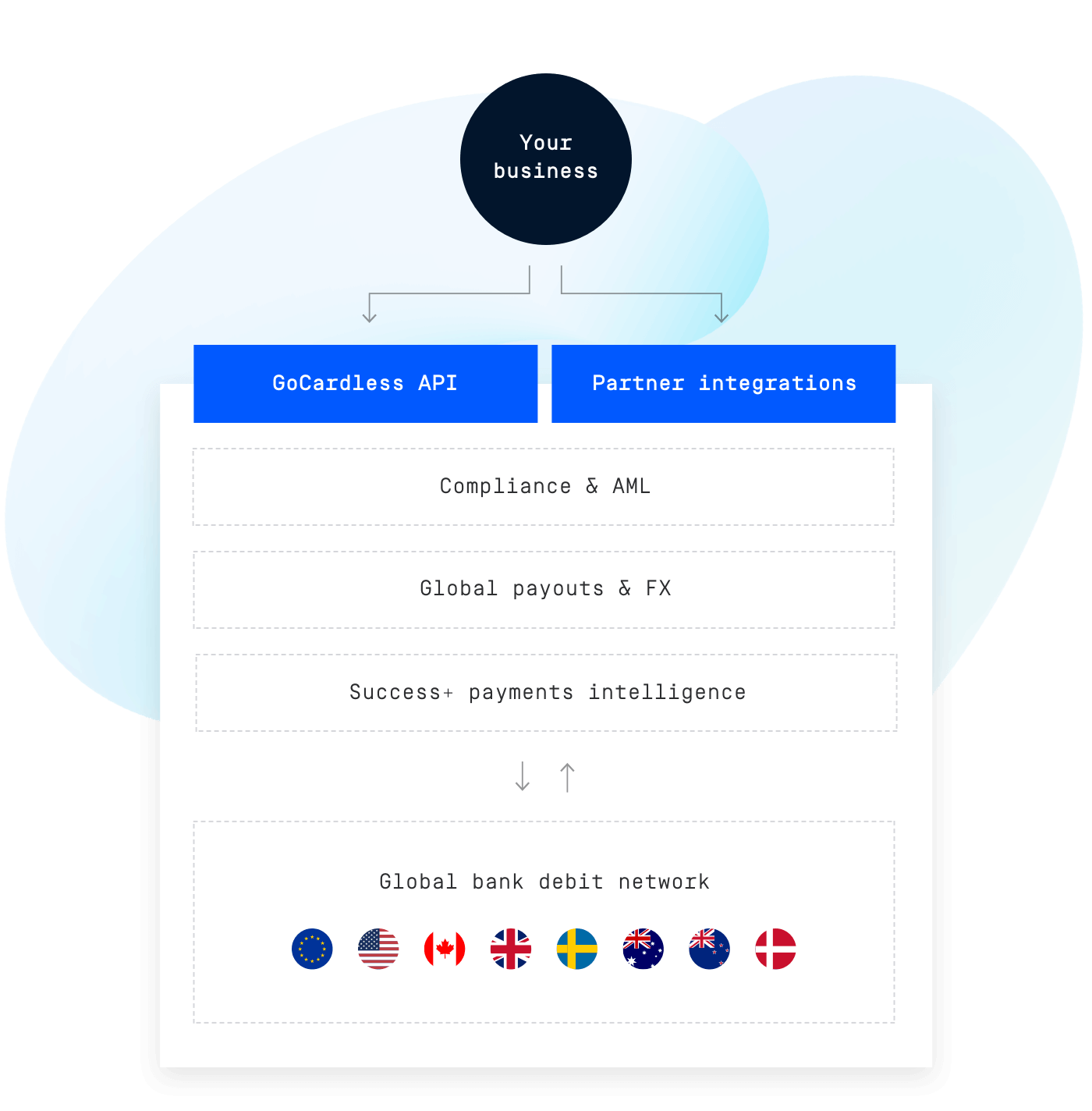

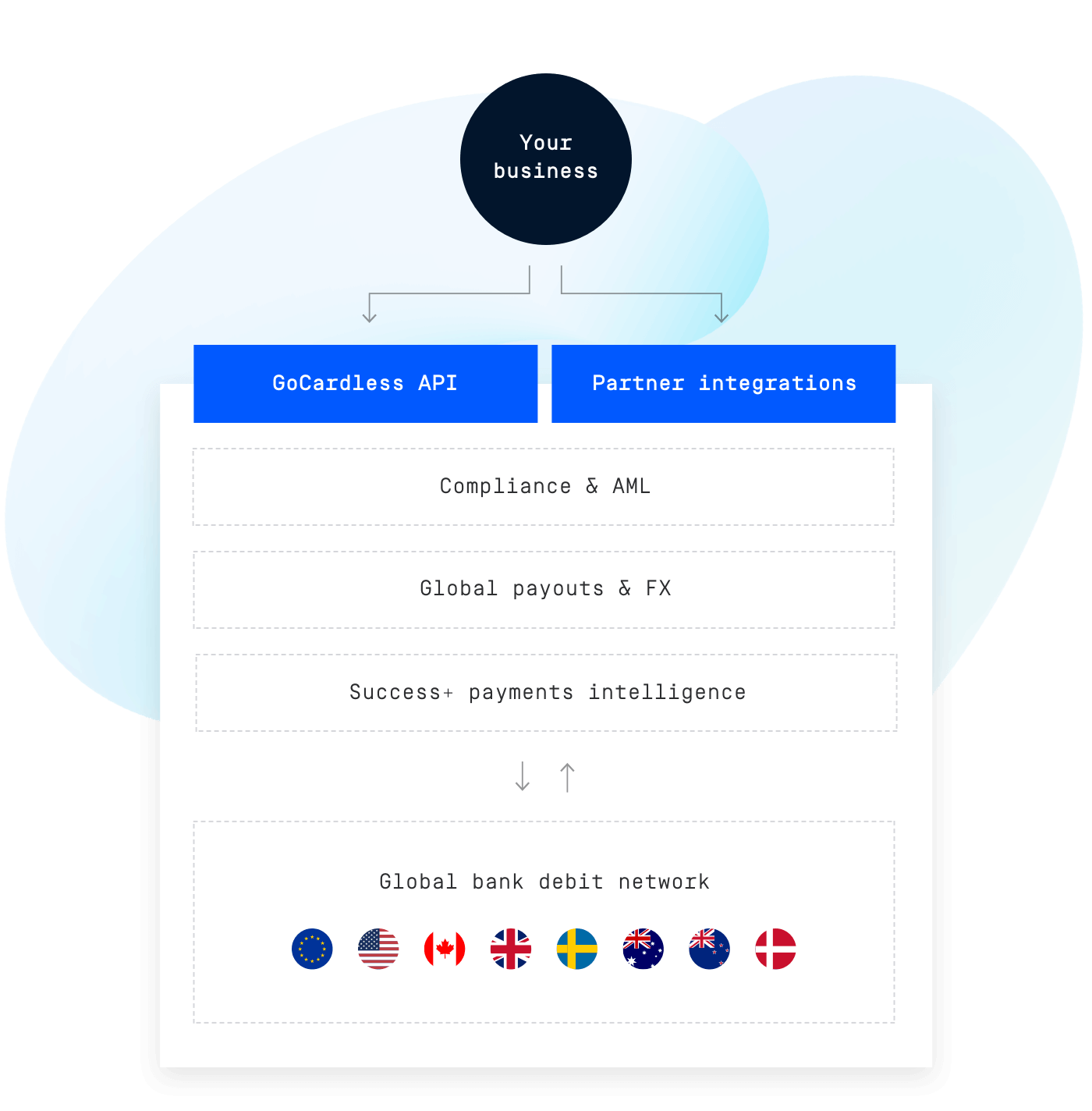

Collect payments using bank debit and bank-to-bank payments in more than 30 countries with GoCardless. Bank debit compliments your payment strategy to create a best-in-class checkout experience.

GoCardless helps you:

Use local payments with a global reach

GoCardless has created the first global network designed for recurring payments. Offer bank debit in 30+ countries, including; the UK, Eurozone countries, the US, Canada, Australia and New Zealand.

Lower payment failure rates

With GoCardless, around 97.3% of payments are collected successfully first time. With real-time reporting, know instantly when a payment does fail so you can take action.

Integrate with your existing systems

Connect GoCardless to your global tech stack with our extensive list of partner integrations, including; Salesforce, Zuora and Chargebee. Or use our API.

Built for security, scale & success

ISO27001 certified

Security protocols across our business, services and products have been fully audited and certified with this globally-recognised international standard.

GDPR compliant

The GoCardless global data risk management programme is built to strict GDPR standards and applies privacy best practices to help protect and respect personal data.

Trusted by global businesses

GoCardless processes $13bn+ annually, and has been funded by prestigious investors including Google Ventures and Salesforce Ventures.

Compliance built in

We handle the complexities of bank debit across 30+ countries in a single integration.

Trusted by over 60,000 businesses globally

Leverage payer preferences to your advantages

Speak to a payment expert to learn how you can optimise your payments strategy.