Simplifying Payments for your Business with FinancialForce and Asperato

Last editedJan 20222 min read

Payments and payment processes can be complex and convoluted. From having clear visibility of how much it actually costs your business to process a transaction to understanding what solution is the best fit for you and your customers.

FinancialForce, Asperato and GoCardless joined forces to discuss precisely how you can leverage open banking technologies and Account-to-Account payments to take the pain out of getting paid. In this webinar the payment experts considered:

Why is it important to optimise Account-to-Account payments across revenue operations?

What can you do to reduce DSO costs and collect more payments successfully?

How can you benefit from a pre-built solution over building your own integrations?

![[On-Demand] Simplifying Payments for your Business](https://images.ctfassets.net/40w0m41bmydz/4oArX7IrHUzTxLKykDW3ai/c9007e233fd48ffaab3e87667a570155/Asperato_Webinar_Gated_Image_Hero.png?w=1600&h=1920&q=50&fm=png)

[On-Demand] Simplifying Payments for your Business

Understand why Account-to-Account payments are the ideal means to collect recurring payments and invoices.

Why is it important to optimise Account-to-Account payments across revenue operations?

When you think of optimising your payments processes it’s easy to only think of transaction fees, but these fees are just the tip of the iceberg. It’s important to think about your payment process from integration to daily running and maintenance. When we think of the process in that way from end-to-end, there are other aspects that are also important to consider:

The time and resources your business spends processing, reconciling and chasing late payments.

The cost of payments that are stuck in receivables and the inability to invest that income in your business’ growth.

The cost of expanding into new markets and setting up new integrations that can quickly snowball.

There are some solutions that work well for collecting payments on a recurring basis and some that work well for one-off payments. But there is no single solution that will optimise in the right way for both recurring and one-off payments while taking care of the entire process.

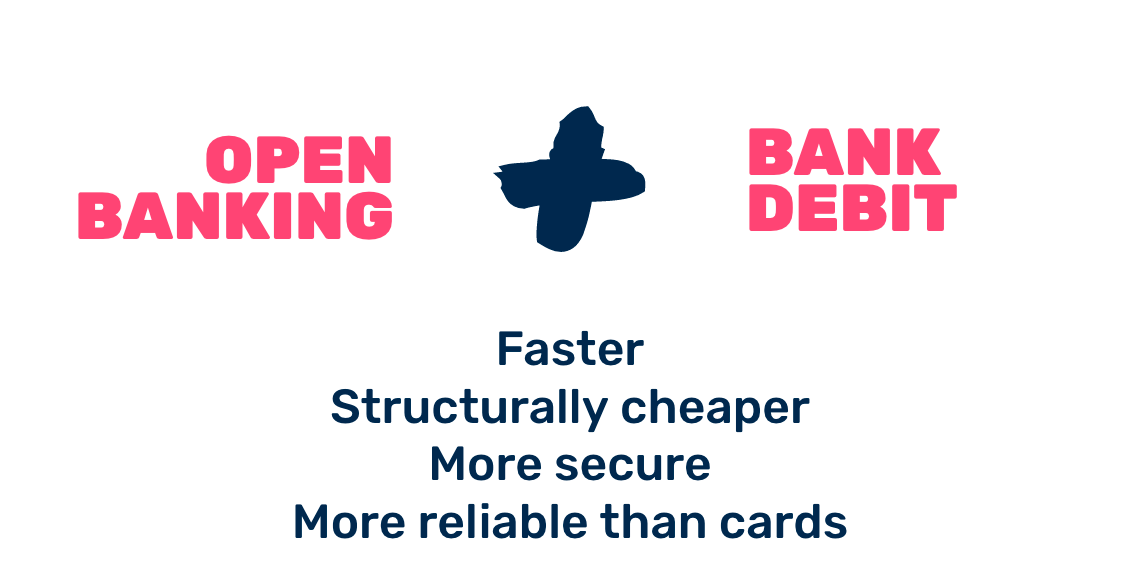

By combining Direct Debit with new open banking technologies, like our own Instant Bank Pay feature, we have created a singular platform that allows you to collect payments as you see fit and unlock both time and revenue across the entire payment collection process. Creating a simple and seamless payment experience for you and your customers.

What can you do to reduce DSO costs and collect more payments successfully?

As aforementioned, there’s typically no one payment solution that caters to every customer and business needs. This means businesses have to use several solutions to collect payments and data is held across several different systems.

This makes knowing exactly how much collecting payments costs you and whether payments have been taken successfully difficult. You should consider the payments process as a part of your business that can add real value to you, if and when you tackle it properly.

How to realise the benefits of Account-to-Account payments:

Offer convenient ways to pay - Give your customers a variety of ways to pay and ways that suit the needs of you and your customers.

Automatically collect invoices - Plan for this in your business processes and take back control of when you receive payments with pull-based payment methods like Direct Debit.

Keep track of payments - You’ll never need to leave the FinancialForce tool and see all your live payment data in one place so you can make informed decisions.

Intelligent payment retries - Use automation and machine learning to quickly retry and collect as many payments as possible with GoCardless’ payment intelligence feature Success+.

How can you benefit from a pre-built solution over building your own integrations?

Building your own integrations is no longer a necessity. By buying a pre-built solution, you can get a customer-centric view of payments with a single account record per customer and benefit from the expertise and continued development and maintenance of a platform or tool.

When buying a solution rather than building individual integrations, you drive forward core business functionality without worrying about acquiring domain-specific knowledge, leaving you time and resources to do what you do best. For example, FinancialForce customers get all of GoCardless’ expertise seamlessly and can benefit from well-documented and tried and tested solutions.

Put an end to late payments with Asperato and GoCardless Take the hassle out of getting paid with our Direct Debit integration for Salesforce.