Invoicing at scale: A guide for financial services

Last editedFeb 20237 min read

Getting paid on time is crucial for growing businesses to be able to survive and reach their goals. Invoicing is a critical part of this process. When administered successfully, companies get paid promptly, with a minimal burden on internal accounting and finance processes.

The challenges of invoicing at scale

Failing to implement a robust, digital and automated invoicing system can create a significant productivity and time drain on finance departments, alongside the financial controllers and finance directors who lead them. In the worst-case scenario, businesses can go bust due to not effectively managing their cash flow, alongside limiting their ability to reinvest funds to aid future growth.

Late payments are inherently a problem for businesses, and the pandemic has heightened this issue. In Australia and New Zealand, a report from Ilion has found that COVID has exacerbated the issue with late payments between big businesses averaging 15.5 days in December 2020, up from 13.9 days during the same time in the previous year. While both the Australian and New Zealand governments have implemented policies (the Payment Times Procurement Connected Policy in Australia and the Prompt Payment Rule in New Zealand) to curb the issue of late payments, the solutions are narrow-sighted and absolves businesses working outside the realms of the public sector of their responsibility to pay invoices on time.

Specific challenges

Alongside the current uncertain economic environment, there are specific challenges of invoicing at scale.

Poor Days Sales Outstanding (DSO)

Unfortunately, it is all too common for invoices to be paid several days past their due date.

GoCardless commissioned a study from Forrester Consulting this year, revealing that over half (52%) of firms surveyed reported an average DSO of over 30 days. The study also found that reducing DSO over the next year was a high or critical priority for 74% of payment decision-makers.

This is one of the key metrics financial controllers are responsible for, and a high DSO indicates that a business is struggling to collect payments owed as they fall due.

Bad debt

Invoices not paid on time can lead to bad debt, which burdens the cash flow of receiving businesses who would have forecast funds being issued by a set date. This creates additional work for financial controllers who have to review late payers, organise for other team members to chase outstanding invoices and, in a worst-case scenario, classify these invoices as irrecoverable debt.

Lack of visibility over the payment process

Not being privy to the processes and scheduled plans of customers who pay by non-pull-based methods, such as bank transfers (the preferred type of payment for regular business bills and invoices in Australia), is another factor creating uncertainty over when invoices will be paid. Additionally, these manual payment methods risk the instance of human error, such as entering data incorrectly.

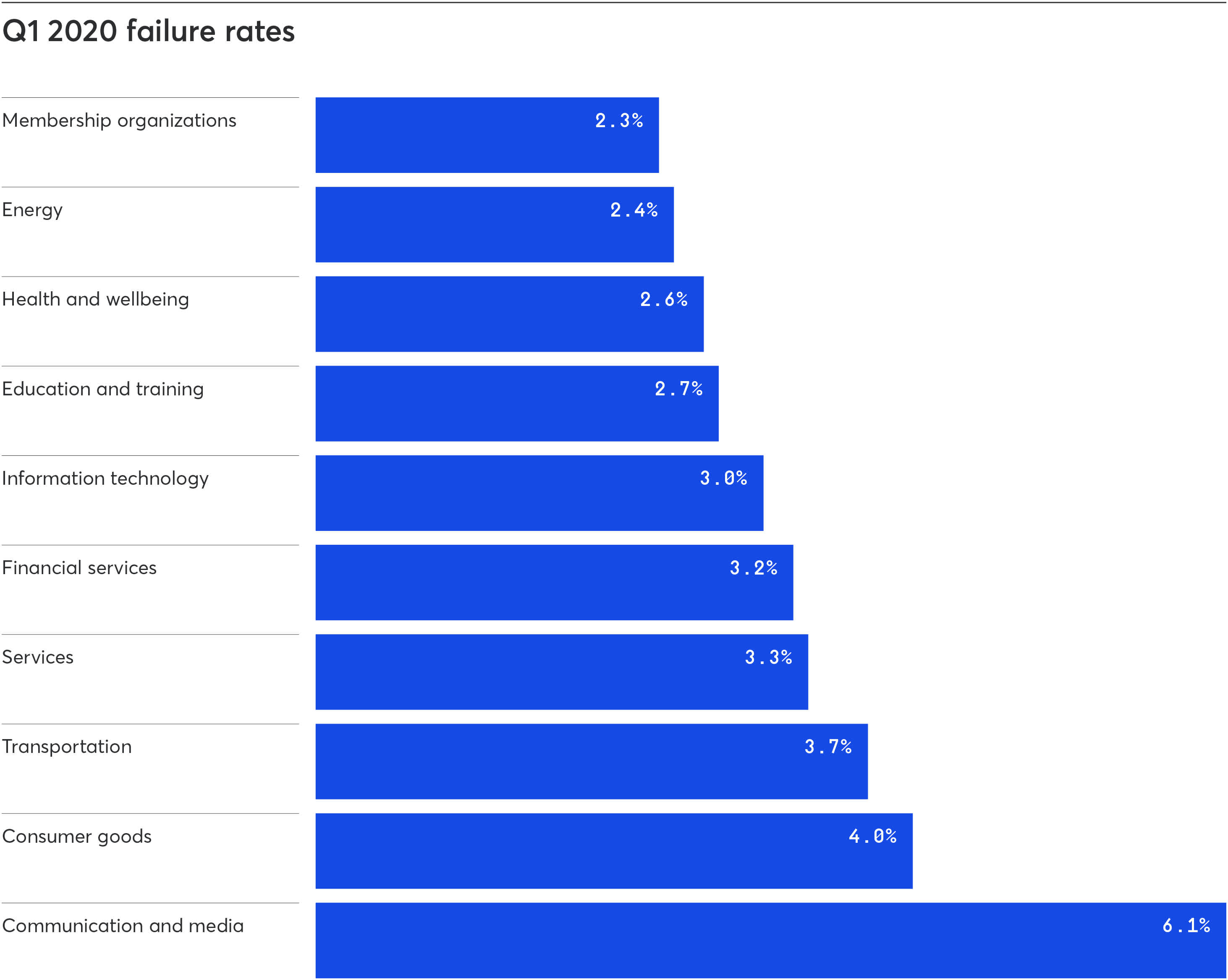

There is also the risk of payments failure across all payments methods, with the average failure rate for collecting payments via invoices being 3.1% and the average failure rate for financial services business coming in a touch higher at 3.2%. There can be various reasons for payment failure, and its occurrence is another factor indicative of merchants not having visibility on their clients' payment processes.

In the Payment Success Index, GoCardless identified the benchmarks for payment failure rates across different sectors, with financial services businesses ranking in the middle.

Invoicing best practices

Invoicing automation

Implementing invoices with automation features is a highly effective way to issue invoices speedily, collect payments and reduce manual accounting and reconciliation work. This is particularly relevant for financial services companies who have many types of operational and business bank accounts across different currencies.

Automated invoices can be created with stand-alone products or well-known cloud accounting providers such as Xero, Quickbooks or Sage. A more extensive list of providers can be accessed through our Australian and New Zealand GoCardless partner network.

Automation allows users to schedule invoices in advance on a specific day and time. This can be particularly useful for subscription-based invoicing, which is relevant for customers billed monthly. This frees up time at month-end, during which financial controllers are likely to be under particular pressure to complete reporting requirements.

According to Forrester research, 86% of companies in Australia & New Zealand have more than 20 full-time employees dedicated to handling recurring payments. By implementing invoicing automation, businesses have a significant opportunity to make the invoicing process more efficient and free up staff time for higher-value work.

Finance teams should select automated invoicing solutions that allow for a number of payment options including credit cards, bank transfers and Direct Debit. Additional options should increase conversion and success rates by making it easier for customers to select their preferred method. Payment can be taken straight away by customers clicking on the most suitable option on invoices. This has the effect of boosting cash flow by allowing for invoices to be paid seamlessly.

Evaluate your payment method

Reviewing your accepted payment methods can be a powerful means to collect payments for invoices faster, as well as leading to lower failure rates.

Wherever possible, customers should be persuaded to pay digitally. Payment by cheques and cash create more manual admin, staff time and resource cost for finance teams and makes it harder to match payments and identify late payers.

While bank transfer payments are popular due to low fees, companies are not alerted when transactions fail. Payment by credit and debit cards, permitting companies to take funds through recurring payment authority, can be effective for one-off transactions or subscription payments. However, they have high transaction costs for merchants and have a high failure rate due to cards being rejected, expired or stolen.

Automatic or scheduled payments, set up by customers instructing their bank to pay a fixed sum on a set date, are a cheap or free way for businesses to take payments. But, as a push-based payment method that requires greater input from the customer, they lack flexibility and carry the risk of late payments.

For best practice, merchants should incorporate Direct Debit. This is superior to other methods due to being a pull-based payment system, permitting merchants to extract funds from customer bank accounts via a pre-existing agreement. Its flexibility allows for recurring payments of different amounts taken at different times. While credit and debit card payments settled by recurring payment authority are also a pull-based method, Direct Debit has lower failure rates due to being linked directly to bank accounts so it overcomes the risk of lost and expired cards.

Additionally, research from IDC reveals businesses using Direct Debit with GoCardless allows merchants to access 44% more markets than other payment methods.

Collecting failed payments and improving payment success - automated retries Failed payments are a common problem for scaling businesses, but companies can mitigate associated late payment activity through automated retries.

Payment providers such as GoCardless provide intelligent technologies using machine learning to automatically retry payment collection at an optimal time for the customer. This means businesses can successfully collect 76% of payments that initially failed.

While it is imperative for cash flow for businesses to collect funds for failed payments, the cost of failed retries can be comparable to the payment itself. The staff time, resources and additional fees associated with retrying payments needs to be considered. Therefore, merchants need to apply an automated retry strategy that minimises costs for both parties.

The success of this approach is supported by research that shows that GoCardless is on average, 47% faster in making payments to merchants than by businesses that do not use it.

Will open banking improve invoicing at scale?

Open banking, otherwise known as the Consumer Data Right (CDR) in ANZ, aims to create competition in the development of financial products and services. In Australia, the CDR was launched in 2018, and for New Zealand, the introduction of the CDR was announced in July of 2021.

Though the details of New Zealand’s CDR regime have yet to be revealed, it will be aligned with Australia’s open banking framework, which requires banks and other data holders to open up their data to Accredited Data Recipients.

Though still in its infancy in the ANZ market, open banking has the potential to optimise invoicing processes for businesses in the region.

The key mechanisms of open banking

Based on Australia’s existing CDR framework, the following participants are involved in the regime:

Accredited Data Recipients (ADRs) are companies that have gone through the stringent accreditation process to receive consumer data to provide new products and services.

Data holders are businesses that hold consumer data and are mandated to provide customer data to accredited data recipients when requested by a customer.

Intermediaries are currently being considered as part of a proposed amendment to the CDR legislation. They are third-party companies who are able \to receive customer data via ADRs

Open banking has the potential to improve invoicing at scale, and a number of invoicing and finance apps already using open banking APIs to help companies get paid faster, credit check new customers, automate processes and manage their cash flow. Open banking also has the capacity to improve the collection of recurring payments significantly.

New open banking-powered innovations in the payment sector will lead to:

Fraud prevention

Better customer payment experiences

Payment-related cost-savings

International invoicing

International invoicing creates extra complications for growing businesses. 49% of businesses are frustrated by the pain of collecting payments internationally. This is due to needing to reflect the correct rate of GST on invoices, manage FX risk if billing in other currencies and enhanced administration due to accurately accounting for overseas currencies in sterling within accounts.

It is critical for financial controllers to pay attention to these international invoicing elements and have clear visibility of the actual cost of processing payments overseas. Getting the basics wrong can require invoices needing to be reissued, leading to delayed payments and inaccurate reporting.

Choosing a recurring payment solution that collects recurring payments from your customer’s bank accounts and allows you to settle them back in your home country, with FX dealt with automatically, can take some of the pain out of collecting international payments.

Important considerations for international invoicing:

Currency risk

While it is preferable to invoice in sterling, as this removes currency risk and is simple, it is often necessary to bill in the local currencies (i.e. euros or dollars) of customers in international target markets to attract their custom.

Businesses can lessen their currency exposure by taking out forward contracts (also referred to as Forward Exchange Contracts) with their banks. This gives companies certainty and protects them against adverse currency movements before getting paid by the exchange rate getting locked in at a set rate.

GST

When selling overseas, there are different GST rules related to the countries you are selling to, whether you are selling goods or services and whether you are selling to other businesses or consumers.

In some instances, this will require registering for GST or the equivalent sale tax in the country you are selling to.

GST-free on international supplies

Sales to overseas customers are generally exempt from GST, meaning that GST does not have to be applied to them.

However, invoices need to detail there is no GST included in the price, and records should be retained for up to five years.

Record keeping

Recording international sales requires more care and attention than domestic ones.

Financial controllers need to accurately convert the values of outstanding overseas invoices within their accounting records based on a commercial rate applied to the date of invoices.

Fluctuations for currency movements of unpaid invoices will need to be recorded in profit and loss accounts on an ongoing basis as foreign exchange gain/loss.

Selling to foreign customers is complex, so financial controllers should take the time to research the tax rules and regulations suitable to their businesses specific circumstances. While a number of useful resources are available, Paddle’s Global Taxes for Saas Companies: How to Sell Internationally is a good primer.

The various challenges of invoicing at scale for financial controllers consist of late and failed payments, irrecoverable debt and a slowdown in processing due to inaccurately recording international invoices.

Financial controllers need to have the foresight to address these potential issues as failing to do so can result in cash flow issues and complications and delays related to reporting.

Reviewing types of payment accepted, introducing automated retries and harnessing invoice automation features will give scaling financial services companies the best chance of success by speeding up cash collection and reducing the time spent on manual reporting requirements.

Find out what makes ANZ different from the rest of the world

Download the global report with Forrester Consulting: Rethink Your Payment Strategy To Save Your Customers And Bottom Line