Spoiler Alert: We’re the bigger boat.

Save yourself from the jaws of failed payments

Your business can't stand to bleed up to $2M in uncollected revenue every year due to payment failures.

Book a meeting with a payment specialist to dive into the impact payment failures could be having on your business right now.

The impact of failed payments

$2million+ uncollected revenue

Enterprise businesses stand to lose over $2million (AUD) in uncollected revenue** every year due to payment failures.

More bad debt

On average, B2C businesses see 16-20% their failed payments turn into bad debt, while B2B businesses see 11%-15% turn into bad debt.

Increased churn

2 out of 3 businesses see their failed payments turn into churn more than 10% of the time, and churn also leads to higher chargeback rates.

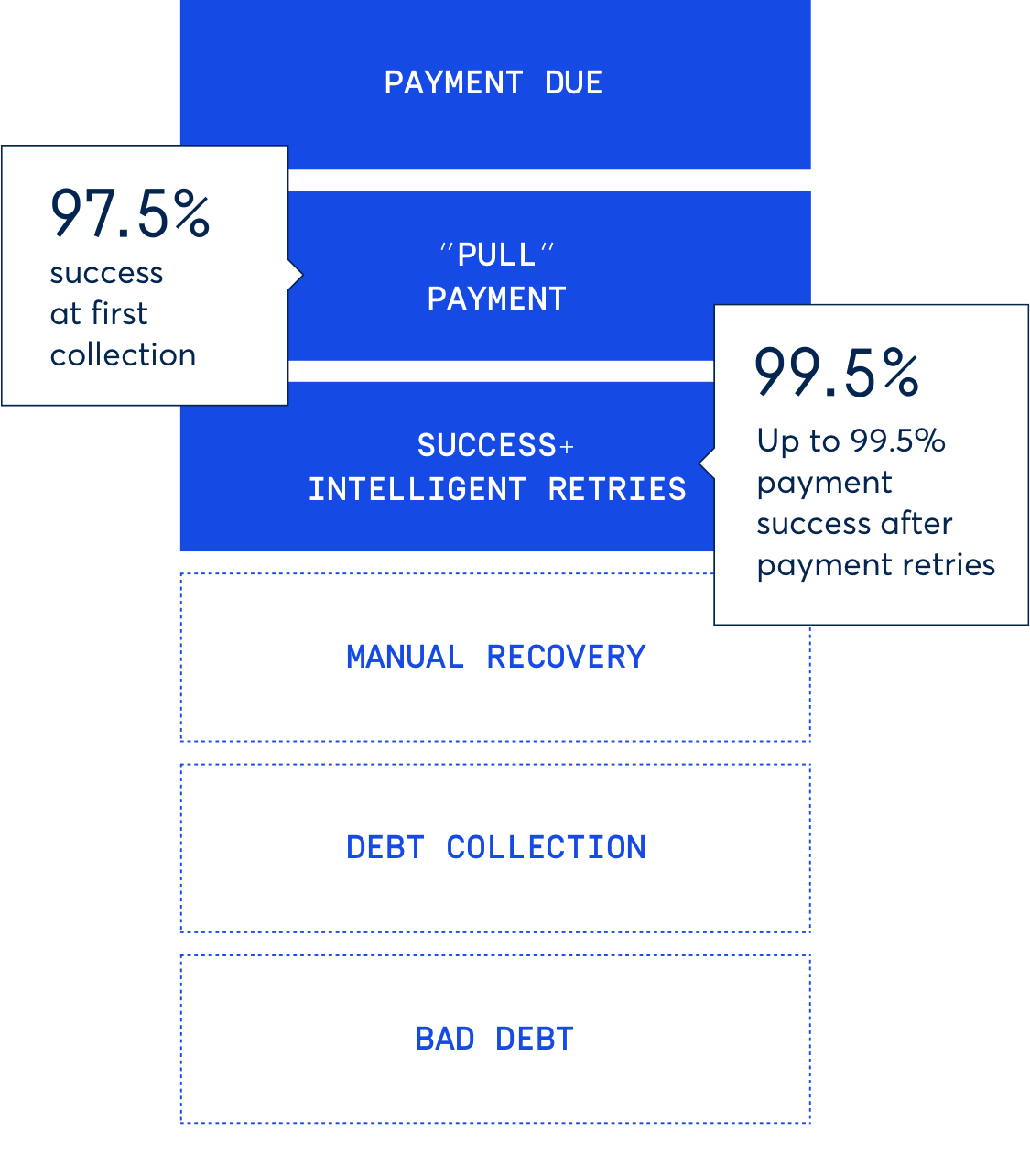

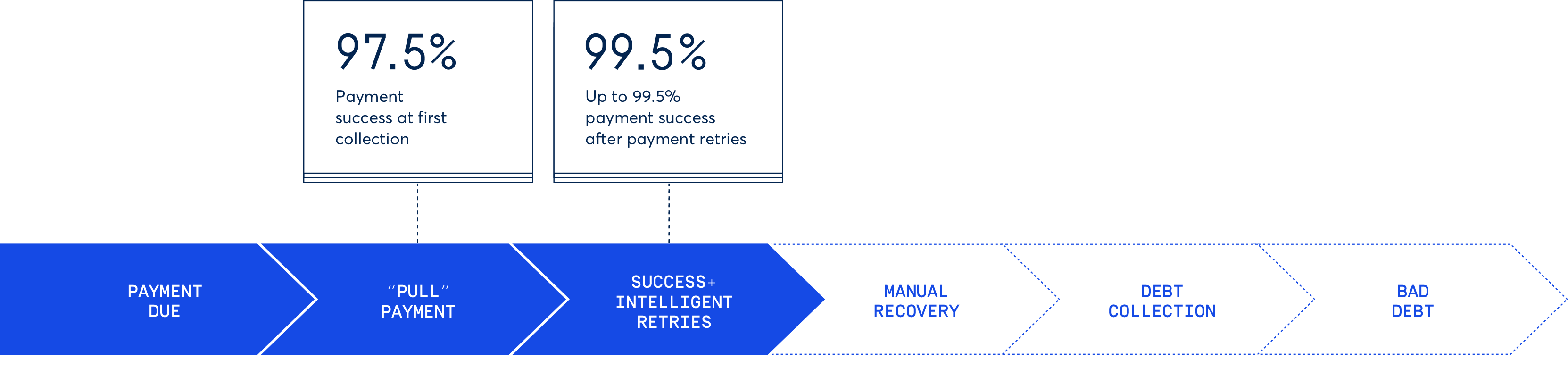

Improve your payment success with GoCardless

The average GoCardless payment failure rate at the first attempt is just 2.5%. Optimise your payments even further, using Success+ to retry those that do fail.

Get your free SodaStream

Book a meeting with a payment specialist to dive into the impact payment failures could be having on your business right now.

Trusted by over 55,000 global businesses

GoCardless streamlines payment operations for over 55,000 businesses like DocuSign, Deputy, SiteMinder, and The Guardian. They have all chosen us to take the bite out of collecting their recurring payments and improve their payment failure rate.

“We typically see 100 payment failures a month from credit cards; with Direct Debit we only see one or two.”

Patrick Hughes, Former Assistant Corporate Controller, Autotask