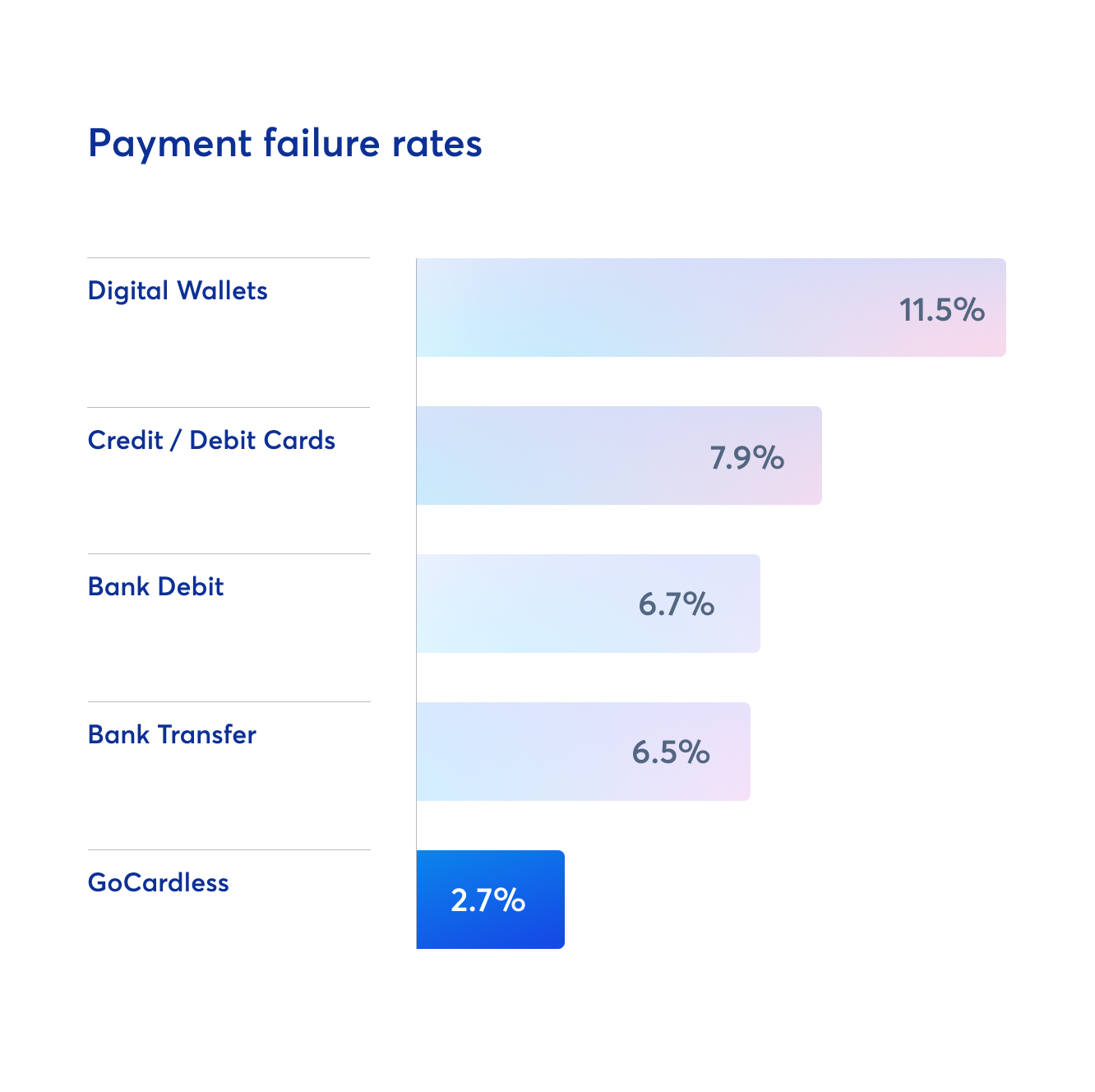

What’s better than collecting 97.3% of payments first time? Nothing.

Done losing time and money to failed payments? Reduce your DSOs, automate collection and let the cash flow back into your business with Direct Debit.

Payment failure costs more than you think

A failed payment is just the beginning.

Bad debt, increased churn, and extra labour costs are quick to follow. Cash flow gets locked up. Customer lifetime value shrinks and cost of acquisition goes up.

And you’re stuck chasing payments instead of growing your business.

Do you know how much you’re losing to failed payments?

Discover how much cash flow you could release back into your business with this nifty calculator. In just 3 simple questions, you’ll know just how much you’re losing. And what you could be saving.

Your payment success. Powered by GoCardless

Deel enhanced their customer experience with prompt, error-free payments

Fast-growing hiring platform Deel chose GoCardless to enable prompt and error-free payments globally to improve customer experience.

Through pull payments, Deel can schedule payments at the optimum time, which saves customers time and increases payment success compared with customer initiated bank transfers.

Lifestyle Fitness boosted revenue by recovering 71.6% of failed payments

Lifestyle Fitness collects thousands of monthly recurring payments. But failed payments were a persistent headache

With Success+, they drastically reduced failed payments, unlocked their cash flow and revolutionized the way they collect payments.

Report: Discover 3 ways GoCardless can maximize your payment success

You’ll find out how GoCardless can help you:

Avoid the 8% credit card failure rate (and why it happens in the first place)

Recover payments, even after an insufficient funds notification

Sidestep critical ACH Debit infrastructure failings that happen when you start scaling

Ready to reduce failed payments?

Book a demo with one of our payments experts to find out how the GoCardless solution help you optimize the way you take payments.