Paylinks make getting paid easy

Collect instant, one-off payments. Or automated recurring payments with Direct Debit. Simply send your customers a paylink and get paid instantly.

![[en-AU] Homepage – Merchant logo – Simply Energy (black)](https://images.ctfassets.net/40w0m41bmydz/7e8sFP6AjmPDFa3MkScjlm/20da743939defaba7e6c49cf13308362/au-01-Simply_Energy.png?w=200&h=100&q=50&fm=png)

![[en-AU] Homepage – Merchant logo – Deputy (black)](https://images.ctfassets.net/40w0m41bmydz/13LsfVpwWUhqelIbnJRE40/ce11ab0564c25b4681a15ebd4bdac993/au-02-Deputy.png?w=200&h=100&q=50&fm=png)

![[en-AU] Homepage – Merchant logo – SiteMinder (black)](https://images.ctfassets.net/40w0m41bmydz/12B1ARE17oDA2N3WUTsYEL/02c64d47da02981c9f6f578e4a54f5f6/au-03-Siteminder.png?w=200&h=100&q=50&fm=png)

![[en-AU] Homepage – Merchant logo – DocuSign (black)](https://images.ctfassets.net/40w0m41bmydz/3fMoyxmgPCZYAaXfR9yq8I/93252f7d23450ccb3f5a07c263978d59/au-04-DocuSign.png?w=200&h=100&q=50&fm=png)

![[en-AU] Homepage – Merchant logo – Aon (black)](https://images.ctfassets.net/40w0m41bmydz/1eO8nwj5V73PaM7KFmsInL/4fbaae170631770d3ed11ce5889bd733/au-05-Aon.png?w=200&h=100&q=50&fm=png)

![[en-AU] Homepage – Merchant logo – UNHCR (black)](https://images.ctfassets.net/40w0m41bmydz/1NivxWaXwV5sE6QxQ8stHe/7717ca499e70b5d004fd0d125e8850ac/au-06-UNHCR.png?w=200&h=100&q=50&fm=png)

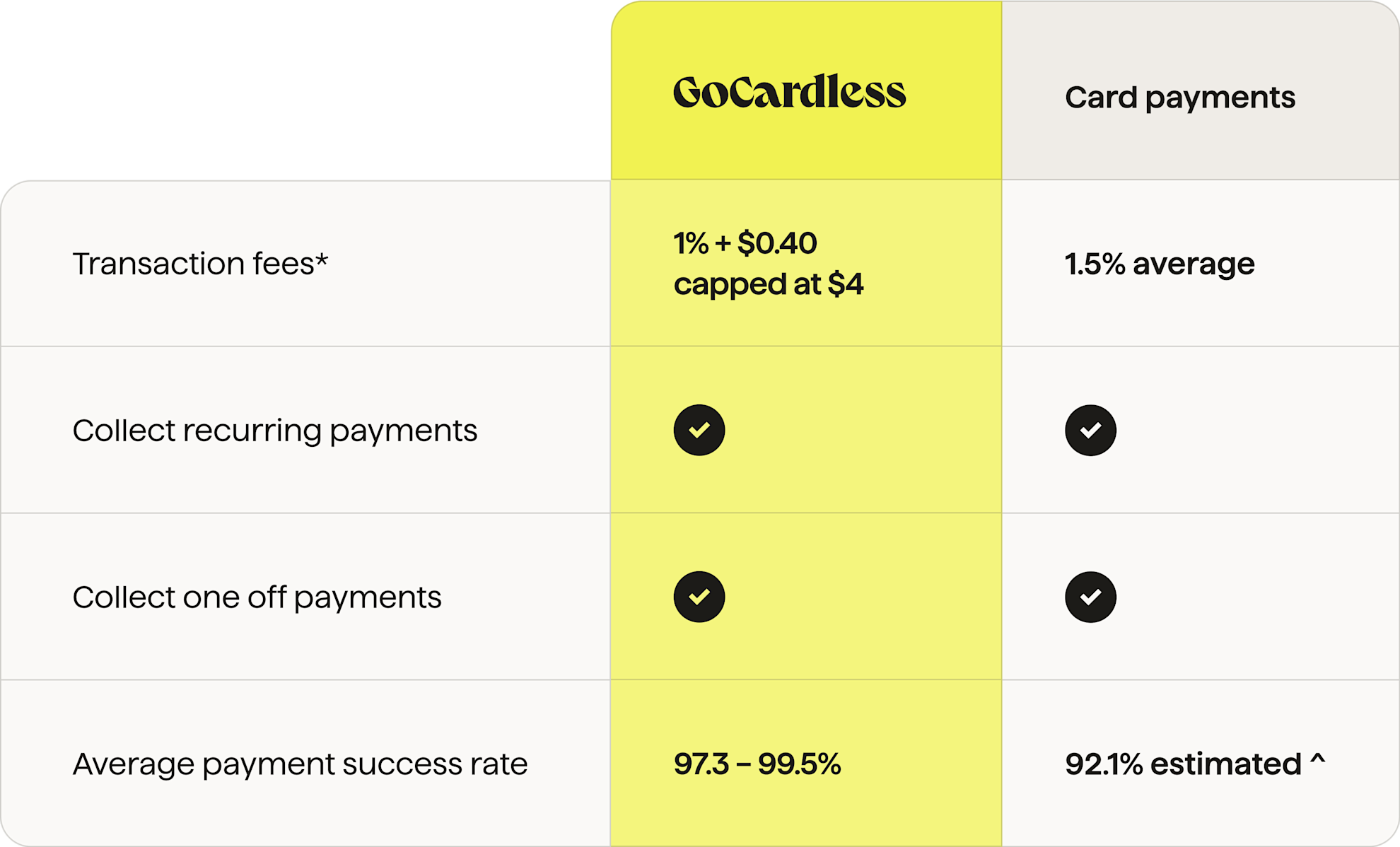

Forget expensive fees

Skip expensive card fees by billing via bank payments. Cut your payment costs by 56%.

Automate admin

Easily see the status of any payment from any customer, any time. And if you connect GoCardless to your accounting system, reconciliation is automatic.

End late payments

You don’t have to rely on your customers remembering to pay invoices on time. Saving you all those costly hours chasing up late payments.

Connect your existing software

Use our easy-to-use online dashboard, or connect GoCardless to the software you already use.

Everything your business needs

One-off payments

Forget about waiting for your customers to make a bank transfer. Or paying expensive card fees. Collect one-off payments with GoCardless. Direct from your customer’s bank account to yours.

Automated, recurring payments

Automatically collect payments on the due date via BECS direct debit. Even if the dates or amounts change. Perfect for subscriptions, membership fees, instalments, and even invoicing for services.

![]()

One-off payments

Forget about waiting for your customers to make a bank transfer. Or paying expensive card fees. Collect one-off payments with GoCardless. Direct from your customer’s bank account to yours.

![]()

Automated, recurring payments

Automatically collect payments on the due date via BECS direct debit. Even if the dates or amounts change. Perfect for subscriptions, membership fees, instalments, and even invoicing for services.

International payments made simple

Collect payments from 30+ countries. Either into a local bank account, or your existing AU account thanks to in-built FX at the real market rate. Powered by Wise.

Intelligently retry failed payments

With GoCardless, failed payments are rare. But switch on automatic retries and our payments data determines the best day to try again. Recovering 70% of failed payments, on average.

Better for your customers, too

Businesses and consumers often prefer to make bank payments, instead of using cards and digital wallets. With automation and peace of mind, it’s not hard to see why.

Payment failure rates as low as 0.5%

Reduce your failed payments. Successfully collect 99% of instant, one-off payments – and 97.3% of automated, recurring payments – on the first try.

Source: GoCardless Payment Success Rates, 2025

We have a 99.8% payment success rate with GoCardless, so customers spend almost no time chasing late payments.

Teegan Bishop, Customer Success Manager, SpacetoCo

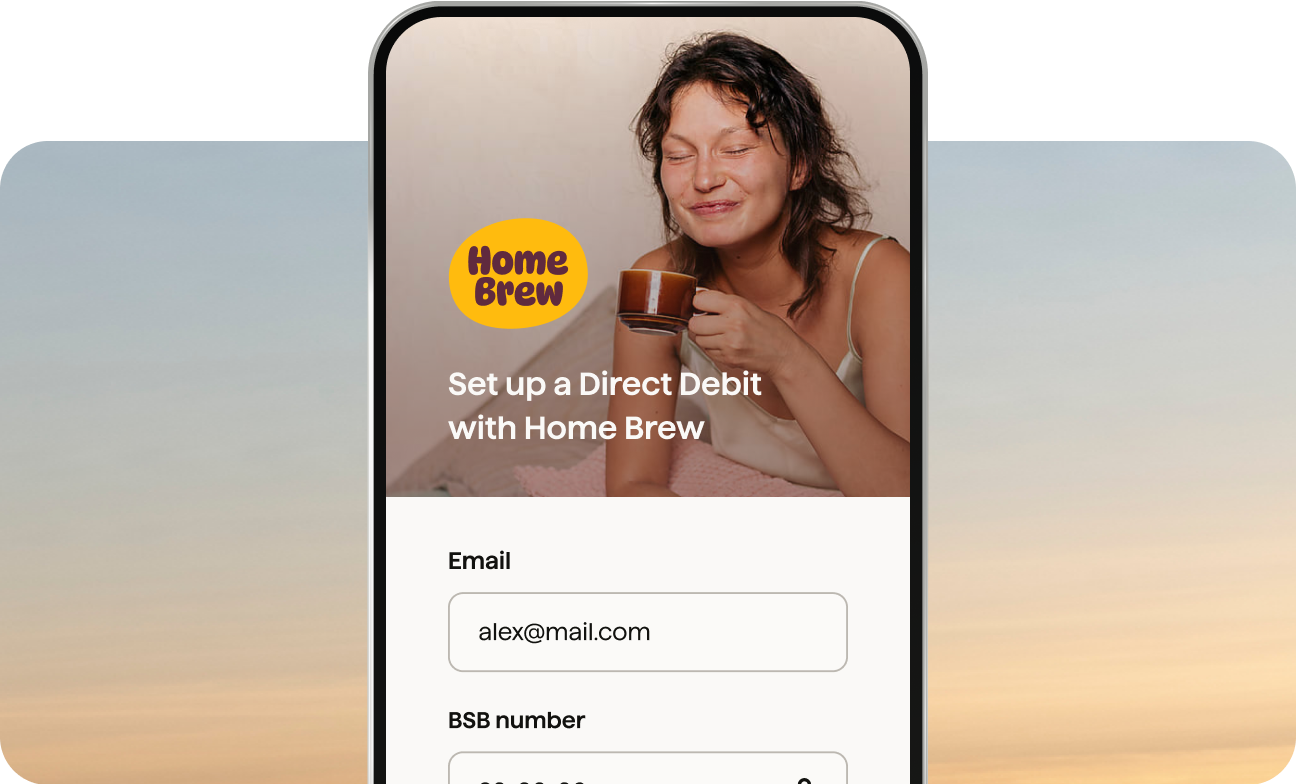

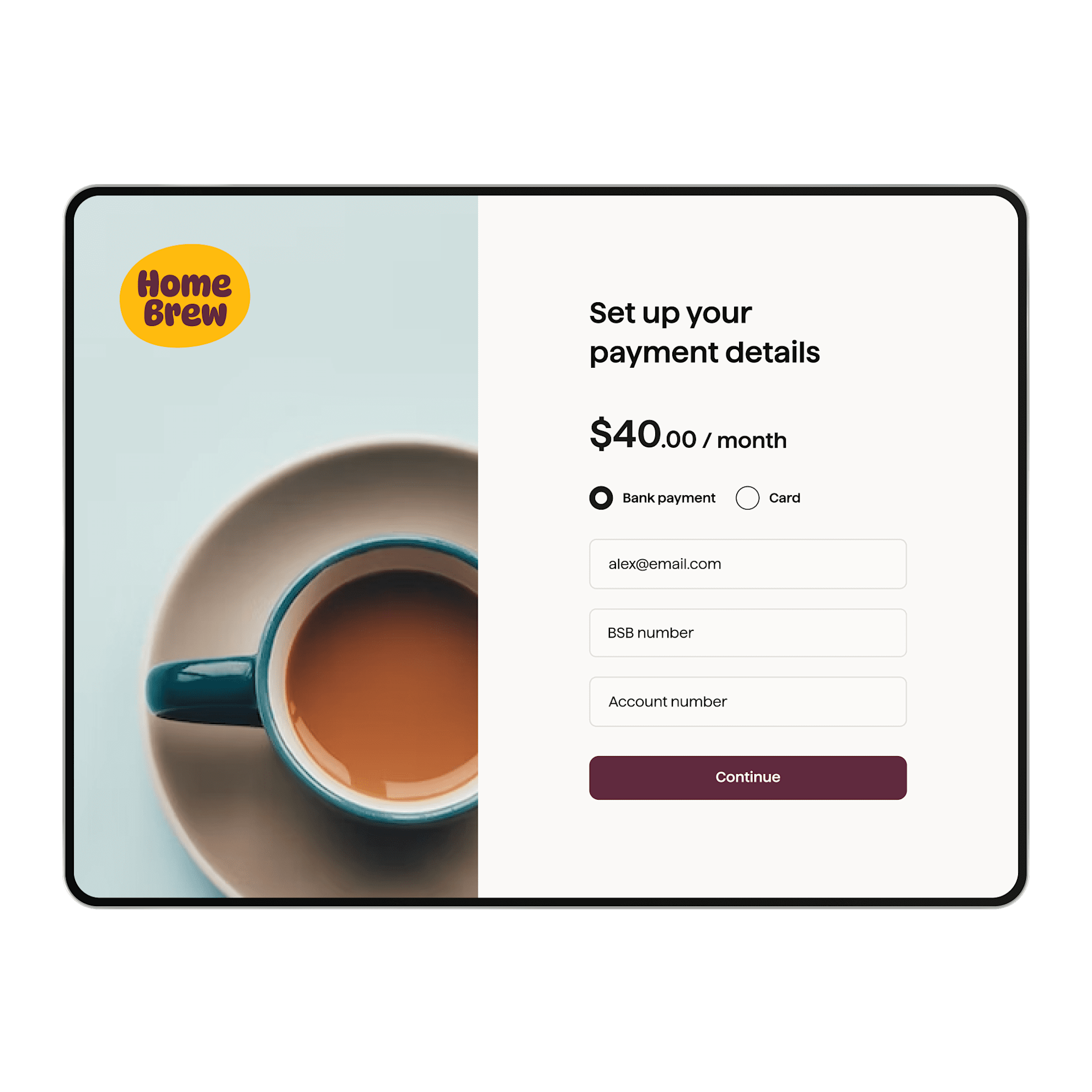

The easy way for your customers to pay

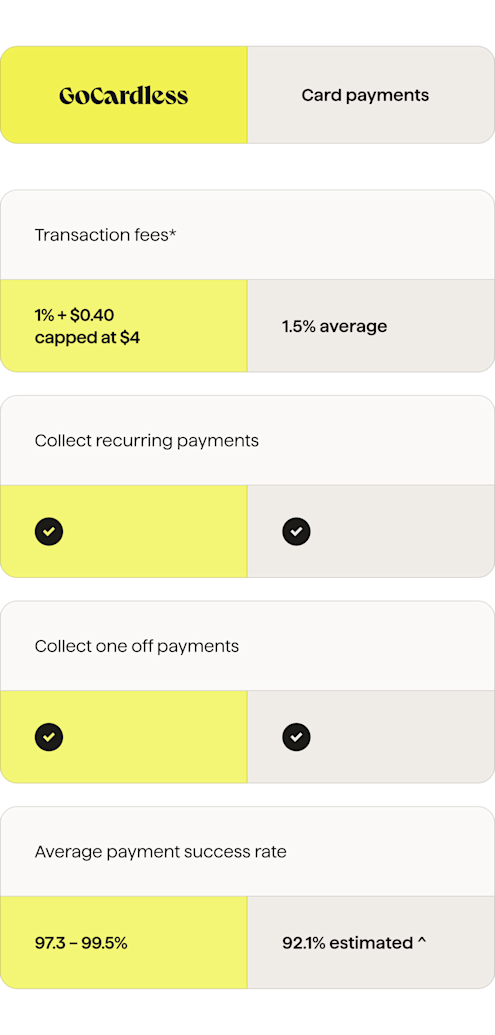

See how GoCardless compares

* Pricing as of Jul 2024. Fees differ by provider. See our pricing

^ Based on market research. Payment success rates vary. See the report

56% lower average cost per transaction*

Standard

Collect recurring and one-off payments in a straightforward way

1%

+ $0.40

per transaction, capped at $4. An additional fee of 0.3% applies to payments above $3,000.

Full fee structure

2% + $0.40 for international transactions.

All fees quoted are exclusive of GST where applicable

Advanced

Boost your payments with a smart way to recover failures and full customisation

1.25%

+ $0.40

per transaction, capped at $5. An additional fee of 0.3% applies to payments above $3,000.

Full fee structure

2.25% + $0.40 for international transactions

All fees quoted are exclusive of GST where applicable

How much GoCardless will save you

Estimate your monthly fees and savings based on your business revenue

Calculate your fees

What is the monthly cost?

Calculate your fees

What is the monthly cost?

=

Estimated monthly saving compared to card payment fees

--

Estimated time saving per month not chasing late payments

--

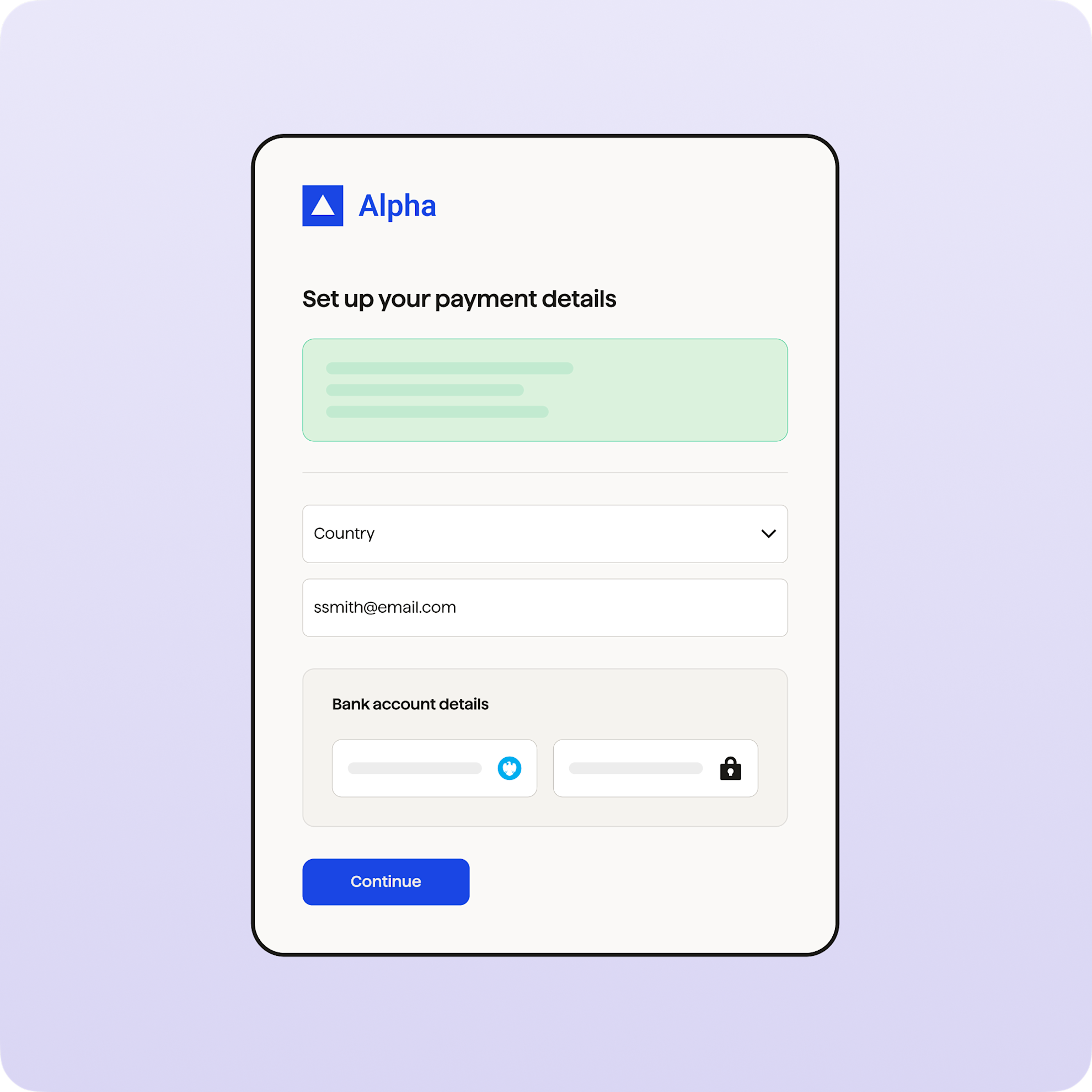

How paylinks work

Partner search

Connect with your accounting software

GoCardless seamlessly integrates with over 350 billing, accounting and CRM platforms including Salesforce, Quickbooks and Xero. Search for your partner to find out more.

Customers simply click the link we send, sign up to pay with GoCardless and the rest is taken care of – invoices get issued, paid and reconciled. It's a dream.

Sam McEwim, Founder and Director, BizWisdom

Trusted by 100,000+ businesses. Of all sizes. Worldwide

![]()

Easy to use

”GoCardless is super user friendly, seamless and allows great visibility at all times. It changed the game for us and has made cashflow issues a thing of the past!”

FAQs

Who is GoCardless for?

With GoCardless, businesses collect payments directly from customer’s bank accounts. Whether domestic or international, one-off or recurring, scheduled or instant. We do it all – quick, easy, and secure.

Can I trust GoCardless?

Yes, GoCardless has been processing payments since 2011 and nearly 100,000+ businesses like DocuSign, TripAdvisor and The Guardian use GoCardless to collect and send their payments. They process US$130bn+ of payments every year across 30+ countries.

Is it easy to switch my customers to GoCardless?

Moving a group of customers with existing Direct Debits with another provider over to GoCardless is straightforward. Go through a simple step-by-step process and switch customers without disrupting any existing mandates.

How do I receive the funds that I have collected with GoCardless?

The funds collected are paid directly into your bank account. With GoCardless, our fees are deducted automatically.

Does GoCardless take credit or debit cards?

No. GoCardless is a direct bank payment company.

What are the hidden fees?

There aren’t any! We want to be as transparent with you as possible and offer a pay-as-you-go pricing model with no contract or long-term commitment required.

Payments that put your business first

Pay as you go pricing, with low transaction fees and no monthly contract. Get started in minutes.