WE'RE READY

Are you ready for open banking?

At GoCardless, we’re using open banking and PayTo to make Direct Debit real-time and provide a data-rich experience for both our merchants and their customers.

Find out how open banking or PayTo might impact your payments strategy.

What is open banking?

Open banking, also known as the Consumer Data Right (CDR), is an Australian government initiative to drive competition and the development of new financial products and services.

These regulation-led changes required banks to open up their data and formed the broader term ‘open banking’ that we use today.

Find out how open banking could improve your payment strategy.

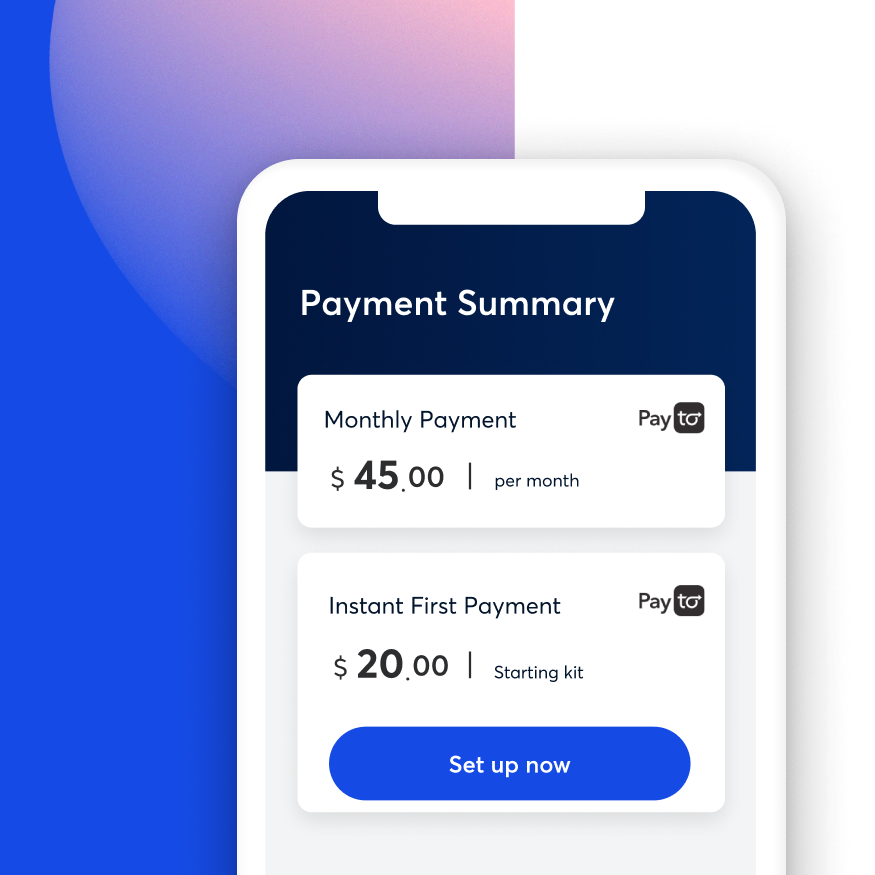

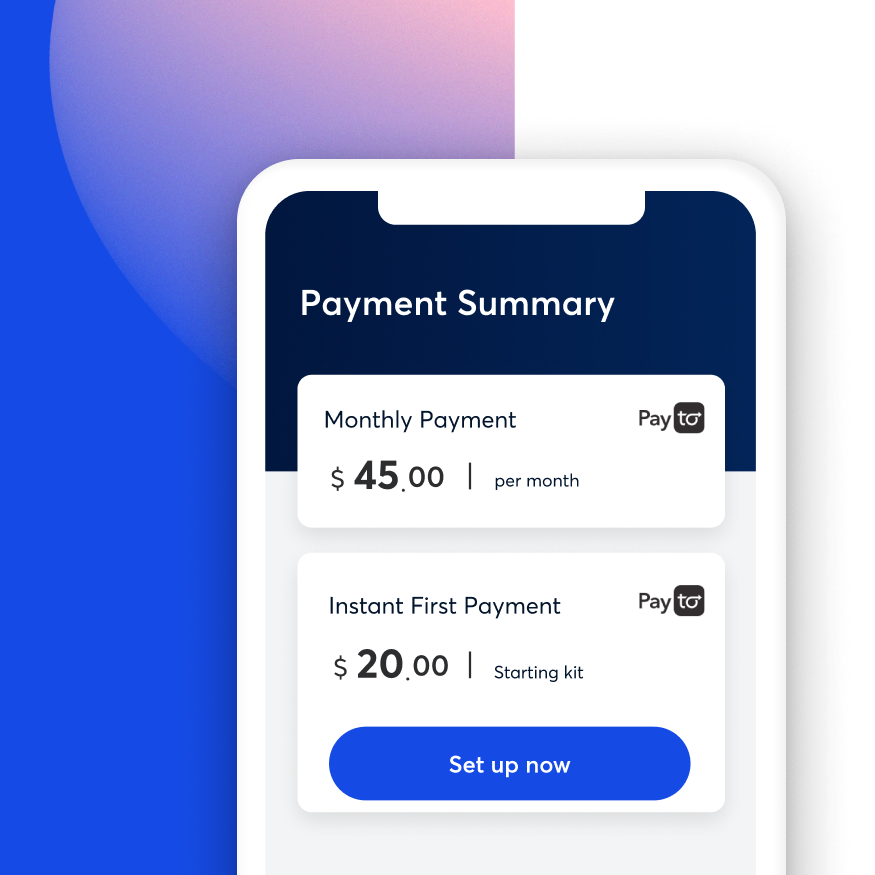

What is PayTo?

In the simplest form, PayTo is real-time account-to-account transactions for one-off and recurring payments and is set to transform the future of payments in Australia.

Developed in partnership by NPP (New Payments Platform) Australia and the financial services industry, PayTo is a new, instant, digital and mandated way for merchants and businesses to initiate real-time payments from customer bank accounts.

The platform’s infrastructure goes beyond being a simple alternative to Direct Debit by enabling the linking of bank accounts for in-app purchases, account-on-file arrangements for eCommerce and subscription services, and funding for digital wallets and other payment options including buy-now-pay-later services. Despite being a preferred method, current Direct Debit rails are not best suited for this breadth of payment types that often require instant authorisation and visibility.

Future proof your payments with GoCardless and PayTo.

What is the New Payments Platform (NPP)?

The New Payments Platform (NPP) was introduced in 2018 to facilitate instant bank-to-bank transfers 24 hours a day, 7 days a week. It provides a fast, flexible and data-rich payments system that enables Australian consumers, businesses and government agencies to make real-time data-rich payments between accounts at participating Australian financial institutions. As well as the core NPP fast payments infrastructure, NPP Australia developed the centralised addressing service, PayID, and is now working with the financial services industry to launch PayTo, a new way for payer customers to pre-authorise payments from bank accounts.

PayTo is set to modernise the way bank accounts are used for payments, underpinning innovation in the sector for years to come.

New - Collect one-off payments seamlessly from your UK & German customers

GoCardless has launched its first open-banking powered product. Instant Bank Pay enables you to take first-time payments, account top-ups and even one-off charges easy and fast with instant confirmation. Powered by open banking it's designed to complement GoCardless bank debit.

Currently Instant Bank Pay is available for your customers in Germany or the UK, and we will be continuously adding more countries.

For Australian merchants, this means if you have customers located in the UK and Germany, you can access this revolutionary payment method with your GoCardless account.

Ask us about getting access to Instant Bank Pay.

Useful open banking resources

How open banking is reinvigorating Australia’s payments ecosystem

The Consumer Data Right (CDR) scheme is the first open banking initiative designed to give Australians greater control and transparency over how their financial data is used.

In the early stages of the CDR roll-out, the conversation has largely been centred on the benefits for consumers. However... Continue reading ->

Open banking has arrived, but without consumer trust, it’s going nowhere

In July 2020, Australia saw the first iteration of open banking in the form of the Consumer Data Right (CDR), allowing customers of the big four banks to securely share their financial data with accredited third-party fintechs and other financial institutions.

The CDR scheme is a significant milestone... Continue reading ->

Open banking: Everything you need to know

A term used to describe the process of banks and other financial institutions opening up data for anyone to access, use and share.

Don’t worry - it’s not as unsafe as that description might make it sound. Banks are effectively putting in place the infrastructure... Continue reading ->

Are you ready for open banking?

Speak to our team of experts to find out how open banking and the New Payments Platform could impact your payments stategy.