Introducing ACH payments with GoCardless

Last editedFeb 20221 min read

Drive down costs, reduce failure rates and decrease involuntary churn by harnessing our world-first global debit network in your business.

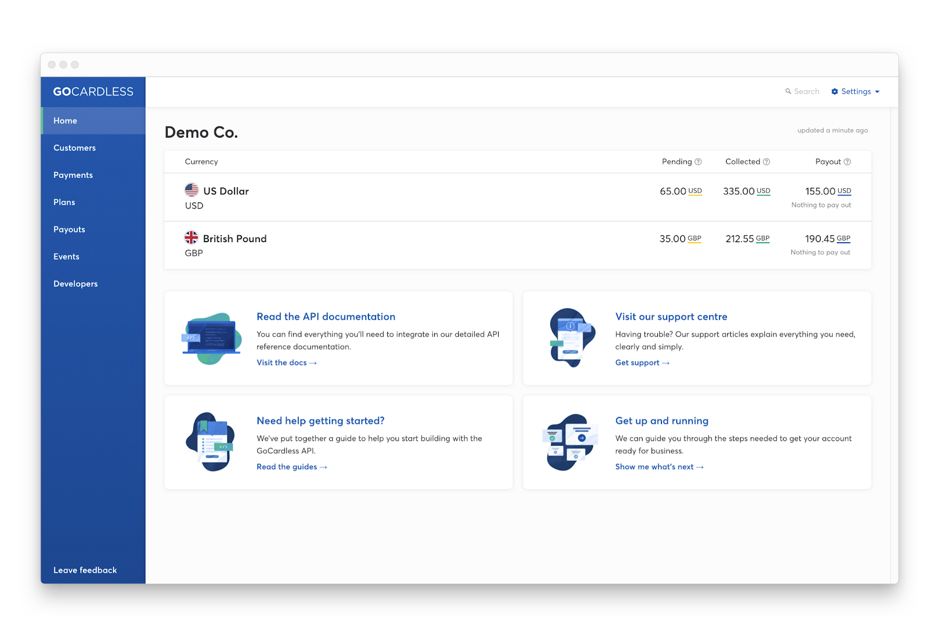

We are excited to announce that you can now take payments from customers in the US with GoCardless – using the ACH debit scheme.

The addition of US payments means that GoCardless users are now able to take payments from more than 30 countries around the world, enabling businesses to provide their customers with a consistent and best-in-class payment experience across multiple markets.

Why ACH debit?

ACH debit is an increasingly popular choice for B2B payments in the US and is expected to be more widely used than traditional payment methods, such as checks, by 2020.

This is because of the significant benefits Bank Debit offers to both businesses and their customers. With ACH through GoCardless you can:

Increase payment visibility - Automate payment collection and reconciliation, and have full visibility of your payment status.

Reduce involuntary churn - Reduce failure rates to as low as 0.5% (compared to 10-15% with card payments) by avoiding errors caused by expired or lost cards, and credit limit breaches.

Transparent pricing - With no hidden fees or set up costs, ACH Debit with GoCardless offers much lower rates than card networks.

How does ACH work?

ACH debit payments in the US are processed through the Automated Clearing House (ACH) network, which is run and regulated by the National Automated Clearing House Association (NACHA).

As with each of our Bank Debit schemes, GoCardless handles all the complex compliance and regulatory requirements, providing an easy way for businesses to get started taking payments globally.

Accessing ACH debit through GoCardless

Adding US payments to your account is fast and simple. If you are an existing GoCardless user, simply complete our ‘new scheme request’ form below and our Support team will do the rest.

Next steps

Speak to us about starting with GoCardless.