Understanding your customers’ buying behaviours

Last editedDec 20222 min. read

Winning new business is important. You spend time and money attracting new customers to your business, you want to make every penny count. Although every customer's journey is different, the common denominator for every customer-to-be's journey is the checkout.

Don’t lose customers who are ready to pay

People who reach your checkout have already made the decision to buy. Understanding and acting on what drives them to hit the ‘pay’ button could be the difference between winning a new customer or losing a prospective one.

Since 2019, we’ve commissioned research with YouGov into the factors that drive different kinds of customers - consumers or businesses - to make a payment. In our most recent and upcoming research, we discovered that 67% of consumers will abandon an e-commerce purchase if their preferred payment method isn’t available. So, catering to your customer's preferred payment methods could have a significant impact on your sales.

What motivates customers to pay

With 67% willing to abandon an e-commerce purchase when their preferred payment method isn’t available, payer preference can be considered one of the biggest drivers for payments being completed.

In our upcoming report Demystifying payer experience with data from YouGov - launching in January 2023 - we take a deep dive into why customers choose different payment methods. Let’s take a sneak peek at some more of the findings.

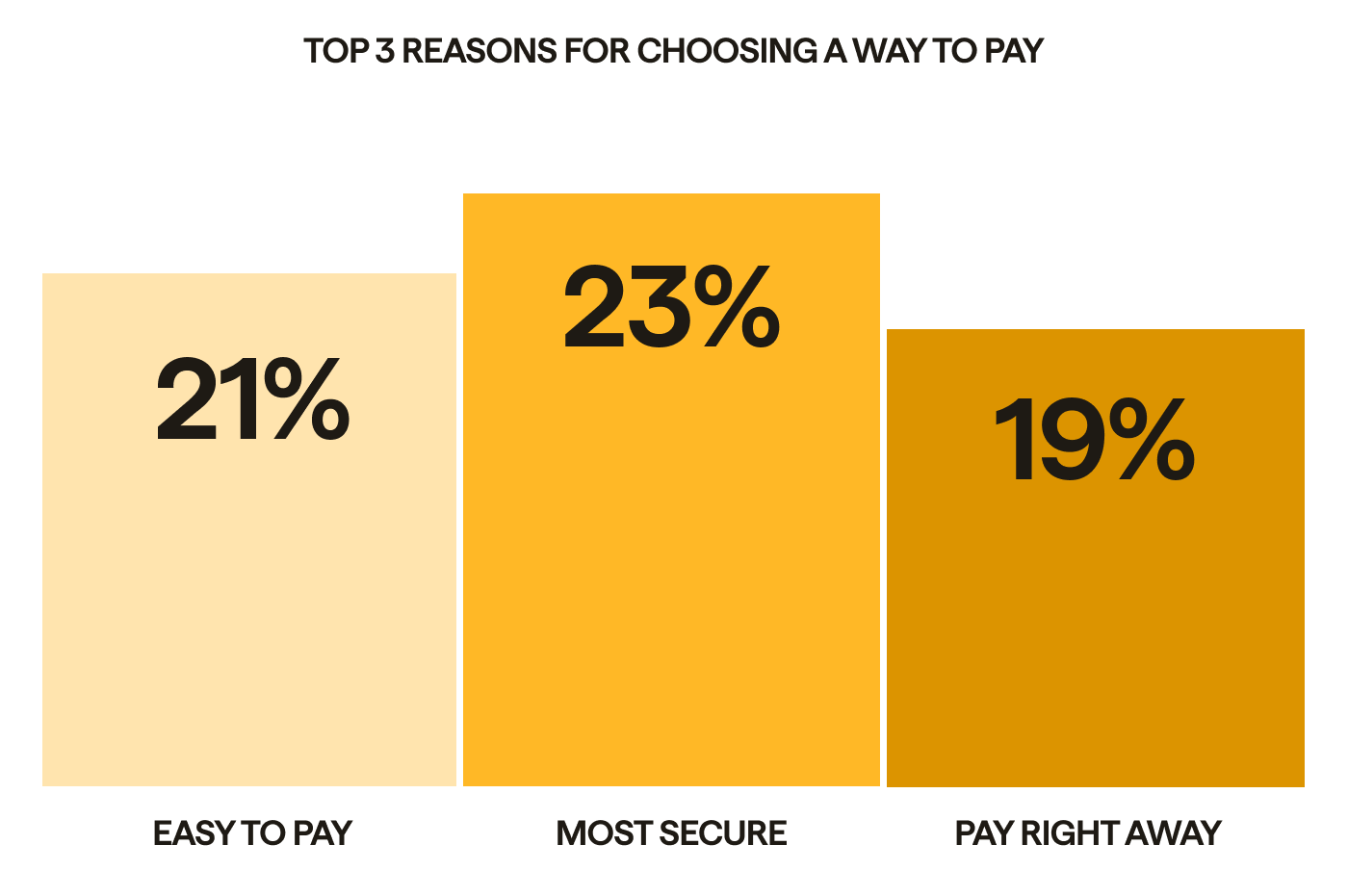

Ease, security and instant payments were ranked as the top three reasons for choosing a payment method by both consumers and businesses for one-off e-commerce and invoice payments. And, when asked which payment method they trusted the most - 89% chose bank payments.

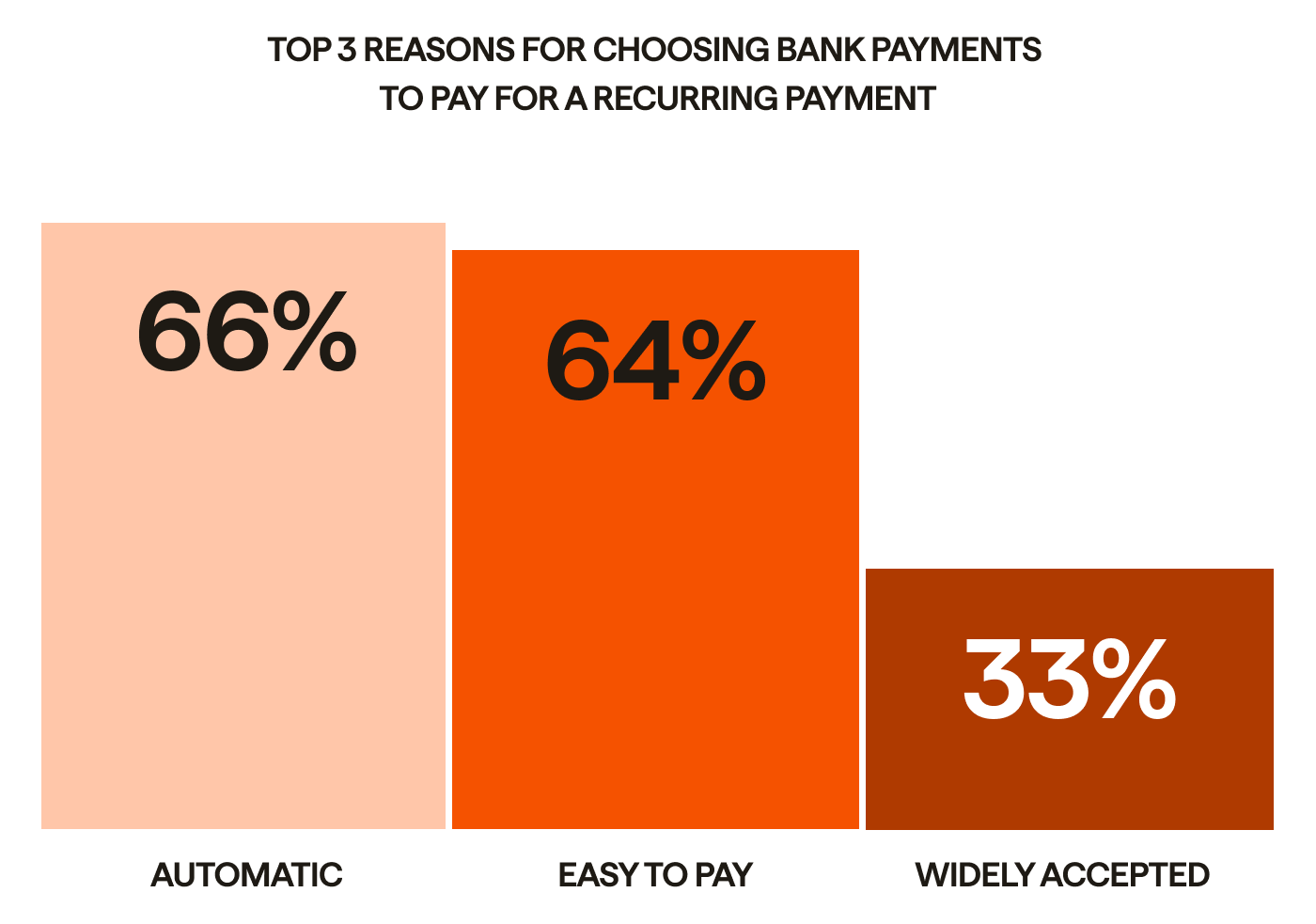

It’s a similar story for recurring payments too. When consumers were asked the top reasons for choosing bank payments as the method for paying for recurring payments; ease, automation and the fact they’re widely accepted were rated as the top reasons.

Top 3 reasons for choosing a way to pay for one-off e-commerce payments:

Top 3 reasons for choosing bank payments to pay for a recurring payment:

What does this intel mean for you?

Offering the right payment methods, that customers perceive as secure, easy and automatic, could mean more people that make it to your checkout complete their payment and become a customer.

Get early access to our Demystifying payer experience report 2023

Be the first to see the latest YouGov research commissioned by GoCardless, into how and why customers prefer different payment methods for one-off payments, so you can leverage the top-ranked payments to win more customers. Understand what drives people to try new ways to pay and discover how your competitors are investing in payment infrastructure.

Payment preference matters

When looking at how customers like to pay for different recurring payments, bank payments come out on top. Businesses and consumers paying for subscriptions and instalments rank bank payments as their first choice. And bank payments rank in the top two methods for recurring invoice payments too.

The methods customers have access to are important too.

27% more customers have access to debit cards and bank accounts (for bank payments) than PayPal. This could contribute to the preference for debit cards and bank payments and explain why the likes of PayPal, digital wallets and Buy Now Pay Later, didn’t rank highly as preferred payment methods. If a customer doesn’t have access to a payment method, that option won’t be relevant for them at the checkout.

Staying competitive in a new era of payments

In the age of the internet and where many payment methods pre-date online purchases, customer expectations have evolved too. Now our experiences with digital content have changed, customers expect these smooth and intelligent experiences across the board, in every digital interaction. And this also comes down to how they want to pay.

Our upcoming YouGov research investigates customers' openness to trying new payment methods - ones purpose-built for online transactions and how businesses who are willing to listen and adapt to customers by investing in their payment infrastructure are primed to win more business.

Uncover the challenges of payments in an evolving market and see how open banking could help meet these customer expectations. Be the first to access the latest YouGov research on payer experience in 2023.