The 8 dimensions of recurring payments: Coverage

Last editedJul 20223 min. read

The recurring payments landscape is fragmented and complex causing challenges for businesses. Choosing the right recurring payment strategy is crucial to remain competitive and for continued growth.

At GoCardless, we’ve spent years helping businesses with the entire recurring payment process. Through market research and conversations with customers, we’ve developed an understanding of what makes a good payment strategy and the best ways to collect recurring payments.

To help businesses understand how to improve their recurring payment strategy, we created a framework to find, measure and optimise operational inefficiencies and help you decide which strategy is best for your business. We call this the 8 dimensions of recurring payments.

These dimensions map out a framework for your business to take action and improve your recurring payment strategy. Each dimension demonstrates some of the biggest challenges businesses face when collecting recurring payments, grouped into three categories:

Customer acquisition

Recurring payment operations

Impact

In this guide, we will focus on the first of the 8 dimensions of recurring payments and how you can optimise coverage to grow your customer acquisition.

What is coverage?

Coverage is a measure of payers who could choose a payment method. There are two key considerations; how many people a business can reach with their payment method, paying particular attention to the number of countries that can be reached, and the number of people that can be reached in those countries.

Different payment methods have different levels of penetration or reach and this varies by country. YouGov research, commissioned by GoCardless* found that payment methods that require some sort of registration, like PayPal or credit cards, have lower penetration than those based solely on a banking rail, like bank debit.

Penetration of different payment methods:

73% of people in Australia said they have access to PayPal

55% of people in Australia said they have access to a credit card

98% of people in a country have access to a bank account

By offering a payment method that has wide coverage and penetration in a country, you’re making your products or services available to a broader range of people. With greater coverage, you widen the top of the customer acquisition funnel and the pool of people that can move to the conversion stage.

Why is coverage important?

When evaluating how you can grow your business, international expansion is often a natural lever for growth.

Businesses that widen their payment coverage and accept more currencies have been shown to grow revenue and subscriber bases more quickly.

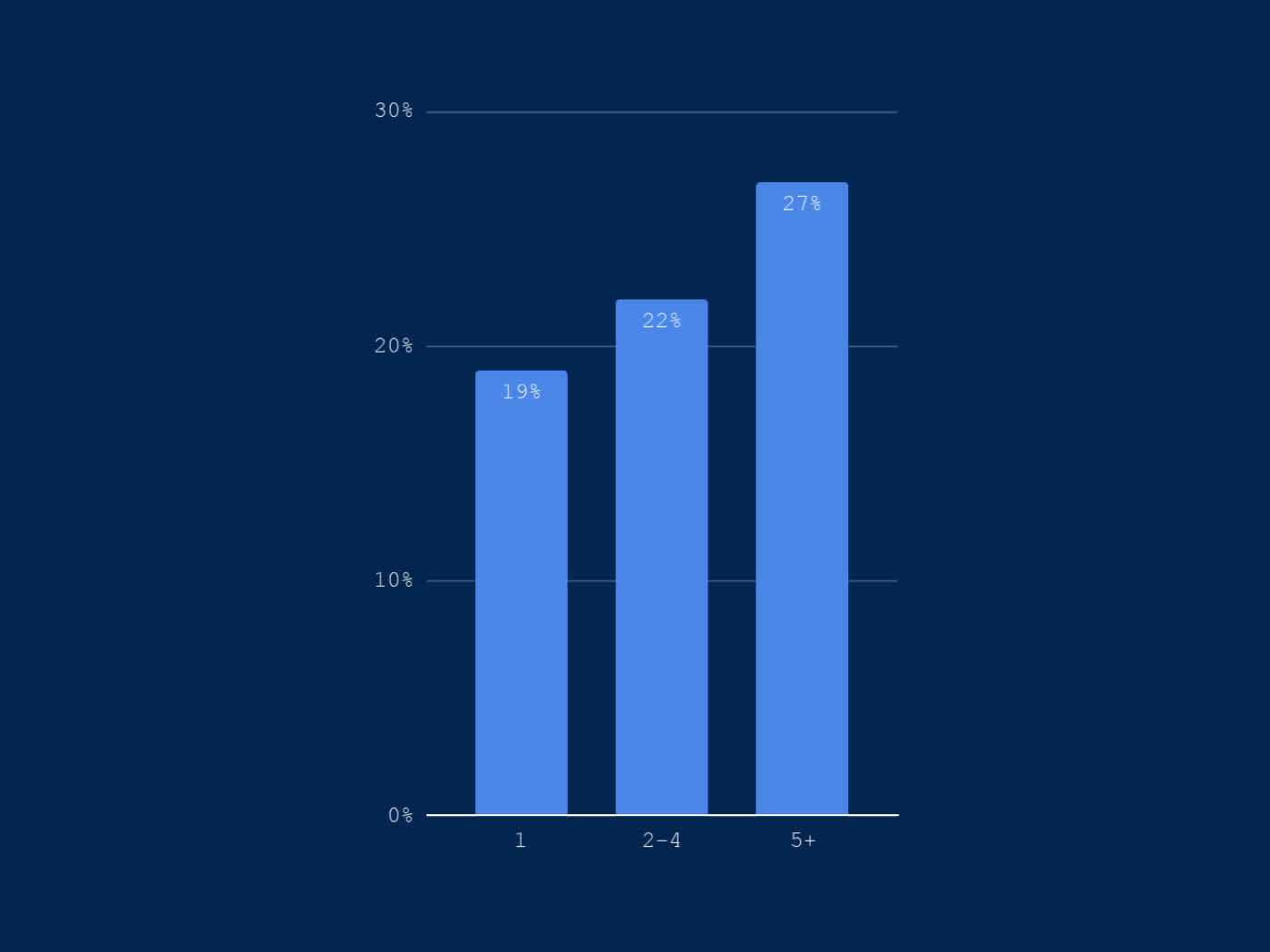

Zuora found that businesses accepting five or more currencies grow 8% faster than those that only accept one:

1 currency - 19% growth rate

2-4 currencies - 22% growth rate

5+ currencies - 27% growth rate

However, expanding your business into new territories presents its own challenges when collecting recurring payments. For successful international expansion, businesses need to spend both time and resources to form relationships with banks in new markets and integrate payment solutions, this can be a costly affair.

If you’re already a global business, you’ll understand the pain of collecting payments across multiple currencies. In fact, 49% of businesses are frustrated by the pain of collecting payments abroad. And 39% are held back by the complexity of processing international payments.

Making international payment collection smoother, minimising cost and freeing up your time for higher-value work is the linchpin for successful international payment expansion.

GoCardless offers the world’s largest global bank-to-bank network to facilitate easy payment collection internationally.

We chose GoCardless as our global bank debit provider because of their strengths in global payment processing and we knew that we could grow with them into new markets as well.” Evan Miller, Global Director of Billing and Collections, SiteMinder.

Find out more about how Siteminder expanded its global payment processing with GoCardless.

How to increase payment coverage

When increasing the number of currencies you accept for bank debit payments you need to take all the costs into consideration. Ideally, you would want to be able to collect payments in a currency most convenient for your payers and receive payment in the currency most relevant for you.

Traditionally, there have been two ways to handle international recurring payments. Firstly, you can create multiple bank accounts dedicated to receiving payments in the currency they were collected in. Or alternatively, you would need to pay an FX rate to collect and settle them in your preferred currency. The problem with FX rates is that it’s not always transparent or explicit exactly how much you will pay.

There is a third, more cost-effective alternative.

By using a comprehensive and dedicated recurring payment solution - like GoCardless - you have the flexibility to collect payments in your customers’ preferred currency from over 30 countries, covering 70% of the world’s recurring payment volume. Making the most of our global network. With transparent fees at the real FX rate and the ability to settle payments in your preferred currency.

According to research by IDC, businesses using GoCardless experienced a 44% increase in access to markets compared to their previous bank debit offering. Showing how choosing a flexible, robust and cost-effective solution can support business expansion.

One study participant talked about how the platform helped it to expand geographic markets: "GoCardless has allowed us to offer a preferred payment method in markets we consider strategic. In the U.K., for example, we're collecting about 20% now through bank debit with those customers that have purchased with us." Along the same lines, another said: "The whole reason why we implemented GoCardless was to provide a preferred payment method internationally."

Learn more about international payments with GoCardless

* A commissioned study conducted by YouGov on behalf of GoCardless, December 2020