3 ways GoCardless reduces your time to get paid

Last editedOct 20225 min. read

For businesses with recurring revenue models or those that collect payments over instalments rather than one-off payments, the fact that revenue is recurring offers a greater level of predictability for revenue. These businesses can spend less time acquiring new customers and generally have a healthier cash flow due to better being able to forecast revenue.

As your business scales and grows, the more important cash flow becomes. Especially when considering making long-term and future-focused investments in your business.

Unfortunately, this model isn’t without its challenges. Problems faced when collecting payments on an ongoing basis; like revenue getting stuck in account receivables, can jeopardise the predictability of cash flow and ultimately impede business growth.

In this article, we look at some of the common challenges faced by growing businesses and how GoCardless can help you tackle them.

1. Reducing Days Sales Outstanding (DSO)

Improving productivity and the efficiency of your payments with reducing credit risk and the risk of bad debt is essential to a healthy cash flow. At GoCardless we have done extensive research to understand exactly how much of an issue problem or negative cash flow is.

As it turns out for most businesses the average number of days it takes for them to receive payment once it becomes receivable (aka the Days Sales Outstanding, DSO) is over 20 days. A number that seems dangerously high and unnecessary risk for businesses.

But why is this so important for businesses to pay attention to cash flow and DSO?

When businesses have an excess in receivables or a large number of outstanding payments, these uncollected funds can’t be put to better use. This limits investment in business growth reduces resilience in a potential downturn and restricts the agility of a business.

Specifically for those businesses seeking investment or fundraising, highlighting a stable cash flow is also an important consideration. As an essential measure of how a business is doing and even as an indicator of a businesses’ potential to grow or for resilience in a downturn, a healthy cash flow is an important factor for investors.

So, what causes a high DSO and how can it be avoided?

Many factors can contribute to a high DSO. As businesses grow, payment collection becomes more complex and convoluted. Manual and time-consuming processes like chasing failed payments or reconciling invoices and payments can become costly and inconvenient. A poor DSO is also often associated with push-based payment methods, like bank transfers and cheques, that rely on a customer to make a payment to you. Meanwhile, pull-based payment methods like bank debit, or automated payment retries can help to reduce DSO.

How can GoCardless help you?

Over the last 10 years, Gocardless has built a dedicated solution for businesses collecting payments on a recurring basis. Whether you’re collecting invoices, membership fees, instalments or subscription payments we put you in control of when payments are collected. This means you can make revenue more predictable. By using bank debit, a pull-based payment method, unlike other push-based payment methods, you have full oversight of your accounts receivable and a better overview of your cash flow.

Businesses that use GoCardless, see 97.3% of payments collected successfully at the first time of trying. With real-time reporting, they know instantly when a payment does fail so they can take action straight away. Research from IDC identified that with GoCardless, businesses reduce the time to get paid by 47% and minimise debtor days by taking control of when payments are made.

How GoCardless helped AutoTask:

With Direct Debit, we don’t have to rely on customers to make a ‘push’ payment - which has helped us to reduce DSOs.” Patrick Hughes, Former Assistant Corporate Controller, Autotask

With GoCardless, Autotask’s DSO is around 3.5 - 6 times lower than it is for wire transfer and cheques, and lower also than it is for PayPal and credit cards.

Read the AutoTask case study.

2. Recovering failed payments & preventing bad debt

Payments can fail for several reasons and failure rates vary by payment method. Failed payments are also more likely to result in bad debt and customer churn. For nearly half of all respondents surveyed in a Forrester Consulting study commissioned by GoCardless, 7% of all payments fail and for two-thirds of B2B firms 10% or more of their failed payments turn into bad debt.

The costs associated with recovering these payments often equate to a significant proportion of the value of the payment. Forrester identified that for the majority of businesses surveyed the cost of recovery is more than 11% of the average payment size. Taking these costs generated by failed payments into consideration, payment recovery can have a significant impact on a business’ cash flow.

Improving failed payment recovery rates and making the process more efficient is a great opportunity for businesses to improve cash flow. If businesses can reduce the number of failed payments, they then reduce the risk of those failed payments becoming bad debt or the numbers of customers churning as a result. This creates a more predictable revenue for businesses and has a positive impact on cash flow.

How can GoCardless help?

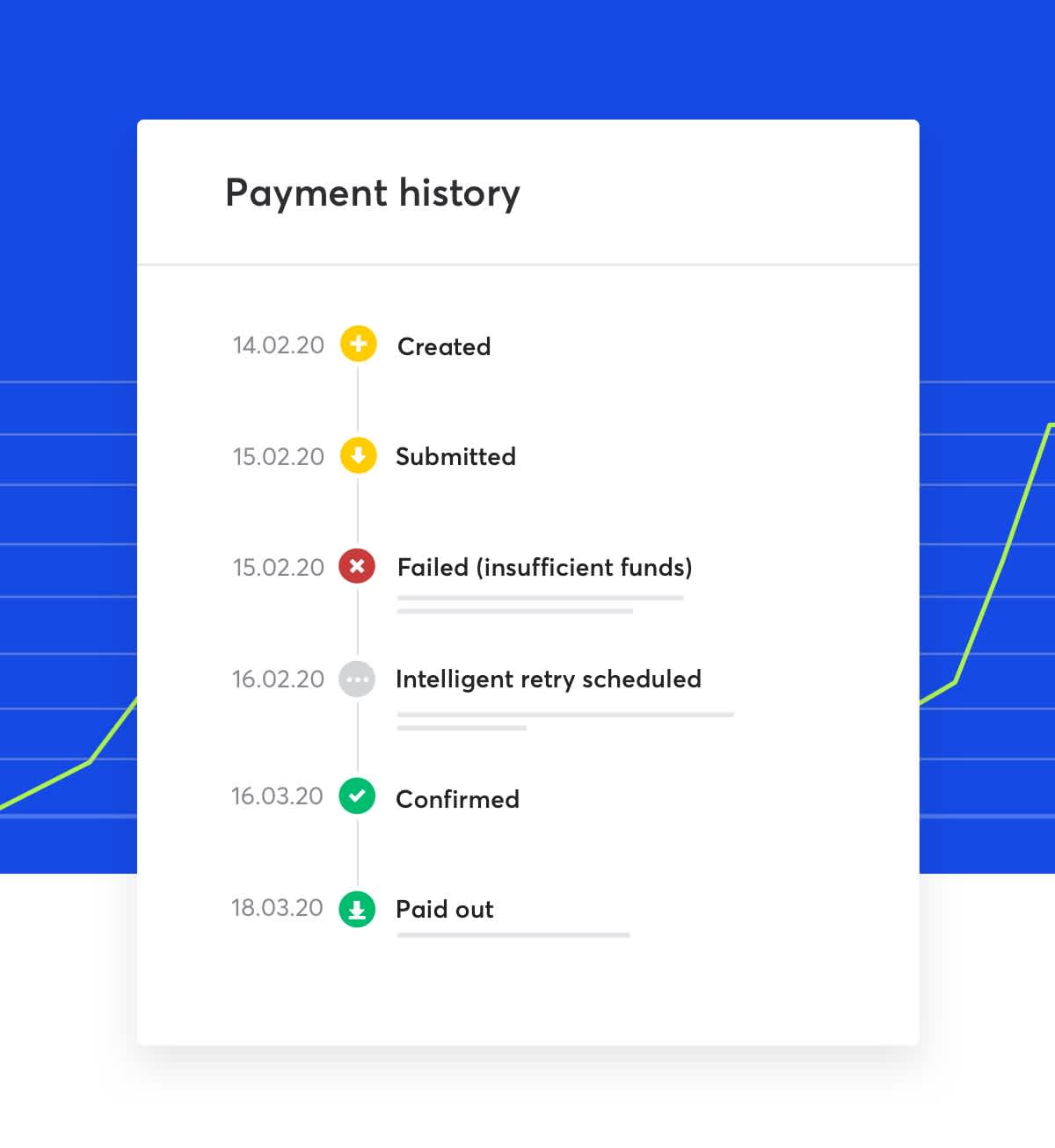

To help businesses improve payment recovery we created Success+, which uses recurring payment intelligence to predict and manage payment failures. Success+ automatically schedules payment retries on the optimal day for your customer.

Not only does this create a better customer experience but saves admin time for your collections team when manually chasing failed payments. Businesses that use Success+, on average, collect 76%* of payments that initially fail. By reducing the number of failed payments, businesses are improving their cash flow.

How GoCardless helped Neos:

“With Intelligent Retries, almost 90% of retried payments are successfully collected, where before we were only collecting 30-40%.” Monsur Alam, Head of Finance, Neos. Read the case study.

3. Reducing the time to get paid with open banking

One of the biggest advantages of a recurring payment business model is the predictability of revenue. However, 85%** of recurring revenue businesses need to collect one-off payments. From charging for extra products or services and account top-ups to collecting one-off payments on new customer registrations or chasing a failed payment.

If your business is optimised for collecting recurring payments, collecting one-off payments can be a challenge. The current methods are limited:

Cards have expensive transaction fees

Bank transfers offer a poor customer experience

Bank debit is not optimised for one-off payments

How can GoCardless help?

Many recurring revenue businesses need to collect one-off payments but they are unable to offer bank debit because of the poor one-off payment experience it provides. So, we have developed Instant Bank Pay, which is powered by open banking and currently only available to collect payments from British customers. It allows recurring revenue businesses to collect one-off payments seamlessly and fits a variety of use cases.

By using Instant Bank Pay, businesses have the autonomy to collect recurring and one-off payments, currently only from UK customers, in the way best suited to their customers. By providing a better payment experience, businesses can reduce failure rates and ultimately improve the time to get paid and cash flow.

Businesses looking to take a first payment when a new customer signs up can take a one-off payment while simultaneously setting up a bank debit mandate. By collecting these payments successfully and quickly, with instant confirmation, businesses can maximise cash flow across the board.

How GoCardless helped Cuckoo Broadband

We’re excited to continue using Instant Bank Pay for one-off payments. Not only will it prevent our customers from losing access to our services, it’ll also help reduce the time we spend chasing late payments and the risk of costs outstanding.” - Alexander Fitzgerald, Founder and CEO at, Cuckoo Broadband

Conclusion

For growing businesses, the predictability of revenue and maximising cash flow is essential for the agility to invest in your business and resilience for potential downturns. Improve your cash flow and tackle the challenges of collecting recurring revenue with dedicated solutions from GoCardless.

*76% figure is an average based on 3 retries during a 4 week period, as per a sample of 1000+ in November 2019

** Based on GoCardless market research, February 2021