3 key insights from the Zuora Subscribed Institute churn research 2022

Last editedFeb 20232 min. read

A growing base of loyal customers is what the subscription economy and many businesses revolve around.

Developing and keeping those customer relationships is the key to business growth. Best-in-class practices denote that businesses fully understand customer preferences and use this to predict behaviour and optimise experiences.

Zuora and the Subscribed Institute partnered with GoCardless to empower businesses to assess their end-to-end payments process and provide the latest benchmarks for customer churn. ‘How customers pay impacts how long they stay’ - this report lays out the role payment methods play in retaining customers and identifies how some easy-to-execute changes can result in a meaningful increase in revenue over time.

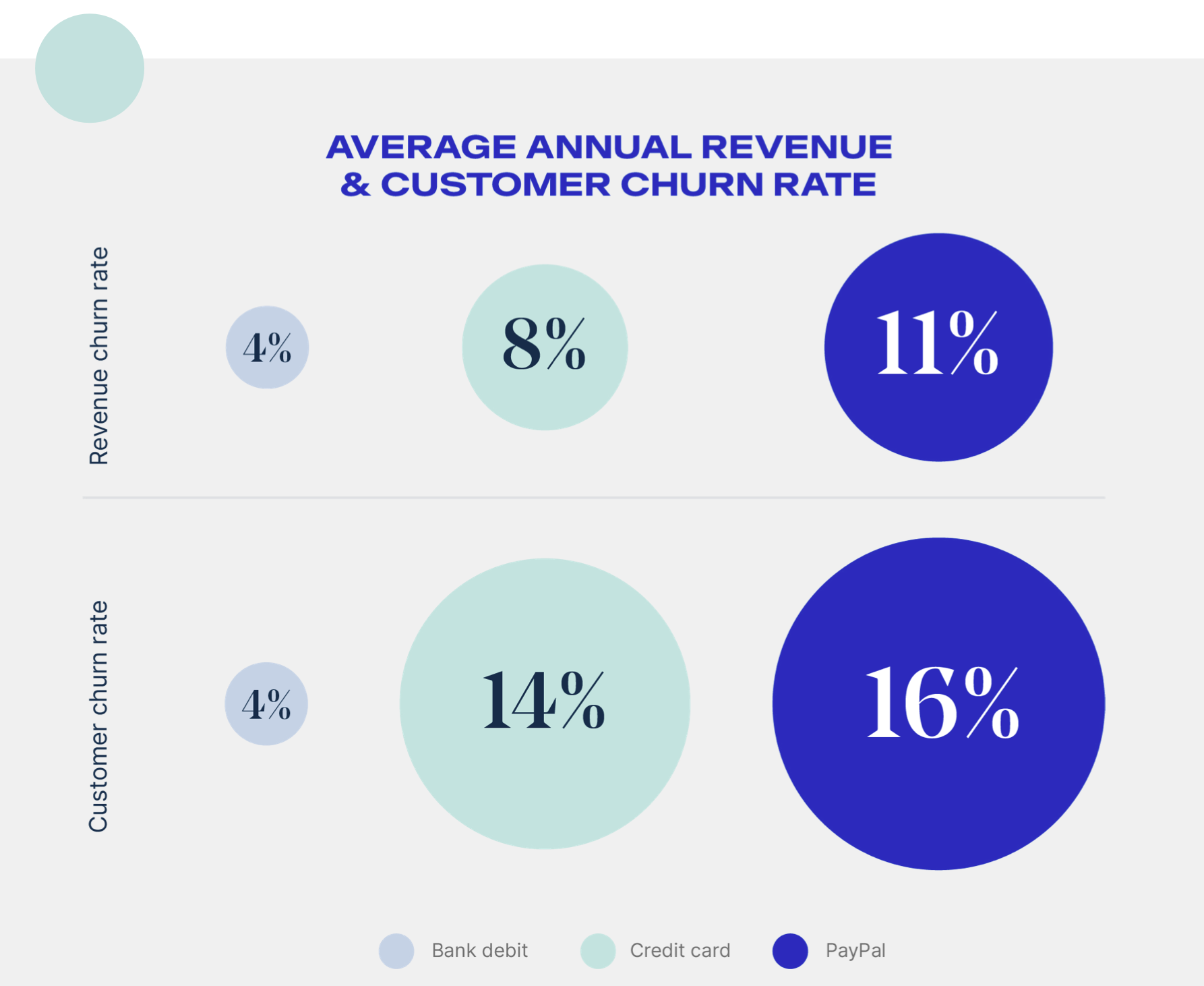

Ultimately, the percentage of revenue and customers lost to churn is reflective of the payment methods businesses choose to use.

1. A lot of churn isn’t driven by unhappy customers

In fact, 20% to 40% of customer churn happens as a result of failed payments.

Factors, such as the value of the product and quality of service, can mean the difference between a happy, loyal customer and a churned one. Businesses typically focus on these factors when assessing churn. Rarely considering the more tangible and addressable factor, the payment method they are using.

Yet, so many customers leave a business because something goes wrong within the payment process, like a payment failure. Whether it’s because of insufficient funds, or credit card expiry, many customers will churn unintentionally. This is known as involuntary churn.

2. Involuntary churn can be a simple fix (and it’s cost-effective)

As you can imagine as a customer, unexpectedly having your subscription or service stop, creates a negative experience.

When looking to minimize these negative experiences and boost your Customer Lifetime Value (CLV), the different payment methods a business offers its customers plays a vital role. The percentage of revenue and customers lost to churn is reflective of the payment method used.

For example, every quarter 3% to 6% of customers paying with PayPal churn, compared to 3% to 4% of credit card users and just 1% to 2% of bank debit (ACH Debit) users. If businesses choose to encourage more customers to pay with bank debit, they can easily cut the percentage of customers leaving accidentally and retain the revenue they bring.

3. The cost of churn compounds

Failed payments cost your business in subscriptions fees, revenue and the cost to recover payments. Businesses based on a subscription or recurring revenue model will depend on this ongoing revenue from customers for business growth, predictability and longevity.

The value of one lost customer, with a monthly subscription, will be felt in the months that follow it.�

Annually, businesses needlessly lose up to 16% of customers to churn. For those using bank debit that number is as low as 4%, meanwhile, for those collecting payments via credit card, it's 14% or PayPal, it's as high as 16%. When looking at the revenue lost to churn, the numbers are similar. Annually, businesses also lose up to 11% of revenue to churn, but for bank debit that number remains lower at 4%.

Data from ‘How Customers Pay Impact How Long They Stay’ from Zuora Subscribed Institute and GoCardless

Payment strategy matters

Payments play an important role in every business. This makes them instrumental to the customer experience but can often be overlooked. When choosing which payment methods to offer at your checkout, it’s important to consider which will be most effective in terms of reducing churn and improving the happiness of your customers.

After all, happy customers make loyal customers.

To find out more about how the likes of customer churn rates, the link between involuntary churn and payment failure and how many payment methods you offer impacts your annual churn rate, read the full report.

How They Pay Impacts How Long They Stay

Download the full report for the latest benchmarks for churn, as well as recommendations on how businesses can meet the challenges of retention with a well-planned payment strategy.