PayTo: the real-time Direct Debit revolution

Last editedDec 20223 min read

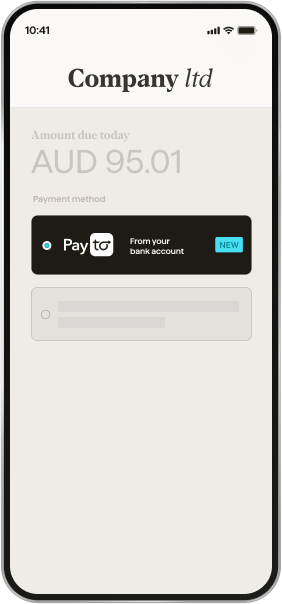

PayTo is here and GoCardless is connected. Lean what PayTo will mean for your business.

The payment system that serves you better

Direct Debit is evolving. Account-to-account or bank payments like PayTo will become part of the staple financial infrastructure of every fast-moving business.

Why?

Australia’s New Payments Platform (NPP), in partnership with the financial services industry, will release its latest innovation in account-to-account payment technology.

PayTo is a new, digital and mandated way for merchants to initiate real-time payments from customer bank accounts. And it’s set to transform the future of payments.

Why the switch from traditional Direct Debit?

While account-to-account payments are commonly accepted in Australia, there are a number of disadvantages that often see consumers defaulting to expensive credit card transactions.

It can take up to 4 days to receive payment confirmation

It can be slow and awkward to set up

If payment fails, the business is often charged a dishonour fee

Changes to the payment agreement have to be updated manually by the business

Businesses can’t validate the payment before the Direct Debit agreement starts

The alternative, credit cards, are subject to high transaction fees, increased risk of fraud and some of the highest payment failure rates; everything you don’t want to present to your stakeholders.

But it's all changing. And GoCardless customers get the opportunity to one of the first in the market to "turn on" this game-changing technology.

PayTo offers a smarter alternative to Direct Debit

PayTo lets customers link their bank accounts to apps, account-on-file arrangements for eCommerce and subscription services, loan repayments, membership fees, digital wallets and payment options like buy-now-pay-later services.

Reduced risk

Current Direct Debit rails increase the risk for these types of payments, as they often require instant authorisation and visibility. With instant customer verification, PayTo is now the fastest and safest way to conduct account-to-account payments.

Flexibility & rich data

PayTo payment agreements were purpose-built for flexibility, and the range of available data fields on offer is proof.

Identifying data on the account holder and the agreement conditions come as a standard. Businesses also have the ability to add optional data fields, depending on the needs of the customer and the party initiating the payments.

PayTo’s rich data capability will enhance GoCardless customers’ accounting matching and easy reconciliation. The result? Even easier accounting admin.

A springboard for innovation

Although simple in theory, PayTo’s infrastructure was developed for foundational capabilities that will enable a broad range of use cases in the future.

PayTo commenced its rollout in mid-2022 and a number of organisations, like GoCardless, are now offering PayTo services to their customers. The industry expects the majority of Australian bank accounts will be enabled for PayTo by mid-2023.

At GoCardless, we have a dedicated team working tirelessly behind the scenes to ensure we bring you a seamless PayTo experience. We are live, connected and ready to enable our customers on PayTo. If you would like to be part of our early access programme reach out here.

PayTo + GoCardless: a game-changer for business

For the first time, companies now have the ability to completely tailor their payment strategy to meet their business objectives.

With PayTo, businesses get the following:

Real-time customer account validation

Real-time funds verification and confirmation of payment, at time of payment

Platform infrastructure that’s supported by APIs to ensure a seamless process

Secure storage of reconciliation data - payment reference and mandate details - in the one place

Instant notifications when a customer cancels, pauses or changes their payment agreement

Facilitation of third parties to conduct payments on a businesses’ behalf, such as corporate payroll and accounts payable

For GoCardless this means that we will now be able to offer a more powerful platform to support your payment needs – we will combine the functionality of Direct Debit and PayTo to provide you and your customers with the best coverage and functionality.

This means you can now optimise and tailor payment infrastructure for security, speed or cost.

How could this look in practice?

A telco company may use PayTo rails to:

Authenticate a new customer while receiving instant payment notification, allowing them to seamlessly onboard the customer

Collect the setup fees or hardware costs upfront while authorising the month-to-month billing

Address failed payments due to insufficient funds by leveraging GoCardless intelligent retry product, Success+, or

Opt for a PayTo transaction to immediately recover the outstanding amount when the payee knows they have sufficient funds in the account

Or, for example, Uber could use PayTo as an alternative to credit cards kept on file:

Credit cards offer instant payment notification which makes them suitable for this type of transaction

They can also be expensive for merchants and consumers, the latter of which also increasingly wants to avoid debt traps

PayTo offers real-time payment confirmation, like credit cards but for lower costs, better payment transparency and higher security

PayTo: an easier option for your customers

PayTo gives your customers more control over both one-off and scheduled account-to-account payments. Which makes it simpler to transact with your company and improves the overall user experience.

Customers can pre-authorise real-time payments from their bank accounts, ensuring efficiency and security, while also reducing incidences of failed payments due to insufficient balances. They can also correct inaccurate account information and fraud blocks from the banks.

PayTo helps make routine life admin that little bit easier for customers while optimising payments strategy for merchants.

Your customers will appreciate:

A smoother payment experience

The ability to set and forget, view and manage payments, all in one central place

A choice between a PayID or traditional account and BSB number, simplifying the entire payments process from start to finish

The choice to pause, cancel, or authorise new payment agreements with the swipe of a finger within their banking app

Want to find out what PayTo can do for your business?

Discover more at gocardless.com/payto

Join GoCardless' PayTo University

We've launched PayTo University, a free education platform that will guide you through everything you need to know about PayTo and how your business can use it to enhance your existing payments strategy. Start learning today by visiting our University.