3 key takeaways from The Global Payment Timings Index 2021

Last editedSept 20213 min read

Getting paid on time is important for every business. Improving payment timings means businesses can optimise revenue, cash flow and maximise revenue growth.

A healthy cash flow keeps the lights on and enables businesses to invest in expansion. If money goes uncollected from customers, that revenue cannot be utilised to the business’ benefit. This is especially important in light of the economic downturn as a result of the COVID-19 pandemic, for small and large businesses alike.

Collecting payments on time goes a long way to improving a business’ cash flow and makes revenue more predictable.

What’s more, receiving payments on time enables businesses to pay their suppliers faster, creating a virtuous cycle that benefits the entire economy.

According to a Forrester study, commissioned by GoCardless, most businesses have an average Days Sales Outstanding (DSO) of 20-30 days. But businesses don’t need to wait that long to get paid.

To get a better understanding of Forrester’s findings, we analyzed our own data to identify how long it takes businesses to receive a payment. From these findings, we created The Global Payment Timings Index 2021 to:

Set a benchmark for payment timings across different sized businesses, payment methods, locations, business verticals and transaction values.

Identify opportunities to help businesses optimise the time it takes to get paid and improve their cash flow.

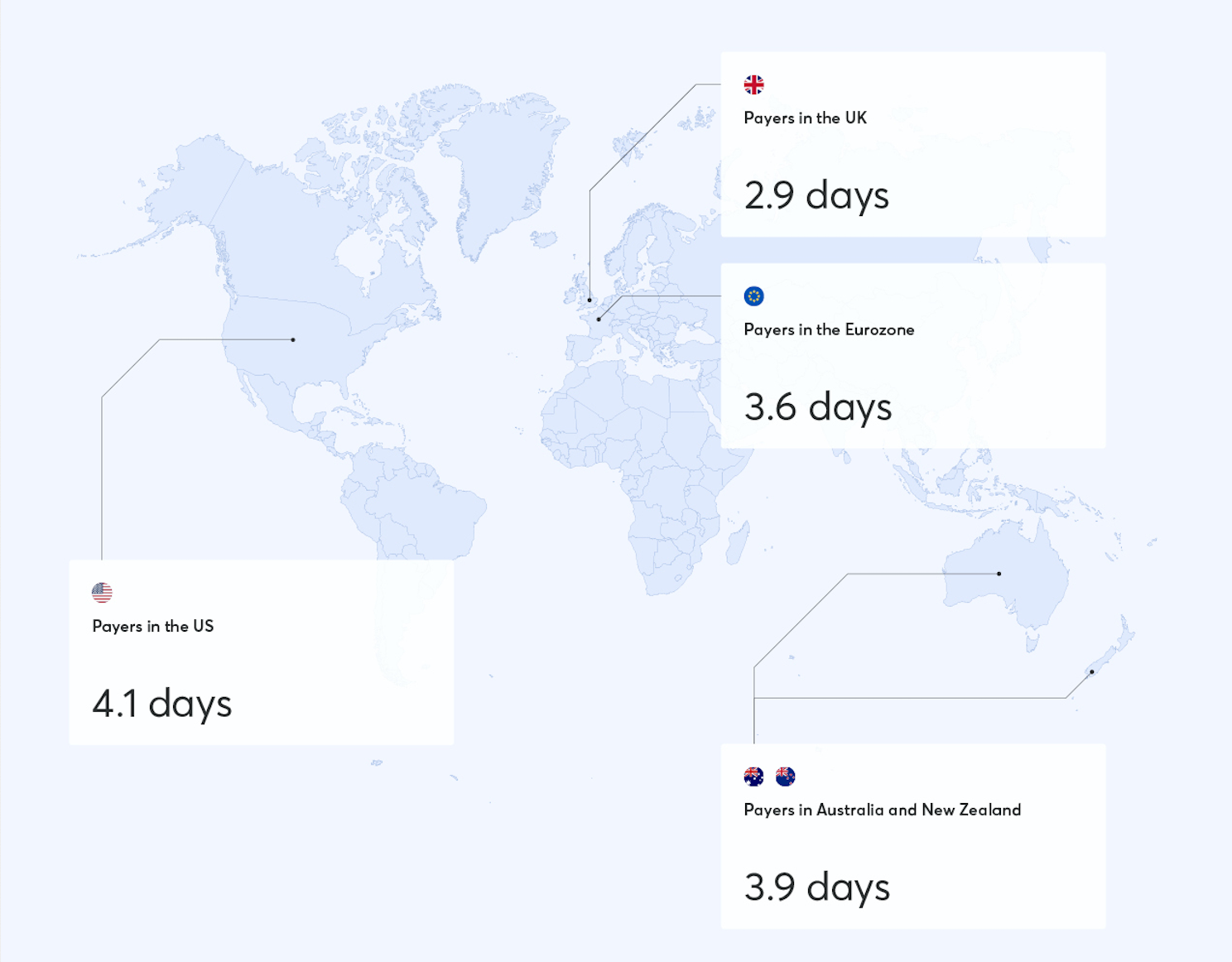

Our research shows that businesses using GoCardless have an average payment timing of 3.6 days.

The Global Payment Timings Index 2021

Download the full report for all the important insights, as well as recommendations on how businesses can improve cash flow and payment timings.

We examined data from over 65,000 businesses and 40 million payments to establish benchmarks for how long it takes businesses to get paid. We also conducted an external survey of 1,900 businesses across the UK, France, Germany, the US and Australia and asked participants about the number of days it takes for them to collect a payment.

In this report when we talk about payment timings we mean: The average number of days it takes the money you’re owed to be collected. From the day you would like to charge your customer - the charge date, until the day the money arrives in your bank account - the payout date (excluding payment terms).

Here are the 3 key takeaways from The global payment timings index 2021:

1. Businesses of every size need to consider how cash flow impacts their company

Small businesses:

A healthy, positive cash flow means a business can function smoothly day-to-day.

Poor cash flow can slow down normal functions or even result in closure. Money that goes uncollected can be paralyzing for small businesses.

Medium-large businesses:

A healthy, positive cash flow frees up funds and enables businesses to focus on long-term investments and expansion plans.

Poor cash flow inhibits business growth and investment in expansion projects. Money that is uncollected, is money that can’t be used and might cost extra in fees and recovery.

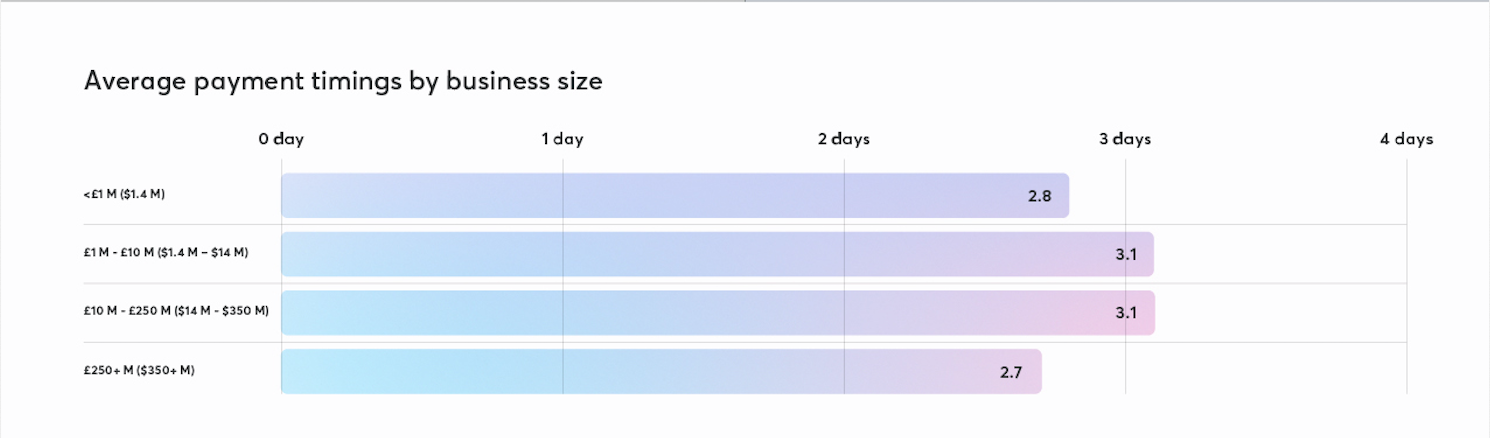

Although the consequences of cash flow vary for small and large businesses, payment timings for GoCardless customers are quite consistent across every business. Timings only varied by up to 0.4 days across all business sizes, with the smallest and largest businesses experiencing the fastest payment timings. By reducing payment timings from Forrester’s industry average of 20-30 days to the 3.6 days identified in The Global Payment Timings Index 2021, businesses could optimise revenue by as much as 86%.

Will reducing your time to get paid improve your working capital?

Work out exactly how much capital you could unlock with our simple calculator.

Late payments don’t just affect the businesses that are waiting for funds. There are real implications up and down the supply chain. An additional survey* from GoCardless found that of the 31% of UK businesses that reported paying a supplier late, nearly half (47%) said it was due to late or failed payments from their suppliers or customers.

The burden is also transferred to the end payer: over a third (35%) of companies would consider raising prices for customers as a result of suffering from late payments. The domino effect of just one delay only serves to underscore the importance of choosing the right payment method - not only to help an individual business thrive, but to ensure the robust health of an entire economy.

2. Different payment methods impact the time it takes to get paid

How long it takes for a business to collect recurring payments is influenced by the payment methods it chooses to offer.

When we talk about payment methods they fall into two categories:

Account-to-account - moves money automatically from one account to another, like bank debit and bank transfers.

Non-account-to-account - payments that rely on third-party mechanisms, like cards or digital wallets to move money.

The research shows that account-to-account based payment methods (like bank debit via GoCardless) have faster payment timings at 3.6 days compared to physical methods (like cheques) that take 22.1 days.

3. Payment timings vary across the globe

Every currency has its own payment scheme and its own regulations. We compared the payment timings across 5 different regions to identify how location and currency impacts payment timings.

The Global Payment Timings Index 2021

Download the full report for all the important insights, as well as recommendations on how businesses can improve cash flow and payment timings.

Could GoCardless be your new payments partner?

As mentioned above, the payment methods you offer have a significant impact on cash flow and payment timings. We’ve put together useful information on how GoCardless can help reduce the time it takes to get paid. If you’d like to discuss your payment challenges in greater detail, have a 15-minute chat with one of the team to see where GoCardless can help, and how your business compares to other important industry benchmarks.

*Additional survey conducted in August 2021 by GoCardless of 500 business decision-makers.