Last editedJan 20223 min read

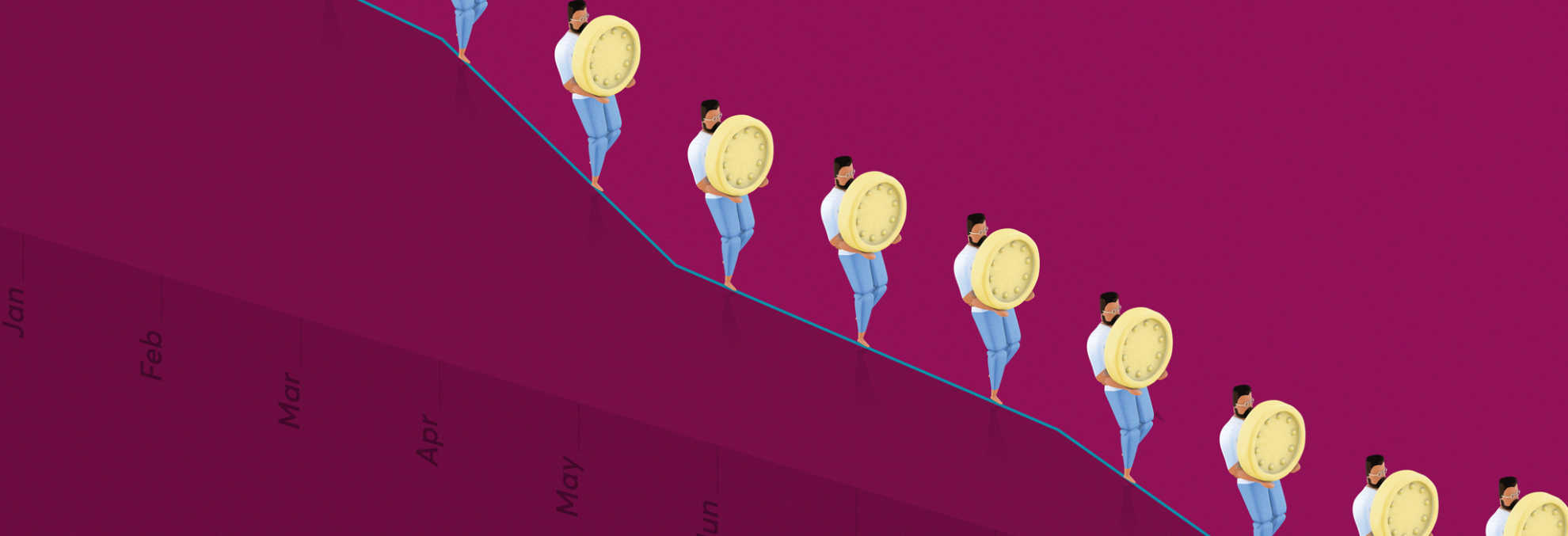

Every month, subscription businesses are losing 1-4% of their customers, pointlessly. For a business doing 100,000 transactions a month, with an average transaction value of £10, that could mean a loss of c. £15m in accumulative revenue over 5 years.

And that’s not taking into account the impact on Customer Acquisition Costs (CAC) (since it’s anywhere from 5 to 25 times more expensive to gain a new customer than to keep one).

This is involuntary churn. While customer success and product teams work hard to make sure customers continue to get value from their subscriptions, their efforts can be brought to nought by losing a customer to a preventable payment issue.

Subscription metrics and growth software provider ProfitWell found that up to 40% of subscription churn is involuntary - it happens when an administrative payment issue is not addressed, causing a subscription to elapse.

Patrick Campbell, Co-Founder & CEO, ProfitWell, comments: “20-40% of your churn is actually absolutely needless, stemming from failed, expired, and delinquent credit cards. Let me put that data in perspective for you. If your churn rate is currently 5%, then one to two percentage points of that churn exists for an absolutely needless reason. You’re pointlessly losing a lot of money every month.”

Involuntary churn (also known as passive churn or delinquent churn) is a particular issue for subscription businesses, who typically capture a customer’s payment information at sign up and store for processing future payments. Over time those details become out of date.

Payment failure rates for business vary depending on sector and market, but are typically 5-18% (Recurly suggests an average of 13%).

Why do payments fail?

The number one reason payments fail is card network infrastructure.

With their global reach and popularity, particularly for transactional e-commerce, it’s easy to see why credit and debit cards have become the default payment method for subscriptions businesses.

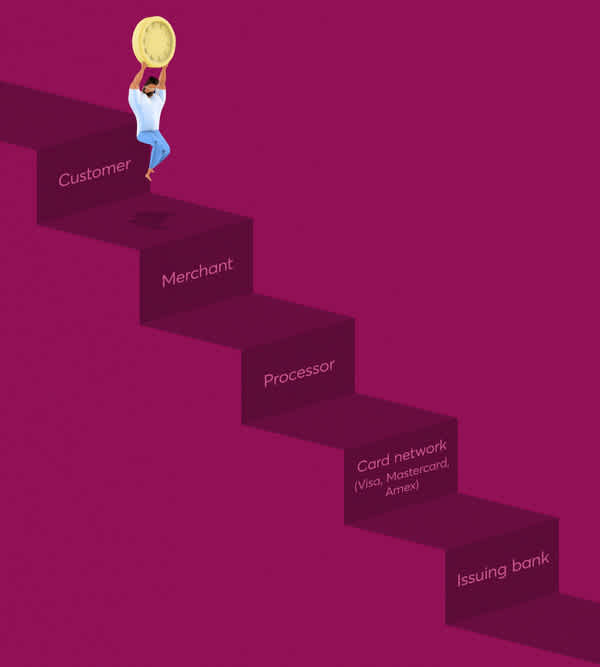

But cards weren’t designed for recurring payments. They operate on a complex infrastructure with multiple players, creating plenty of opportunity for failure (see figure 1).

Over time, stored card details become outdated as cards expire (typically every three years), or are cancelled, after being lost or stolen. They can also fail because a customer hits their spending limit.

Figure 1: The complex card infrastructure

What can you do about it?

There are services available today to help business reduce card declines, from automated dunning and payment page optimisation to account updater services, Cards on File (CoF) and smart retry logic:

ProfitWell offers an all-in-one ‘recovery’ package, including automated recovery emails, landing pages, annual upgrade options and in-app messages. Its customers typically cut their involuntary churn by 40-50% and it comes with a guaranteed 100% ROI.

SaaS subscription software platforms Zuora, Chargebee and Recurly offer to help customers reduce failures with built-in dunning management and account updater services.

The problem with account updaters

Account updater services are a proactive way to reduce involuntary churn - Visa and Mastercard will batch check your customers card details with issuing banks, before each renewal (and you pay a few pence for every set of updated details).

Most businesses access account updaters via an acquirer like Adyen, Braintree and WorldPay (acquirers may build their own logic on top of basic account updaters, for example allowing you to run reports), and/or through their billing software provider.

Card updater services will catch a proportion of your failed payments; but their success is dependent on every actor in the complex card value chain (figure 1) doing what it’s supposed to. Account updaters may fail for the following reasons:

A local issuing banks' processor is not opted into, or integrated with the scheme (particularly a problem outside the US and Canada, where scheme coverage can be patchy)

A bank has not yet integrated with the scheme (this can happen even in the US where it’s mandatory for issuing banks to participate in these schemes)

A card is unsupported, e.g. it’s international or prepaid

The card belongs to a card network which doesn’t support account updater

A bank fails to promptly update Visa and Mastercard about a change in card details (since many smaller banks still rely on manual processes)

A customer switches card provider

Tackle the problem at the source

Smart retries and account updaters deliver a welcome decline in failed payments for many SaaS businesses. Take Stripe Billing for example, which claims to reduce payment failures by 45% - if you started with a 10% failure rate, you’ll reduce it to 6.5%.

But tackling the root of card declines, could bring down your failure rate to a low as 0.5%, cutting involuntary churn by more than 70% and bringing down overall churn by 1-3% - ultimately enabling you to increase lifetime value and ROI by more than 30%.

Rooting out the cause of involuntary churn means reducing your reliance on cards. By using bank to bank payment methods like Direct Debit, you can achieve failure rates as low as 0.5%.

It might sound bold, but SaaS businesses (like GoCardless customers Box and TripAdvisor) are already starting to recalibrate their customer payment mix by introducing bank to bank payment methods designed for recurring payments, like Direct Debit, into markets like the UK and Europe, where customer demand for these payment types already exists.

The good news is alternatives to card payments are on the rise across Europe and providers like GoCardless are joining the dots to create a global bank to bank payments network that can support global subscription businesses.

In 2016, Direct Debit made up 20% of all 122 billion cashless payments taking place in the EU (source: European Central Bank, Payment Statistics for 2016).

In the UK in 2017, 75% of all recurring payments were processed via Direct Debit Direct Debit (Finance UK)

More than 50% of non-cash transactions in Germany are processed via SEPA Direct Debit

60% of online transactions in the Netherlands are made with bank transfer system iDEAL.

Payments built for the subscription economy

GoCardless uses bank-to-bank payments to help SaaS businesses eliminate involuntary churn and maximise LTV.

We support payments in more than 30 countries via 8 Direct Debit schemes - Bacs (UK), ACH (USA), SEPA (Eurozone), BECS (Australia), Autogiro (Sweden), Betalingsservice (Denmark), PaymentsNZ (New Zealand), and PAD (Canada) - with a single point of access and a standardised user experience.