7 subscription metrics you need to be tracking in 2020

Last editedMay 20224 min read

“What gets measured, gets managed.”

Those are the words of legendary management consultant Peter F. Drucker. The sentiment is as true today as it was when Drucker said it in his 1954 book, The Practice of Management.

Subscription businesses need to be able to measure and optimise key metrics for growth, retention and profitability, which are all inextricably linked.

A subscription model relies on recurring revenue; that is, where your customer pays at regular intervals. So it’s important to measure just as regularly as your customers pay you, to make sure your key metrics are trending in the right direction, and allow you to do something about it if they’re not.

Here are seven important ones for your subscription business to track in 2020:

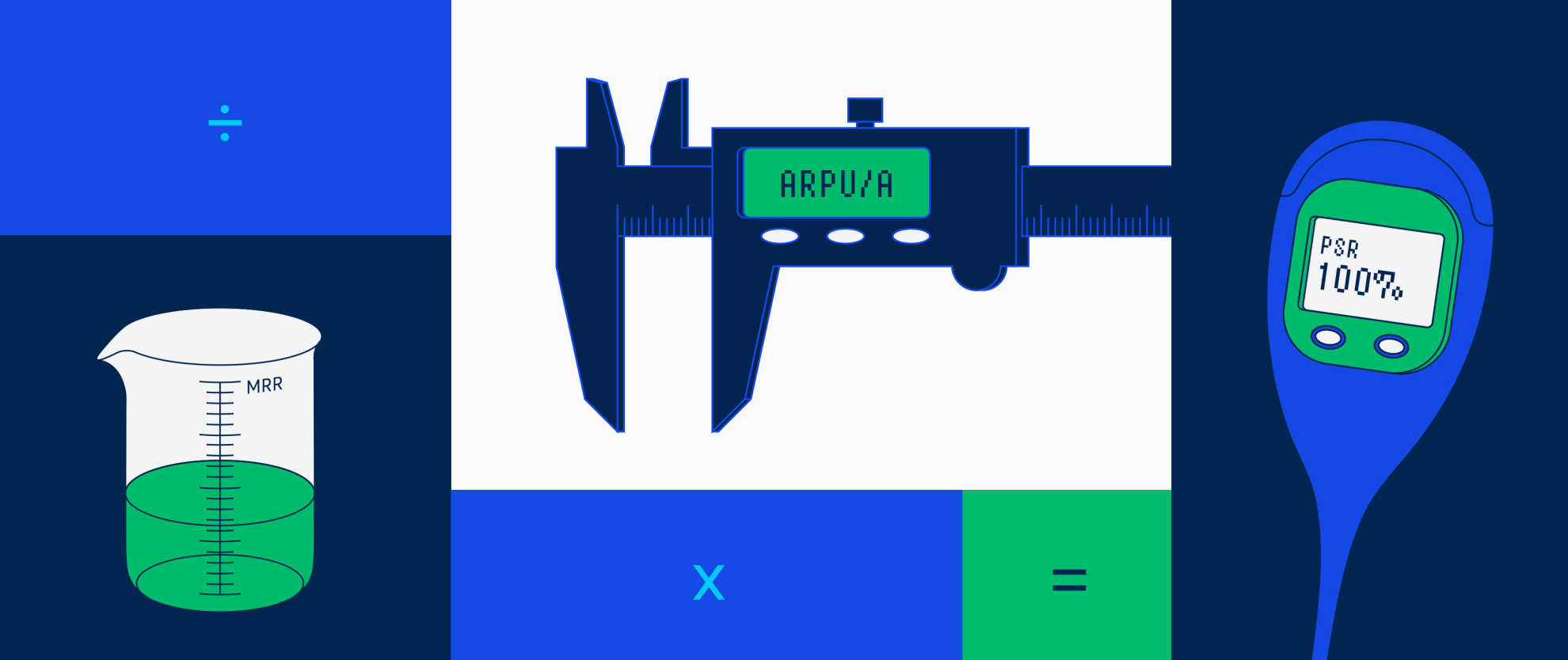

1. MRR (monthly recurring revenue)

What is MRR?

MRR is all your monthly revenue shown as one figure. It allows you to combine your different pricing plans and billing structures into one metric.

Correctly calculating MRR allows for dependable financial planning and forecasting. MRR is also a key indicator of growth, which is especially important if you’re at a VC backed company.

How can MRR be improved?

Improving MRR is a responsibility that extends across multiple teams. Though sales and marketing will focus on finding and engaging with high-quality leads, they can’t do much without the product team constantly improving the offer. And without a great customer success or support team, all the hard work of finding new customers will be lost to churn.

How to make a simple MRR calculation:

Total # of customers x Average monthly revenue per user/account (ARPU/A) = MRR

Related metrics:

New MRR | Net new MRR | Churn MRR

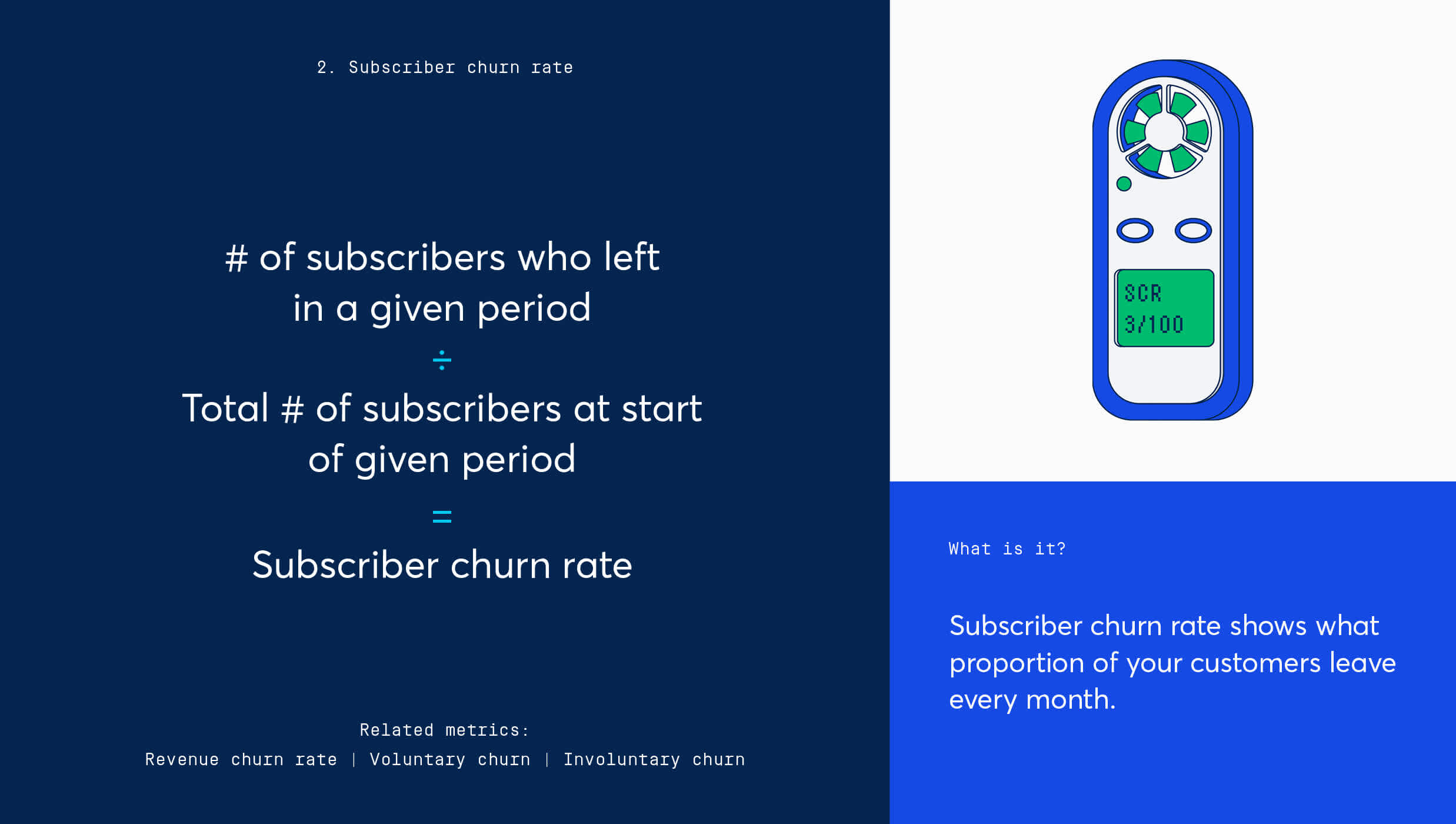

2. Subscriber churn rate

What is subscriber churn rate?

Subscriber churn rate is the rate at which your customers stop doing business with you, often measured as a percentage of those who leave you every month.

Why is subscriber churn rate important?

Subscriber churn identifies the number of customers who leave, and it can also indicate if there are opportunities to win back recently churned subscribers.

How can subscriber churn rate be improved?

There are many causes of subscriber churn, so the first step is to understand why churn is happening. Seeking feedback from those who have recently churned is a great place to start. Churn also happens by mistake, because you are unable to collect their payment. This is called involuntary churn and makes up 30% of all subscriber churn. It can be improved by using a more reliable payment method.

How to calculate subscriber churn rate:

# of subscribers who left in a given period / Total # of subscribers at start of given period = subscriber churn rate

Related metrics:

Revenue churn rate | Voluntary churn | Involuntary churn

3. ARPU/A (Average revenue per user/account)

What is ARPU/A?

ARPU/A is a common subscription metric that allows you to calculate the expected revenue of a single user over a specific period (usually monthly).

Why is ARPU/A important?

The strength of your ARPU/A number provides validation that your sales and marketing teams are making the right deals.

How can ARPU/A be improved?

Increasing your ARPU/A is a lever for increasing monthly recurring revenue (MRR). When ARPU/A is broken down by acquisition channel, it can provide a good steer on which channels to prioritise.

How to calculate ARPU/A:

Total monthly recurring revenue (MRR) / Total customers = ARPU/A

Related metrics:

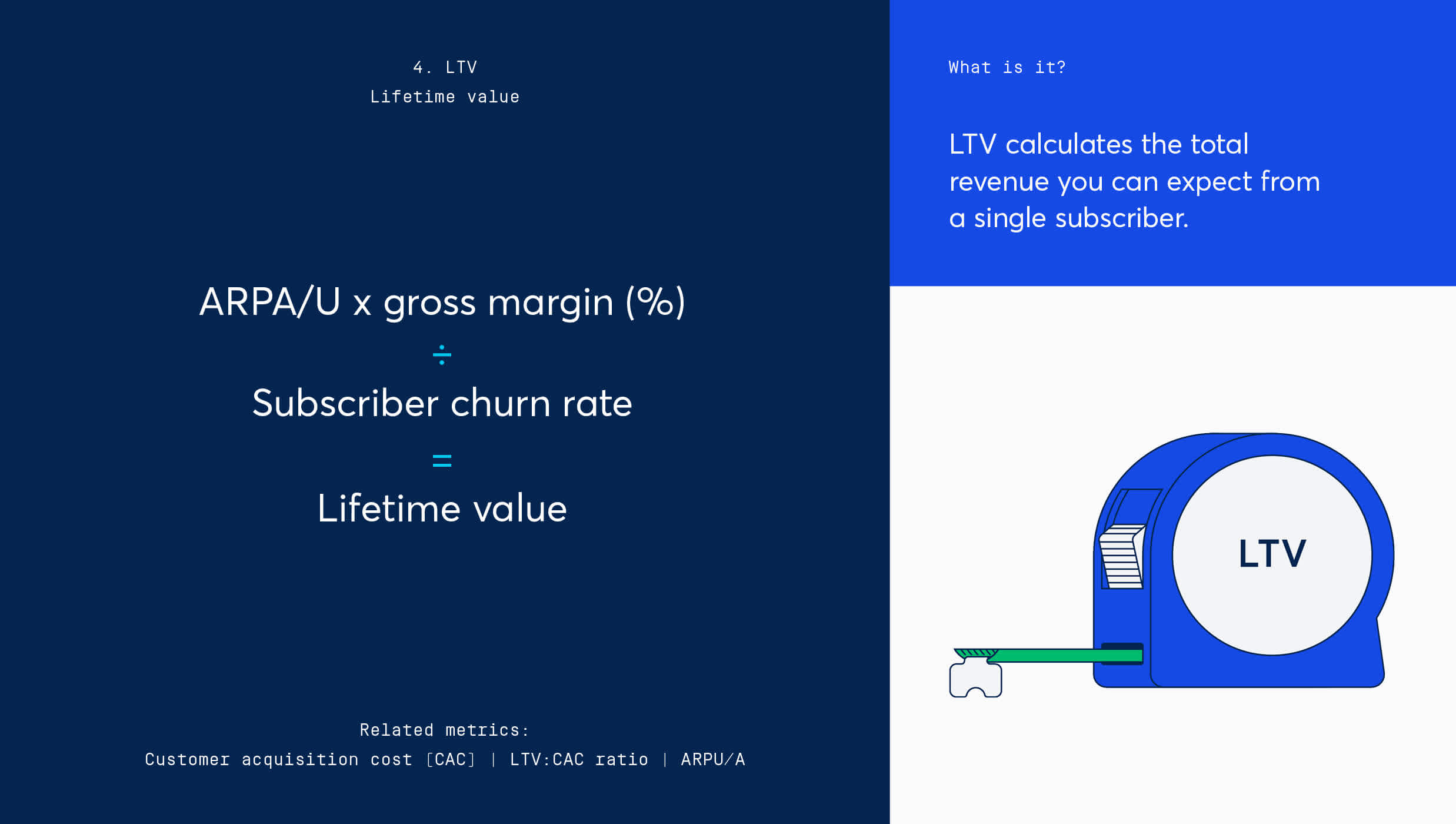

4. LTV (Lifetime value)

What is LTV?

LTV, also known as CLV (customer lifetime value), calculates the total revenue your subscription business can expect from a single subscriber.

Why is LTV important?

In simple terms, the higher the LTV of your customers, the more you can afford to spend on acquiring new ones. It can also be used to calculate how long it takes to recoup the cost of acquiring a customer.

How can LTV be improved?

By segmenting your customers by acquisition channels and marketing efforts, you can predict which customers will stay with your brand for longer. An increasing LTV is also a good signal that new product features have been well received.

How to calculate LTV:

(ARPA/U x gross margin (%)) / subscriber churn rate = LTV

Related metrics:

Customer acquisition costs (CAC) | LTV:CAC ratio | ARPU/A

5. CAC (Customer acquisition cost)

What is CAC?

Customer Acquisition Cost (CAC) is the total cost of both sales and marketing that are required to win a new customer or subscriber.

Why is CAC important?

When compared with LTV, it shows whether your subscription service is sustainable and your business model is viable.

How can CAC be improved?

As CAC is effectively a measure of the money you’re spending, it can be improved by optimising the effectiveness and the speed of your sales and marketing efforts. Invest more in channels where the cost of acquisition is lower and engage with leads as quickly as possible.

How to calculate CAC:

Total cost of sales and marketing / number of customers acquired = CAC

Related metrics

Customer lifetime value (LTV) | LTV:CAC ratio

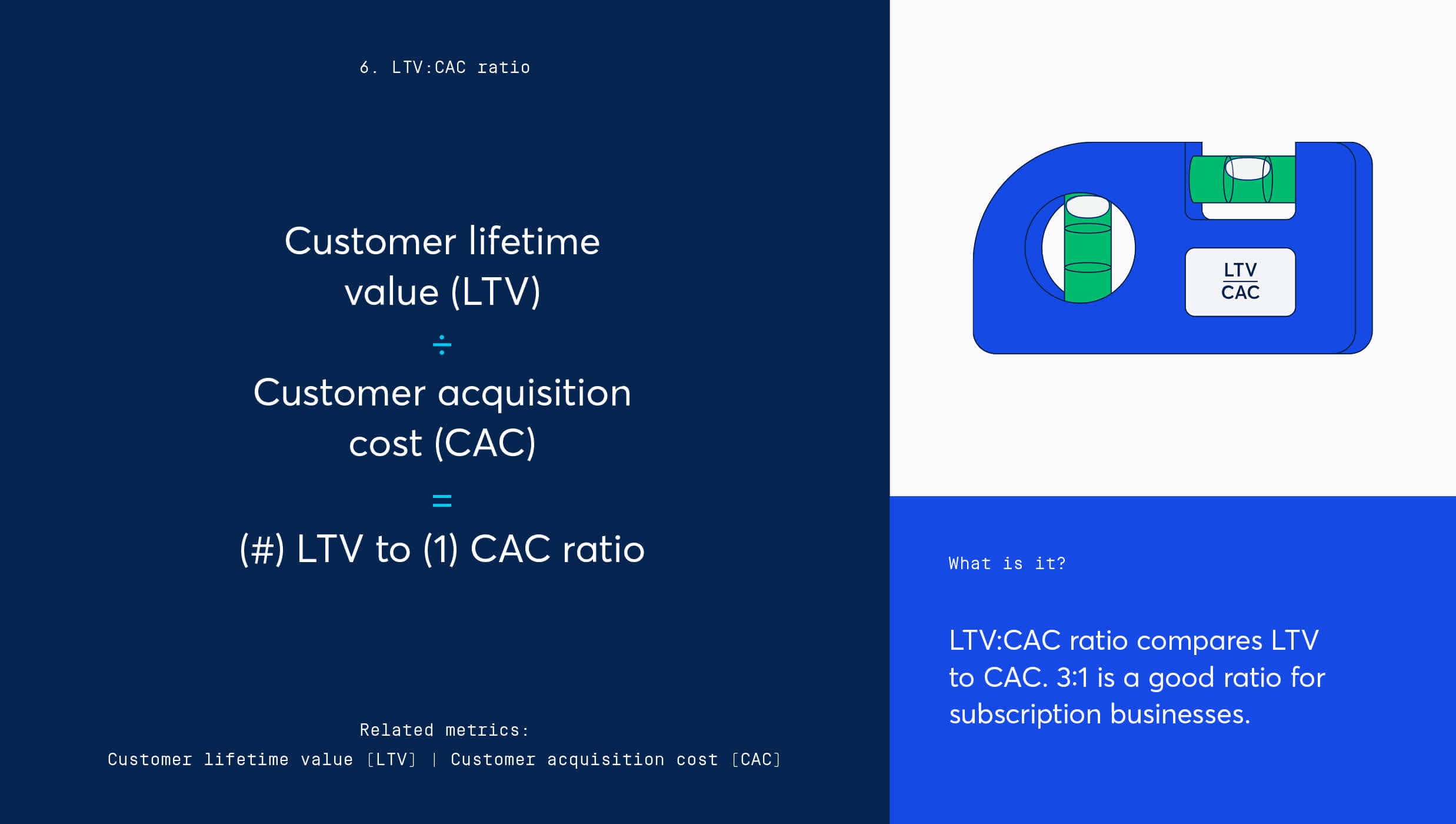

6. LTV:CAC ratio

What is LTV:CAC ratio?

LTV:CAC ratio is a simple metric that compares LTV to CAC. Industry benchmarks suggest a ratio of 3:1 is a good ratio for subscription businesses.

Why is LTV:CAC ratio important?

LTV and CAC are important metrics, but can’t be viewed in isolation. Combined, the ratio shows how profitable the customers you are acquiring will be in the long run.

How can LTV:CAC ratio be improved?

There are two ways to improve your LTV:CAC ratio; increase the lifetime value of your subscribers, or reduce the cost it takes to acquire them.

How to calculate LTV:CAC ratio:

Customer lifetime value (LTV) / Customer acquisition cost (CAC) = (#) LTV to (1) CAC ratio

Related metrics:

Customer lifetime value (LTV) | Customer acquisition cost (CAC)

7. Payment success rate

What is payment success rate?

Payment success rate is the measure of payments taken from your subscribers that are successfully collected and retained.

Why is payment success rate important?

Subscription success is built on recurring revenue, and therefore your business’ ability to collect that revenue. Payment success rate shows how regularly you can collect the promised revenue, and conversely how often a payment fails.

How can it be improved?

Payment success rate depends on the payment method and provider you use to collect a payment. Credit cards, for example, are typically successful 85-95% of the time, whereas Direct Debit (also known as bank debit or ACH debit) payments are typically successful more than 97% of the time.

How to calculate payment success:

(Successfully collected payments / total number of attempted collections) x 100 = payment success rate (%)

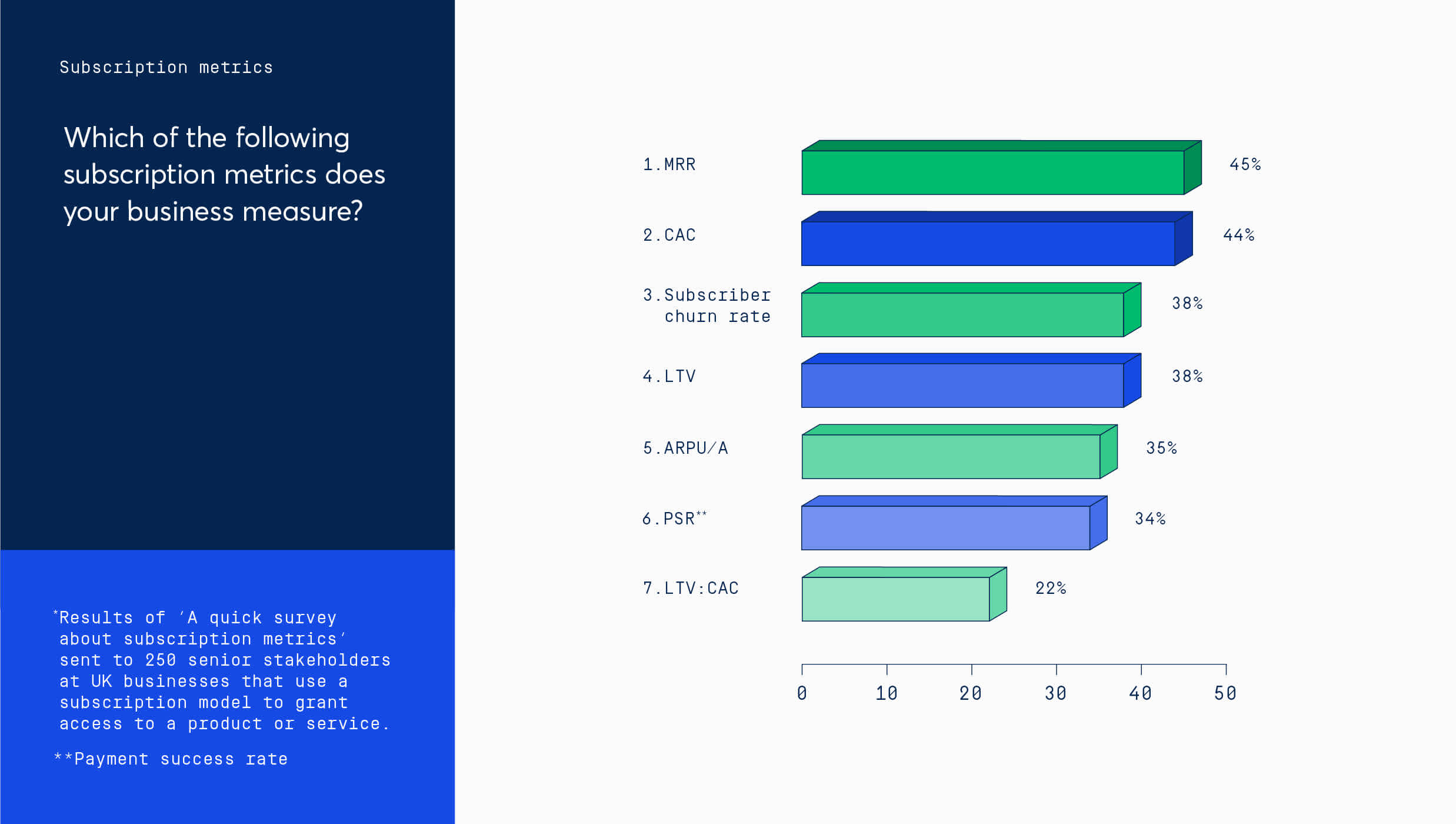

Are subscription businesses measuring these key metrics?

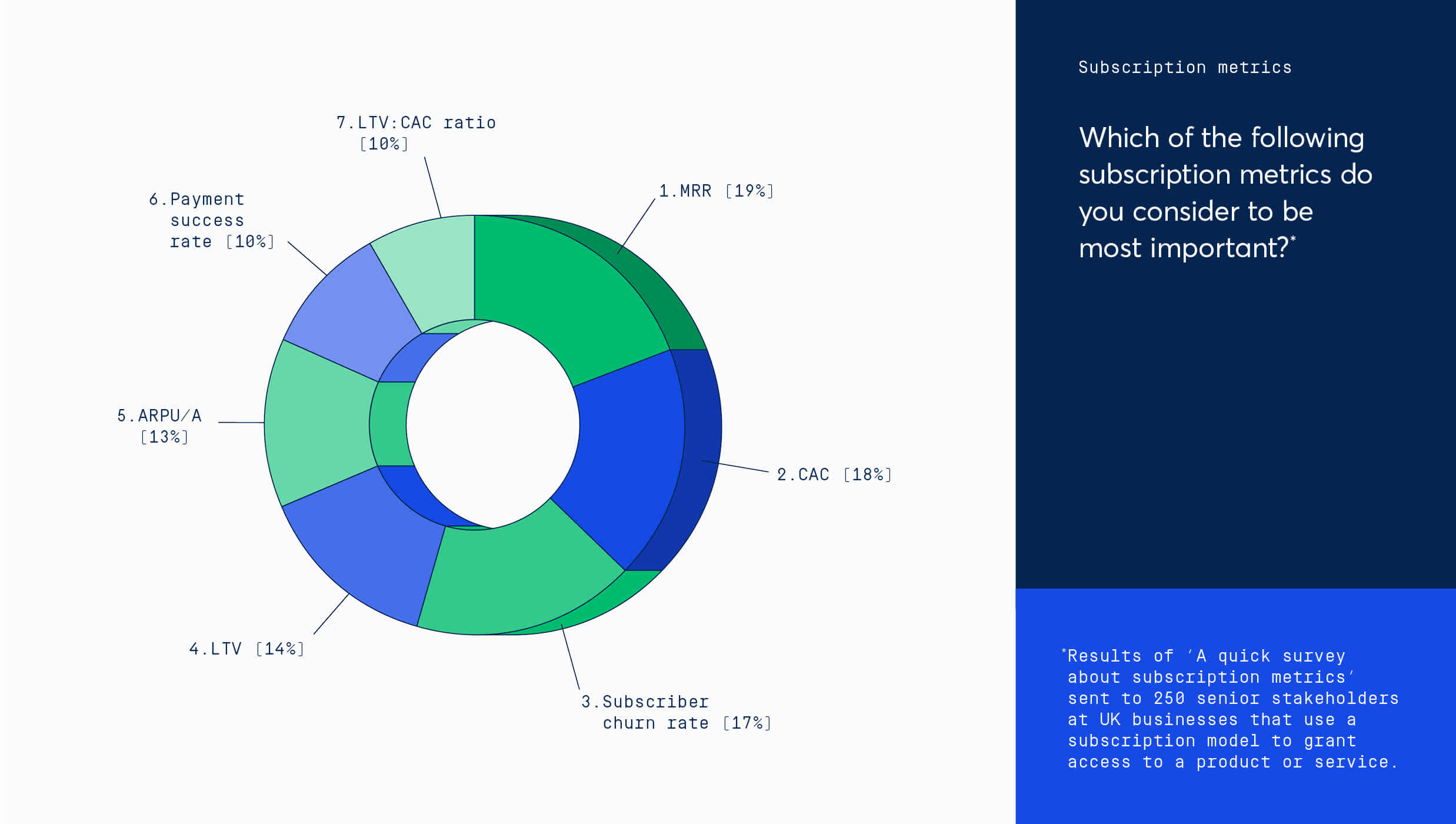

The above metrics provide a good starting point to keep track of the health of your subscription business. But how many businesses are actually keeping track of them. We surveyed 250 business owners and senior stakeholders at UK businesses that use a subscription model to grant access to a product or service to find out.

MRR is the most commonly tracked metric, with 45% of those surveyed tracking it, with Cost of acquisition close behind on 44%. Only 22% of those surveyed measure LTV:CAC ratio.

When asked which single metric was most important, MRR once again proved most popular, with 19% choosing it. 18% felt that subscriber churn rate was most important.

Start measuring

It might feel like a tall order to track and optimise all of the above subscription metrics (and possibly others, depending on your industry and exact business model), but combined they paint a picture of the overall health of your subscription business.