5 mistakes businesses make during international expansion and how to avoid them

Last editedJuly 20235 min read

For any business with even the smallest ambition to reach the famed hypergrowth status, international expansion needs to be considered from the very early stages of growth.

It’s even more keenly felt in Europe, compared to say the US or China, where smaller domestic markets mean the only way to keep going forward is to make the leap into new territories. According to Balderton Capital, it takes the average European SaaS business 4.1 years to open its first international office, while it takes the average US SaaS business 5.3 years.

While there are well-trodden paths for international expansion, it’s still a journey fraught with pitfalls and problems that can stifle growth and cause all manner of headaches.

And there are a few common mistakes that businesses make when entering new territories. This guide will look at how these mistakes come about and how your business can successfully navigate them during your own international expansion journey.

1. Expanding before your business is ready

While not expanding internationally will eventually inhibit your business’ growth, making the jump too early can have its own negative impact. But what are the signs that it’s too soon to think global?

The first is that meaningful international growth needs the attention of at least one senior stakeholder. Your business needs the bandwidth to divert considerable attention away from domestic operations. If you can’t spare that person, you’re not quite ready.

Another measure is having (or not having) clear product-market fit in your new market. As Balderton Capital explains, “pivoting once you have expanded across multiple countries is exponentially more difficult.”

2. Assuming customers will pay using the same payment methods as your home market

In simple terms, people have individual preference over how they pay for a product or service. Some prefer to pay with credit cards, some with cheques and so on. If you don’t offer the right payment method(s) some customers might choose to not pay for your product - especially if a competitor does offer their choice of payment method.

And payment preference differs from country to country. There are cultural and regulatory factors that mean some countries have a completely different ‘preferred’ payment method to another.

GoCardless and YouGov have surveyed over 19,000 businesses and consumers around the world on their preferred payment methods for a number of common recurring payment use cases.

In the B2B world, bank debit (also known as Direct Debit in the UK), dominates in most use cases in the UK, France, Germany and Australia. But interestingly, bank transfers are preferred for business invoices in all of the aforementioned countries.

In Canada and the US, corporate cards are much more popular. In the US, for example, corporate cards are the preferred payment method for every single type of recurring payment, with at least 50% of respondents likely to choose it.

For consumers, bank debit dominates in the UK, with between 53 and 65% of consumers choosing it as their favourite payment method depending on the use case. France and Germany have similar pictures, with bank debit the favourite payment method.

Just like with B2B, in the US and Canada, credit cards are much more preferred for most use cases, particularly digital subscriptions (41% in Canada and 29% in the US).

This disparity in payment methods across the globe shows you can’t force a disliked or misunderstood payment method on customers in new markets. You need to understand and then offer the payment method (or methods) for each country.

3. Ignoring the cost and pain of FX

Sticking with the payments theme, foreign exchange (FX) is another challenge any business scaling internationally will quickly become aware of. 49% of businesses are frustrated by the pain of collecting payments abroad*, and it’s the murky world of FX that plays a big role in this frustration.

FX fees eating into your profit margin could include exchange rate fees, added in to increase the broker’s fee; wire transfer fees, which you're forced to pay to actually move the funds; and small-print costs, like account fees and maintenance fees.

And every new market that involves a new currency compounds these potential fees. It’s vital that you work with a payment provider that can facilitate FX in the fairest and most transparent way possible.

GoCardless, for example, charges competitive transaction fees, with no hidden pricing or commission in the exchange rate. This rate is surfaced when you create a payment, and helps you predict exactly how much of the payment collected will arrive in your bank account after being converted into your own currency.

4. Sticking too rigidly to ‘tried and tested’ sales and marketing activities

While it’s true that having a consistent brand is important, relying too heavily on the sales and marketing tactics and channels that have worked in your home market is setting up your expansion for failure. According to Harvard Business Review, failing to adapt to local cultures in your marketing is one of the biggest mistakes in global marketing.

This failure to localise could be as simple as choosing a social channel that isn’t as popular in your newest territory. Or it could be as fundamental as completely misunderstanding how potential customers like to do business.

Local regulations can also cause your global marketing efforts to come undone. Take GDPR. While European businesses have now adapted their communications and approaches to privacy to adapt to the regulations, businesses outside of Europe might not be as prepared. This is just one example of local rules and regulations commercial teams will need to adapt to when entering new markets.

5. Underfunding international expansion

Not all international expansions require the same amount of funding. A well-trodden path for European businesses is to expand into other similar-sized European countries, but so is expanding into the US. The US market will require a lot more investment and effort to engineer a successful go-to-market.

Take UK ride-hailing app Hailo. It had found some success in Europe, and even raised $77million in investment to help fund its US venture in 2013. Despite this, Hailo lasted less than 18 months in the US before packing up operations and heading back to Europe.

And while $77million might seem like a ‘well-funded’ expansion pot, Uber had already raised $1.5 billion by the time Hailo pulled out of America.

How do you avoid making these mistakes?

Unfortunately, there’s no ‘one simple trick’ that’s going to make international expansion easy. It’s a complex and long-term challenge for every business that attempts it. And while you can learn from others’ mistakes, you can’t always see the potential problem (any business involved in globalisation efforts during COVID-19 will attest).

But there are a few tactics you can employ to expose your business to as many potential problems - and subsequent solutions - as possible.

Build and follow an international expansion playbook

An international expansion playbook is a way for your business to document your strategy and learnings on globalisation. As Pranav Sood, in his previous GoCardless role as Director of International Expansion, points out, having an international expansion playbook clarifies role and responsibilities and creates organisational muscle memory.

Listen to local experts

The simplest way to avoid making cultural and regulatory mistakes is to put the trust in the local experts you’ve hired. There may be existing team members heading to new countries to provide a connection between HQ and the new satellite office, but they should make the most of the expertise of local hires.

Work with partners tailored to your new markets

In a similar vein to putting trust in local team members, local partners can make the process of setting up operations in a new country considerably easier.

Using payments as an example, if your new customers demand a certain payment method, make sure your payment provider can offer that payment method.

Cater to local payment preferences

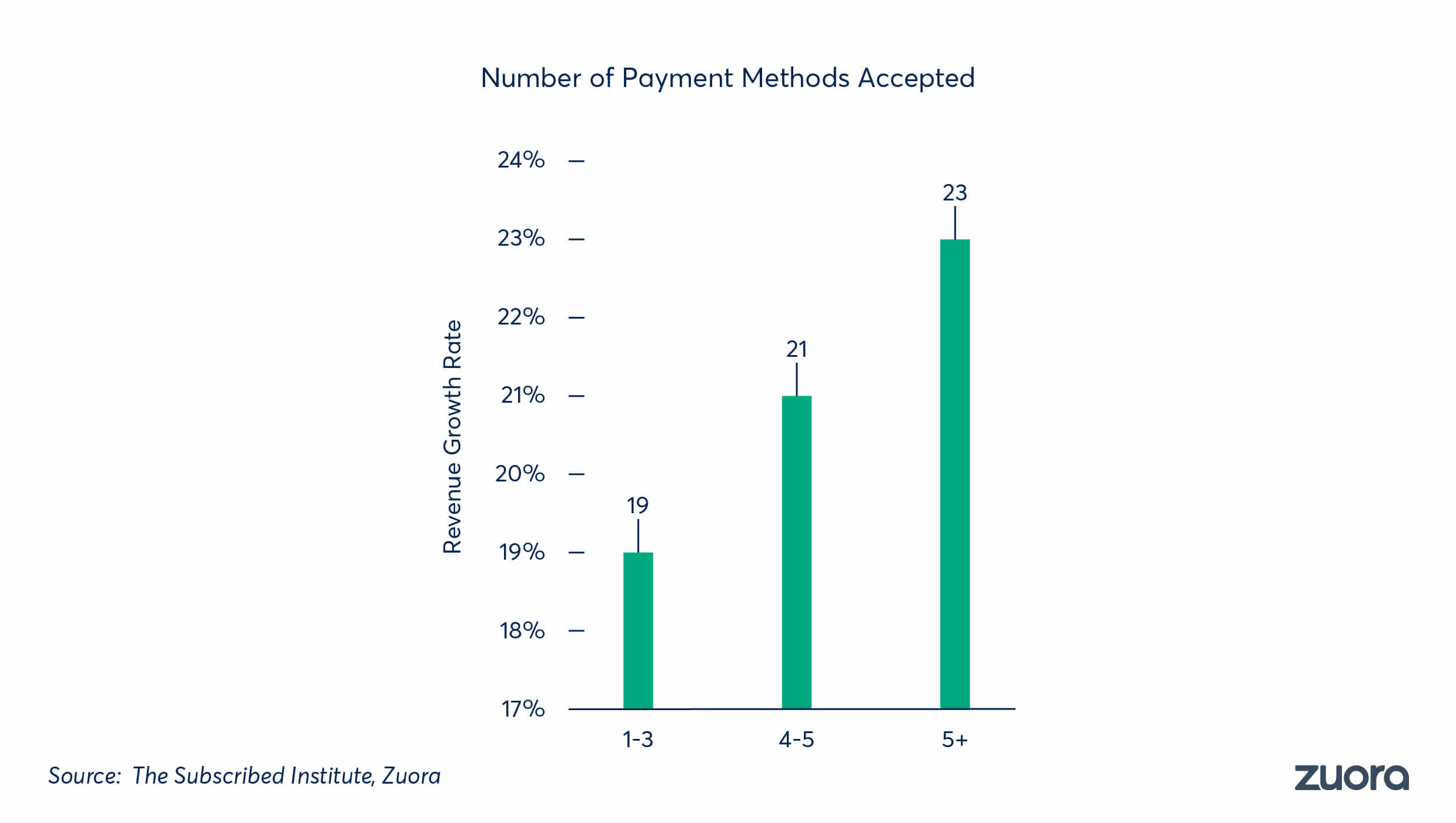

Catering to different customer payment preferences enables your business to attract a greater customer base. Companies that accept more than five payment methods have, on average, 4% higher subscriber growth than those that accept three or fewer methods. Find out more about payment preference in different markets in our B2B and consumer preference reports.

GoCardless is the only global platform to collect recurring payments from your customers' bank accounts and settle them back in your home country, with FX dealt with automatically. Doing business globally is hard enough, don’t add payment processing to your list of problems. Whether you’re an established global player, or just starting to expand abroad, speak to our global payment consultants about the right payment method for your business.

*All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 741 adults (senior decision-makers in private businesses of 50 or more employees). Fieldwork was undertaken between 14th - 30th October 2019. The survey was carried out online.