The 8 dimensions of recurring payments: Preference

Last editedJun 20213 min. read

How do customers actually want to pay?

Have you ever stopped to ask: “How do my customers in different countries actually want to pay for my product?”

It’s worth thinking about. Letting people and businesses pay in the way they want can make the difference between a customer won and a prospect lost. It should be a core part of your growth strategy, particularly when thinking about international expansion.

Giving people their choice of payment method is what we call Preference, and it’s one of the 8 dimensions of recurring payments. To help businesses understand how to improve their recurring payment strategy, we created a framework to find, measure and optimise operational inefficiencies and help you decide which strategy is best for your business. That framework became the 8 dimensions of recurring payments.

For an overview, read our introduction to the 8 dimensions of recurring payments framework and how you can use the framework to assess and improve your recurring payments strategy. You can see each of the dimensions and how they fit together below:

This guide will focus on Preference, one of the dimensions involved in ‘customer acquisition’ (i.e. increasing the size of your customer acquisition funnel).

What is payment preference?

In simple terms, payment preference is a measure of payers who choose a particular payment method. Some people prefer to pay with credit cards, some using cheques, and some will prefer bank debit (often called Direct Debit in Australia). If you don’t offer the right payment mix some people might choose to not pay for your product.

And preference isn’t always the same across countries and industries. Some countries have a much stronger preference for one kind of payment method that may be disliked elsewhere.

Why is payment preference important?

As we’ve touched on already, payment preference impacts what portion of your prospects make the final step and become customers. Offering more payment methods that your overall customer base wants can increase your revenue growth rate by as much as 4%.

Finding the right payment mix to meet customer preference also increases conversion (i.e. it increases your chance of acquiring a customer).

But how do you know what the preferred payment methods are for your customer base? GoCardless has done the hard work for you. In partnership with YouGov, we surveyed over 19,000 businesses and consumers in major markets around the world to find out.

B2B payment preference

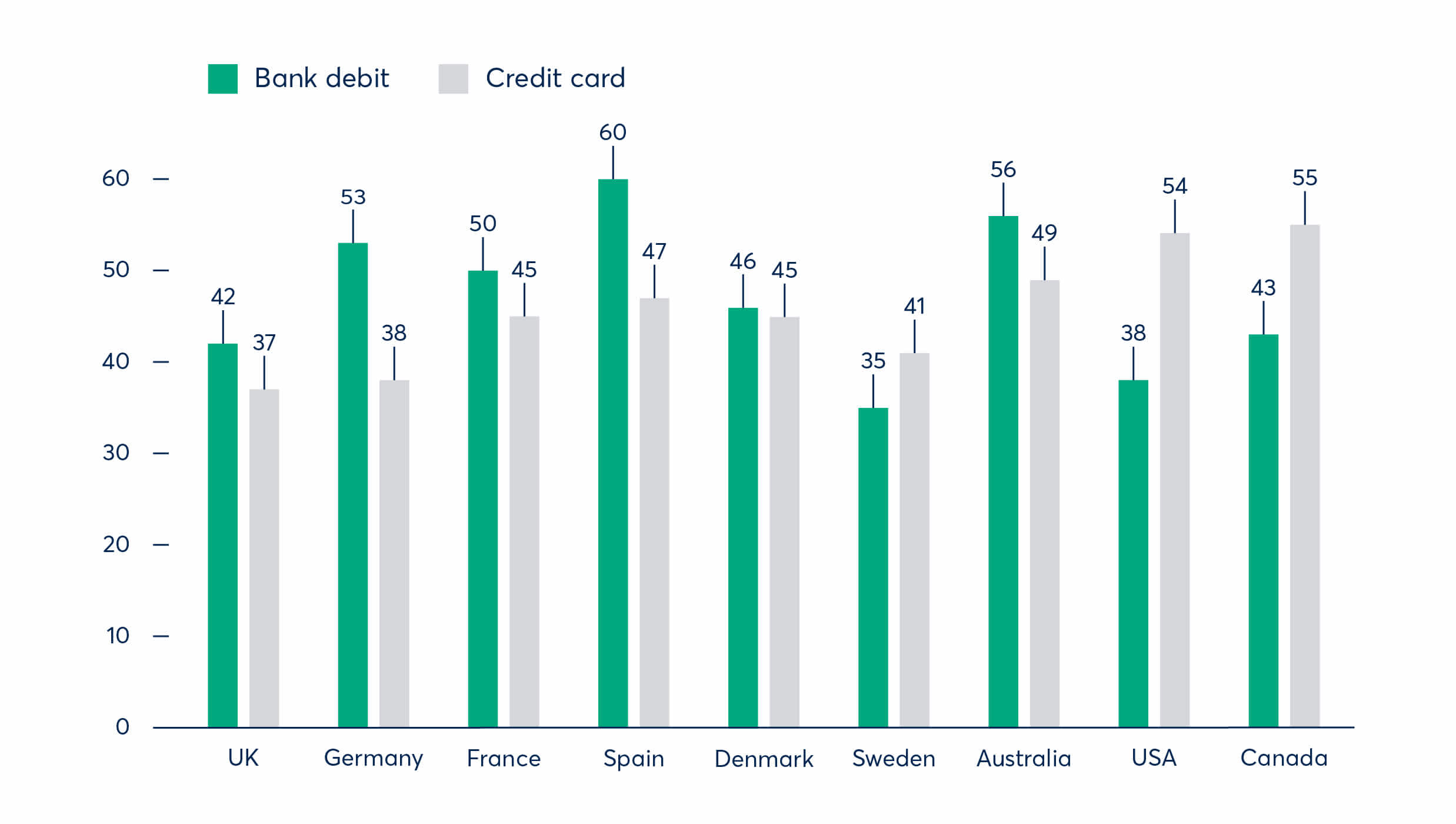

We surveyed almost 5,000 businesses across the UK, France, Germany, Spain, Denmark, Sweden, USA, Canada and Australia on what their payment preferences are for four typical recurring purchase use cases: regular business bills, invoices, digital subscriptions and instalments.

The full results can be found here.

Looking across all nine markets and four payment use cases surveyed, we found that the preference to pay with bank-to-bank methods was on average higher than other payment methods. 42% of global respondents preferred to pay with bank debit. The next most preferred payment method was bank transfer (36%).

In Europe, there is a clear preference for bank debit. In the UK, France, Germany and Spain, bank debit is the most preferred method for B2B digital subscriptions, with between 42% and 60% of respondents saying they would be likely to pay with that method.

However, in North America, Corporate Cards dominate. For digital subscriptions, for example, 54% of US respondents would be likely to pay by corporate card, as would 55% of respondents in Canada. But even in a card-dominated landscape, preferences do differ. 15% of respondents in North America would be unlikely to pay for their invoices using a corporate card.

Chart showing B2B preference (% of respondents likely to pay with the payment method) for bank debit vs. credit card for digital subscriptions.

Consumer payment preference

GoCardless partnered with YouGov to survey 15,424 consumers across the US, Canada, UK, France, Germany, Australia, and New Zealand. The survey looked at four typical recurring purchase use cases: household bills, traditional subscriptions, digital subscriptions and instalments.

The full results can be found here.

The report found that consumer preferences differ enormously across the world, and as consumer choice increases our payment preferences have become more varied and more personal. For example, only 7% of German consumers prefer to use credit cards, while 23% of US consumers consider credit cards their preferred payment method.

One common theme is that consumers want alternatives to the typical default payment methods of credit and debit cards. In the UK, a surprising 57% of respondents actually preferred bank debit, with a similar picture in France (42%) and Germany (39%).

“The way customers want to pay in different markets is fundamentally different. In Europe, bank debit is extremely prevalent. Our customers demanded it and now 70% of our European customers have chosen to pay through GoCardless (bank debit) over credit card to make their payments.” - Siteminder

How to influence payment preference

While people have their own preferences on what payment methods they want to pay with, businesses can influence their customers’ payment preferences by taking certain actions during the payment process.

It may be more cost-effective or take less time to process one kind of payment over another. And while it might be pertinent to offer multiple methods, your business would be more efficient and able to grow faster if your customers choose one method over the alternatives.

To influence a customer’s preference, you need to make sure the payment method you want them to use is seen as simple and trustworthy. You can also incentivise customers with tangible benefits to use that payment method.

GoCardless can help you add bank debit to your payment mix

Bank debit is a popular payment method in many countries for many types of recurring payments. If you think you are losing out on potential customers, then GoCardless is on hand to help you add bank debit to your selection of payment methods.

With GoCardless, collect payments using bank debit in more than 30 countries. Bank debit can coexist with other payment methods to create a best-in-class checkout experience.

“To date, wherever we offer GoCardless it’s the preferred payment option, with 50%-85% adoption. For us, it means we get paid reliably and on time with better visibility into our payments data.” - Quandoo