Request a free demo

Schedule a live demo with one of our payments experts at your convenience.

We can learn about your requirements, answer questions and look at ways GoCardless can help your organisation improve cash flow and reduce the time to get paid.

Why GoCardless:

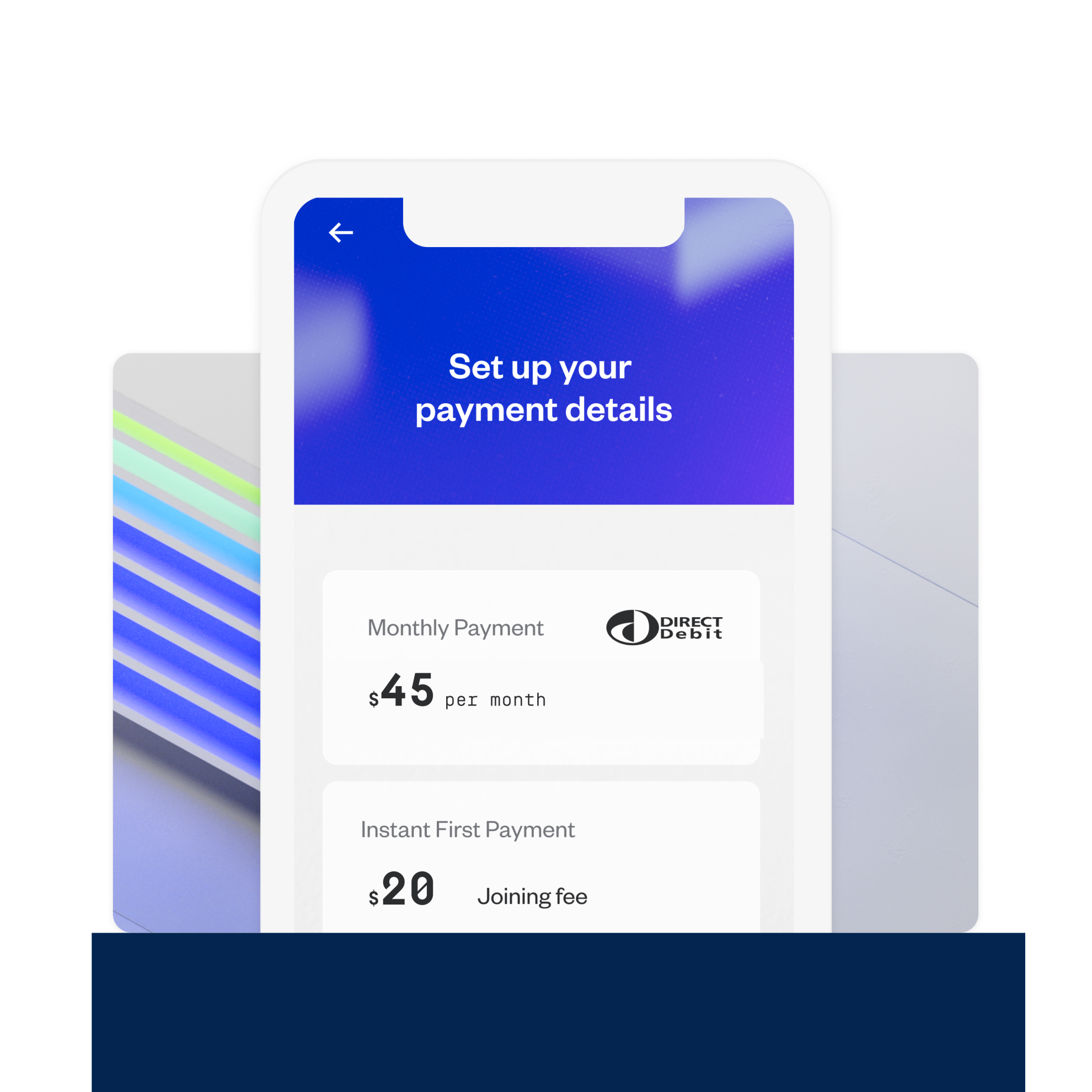

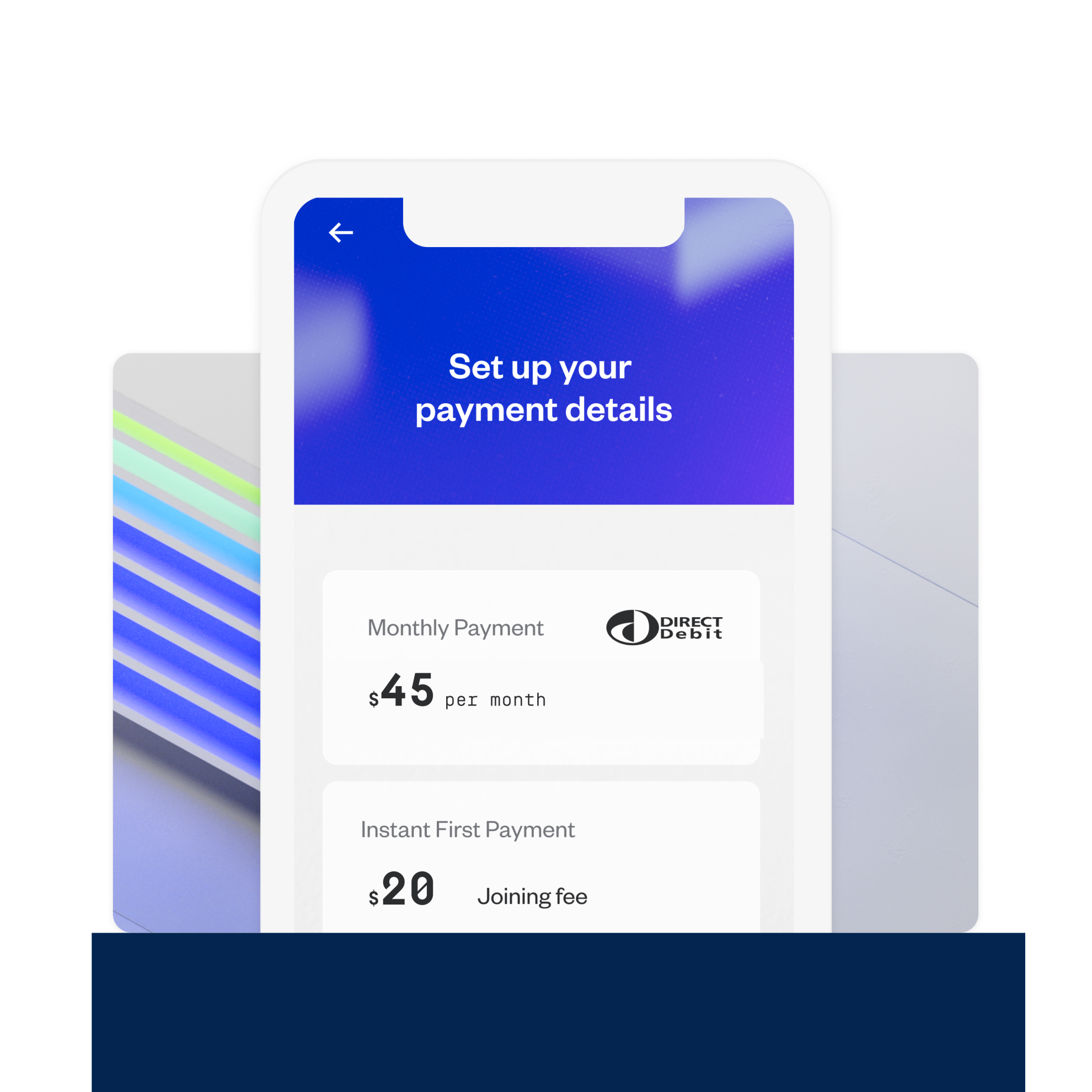

Pull-based payment

You can take control of when you collect payments with our account-to-account payment platform. Pull payments directly from customers’ bank accounts at the time an invoice is due.

97.3% first time collection

With GoCardless, 97.3% of payments will be collected successfully at the first attempt. You can also recover over 75% of at-risk payments with our intelligent payment recovery product Success+.

Reduce churn

30% of churn is involuntary, stemming from failed payments. Maximise your payment success with GoCardless and retain your loyal customers for longer.

API integration

Our RESTful API is designed for a simple integration, which requires minimal investment of resources and connects seamlessly to your business.

Built for security and scale

ISO27001 certified

Security protocols across our business, services and products have been fully audited and certified with this globally-recognised international standard.

GDPR compliant

The GoCardless global data risk management programme is built to strict GDPR standards and applies privacy best practices to help protect and respect personal data.

Trusted by global businesses

GoCardless processes $13bn+ annually, and has been funded by prestigious investors including Google Ventures and Salesforce Ventures.

Compliance built-in

We handle the complexities of bank debit across 30+ countries in a single integration.

G2 Ratings

Our customers ranked us #1

95% would recommend us

We work hard to support businesses with their payment collection. Our customers have ranked us #1 in the G2 Payment Processing Relationship Index Report, ahead of Stripe Payments, BlueSnap, and Worldpay.

“We want our global customers to have access to simple and easy payment methods when purchasing DocuSign, and offering GoCardless as a key payment option helps us achieve this. Offering bank debit as a payment option means customers are able to complete quick and easy transactions”.

Beverly Tu, Director of eCommerce Growth, DocuSign

Trusted by over 60,000 businesses globally

Ready to reduce your time to get paid?

Speak to a payment expert to learn how you can optimise your payments strategy.