Real-time direct debit payments explained

Last editedJun 20242 min. read

The New Payments Platform (NPP) was introduced in 2018 to facilitate instant bank-to-bank transfers 24 hours a day, 7 days a week. Similar to Australia’s Consumer Data Right (CDR) or ‘open banking’ offering, the NPP framework is built upon an open access infrastructure, which enables third party providers to develop ‘overlay’ services. These are products or services that use the NPP as its foundation. This framework was designed with the aim of driving payments innovations that ultimately benefit the end-consumer, just like open banking.

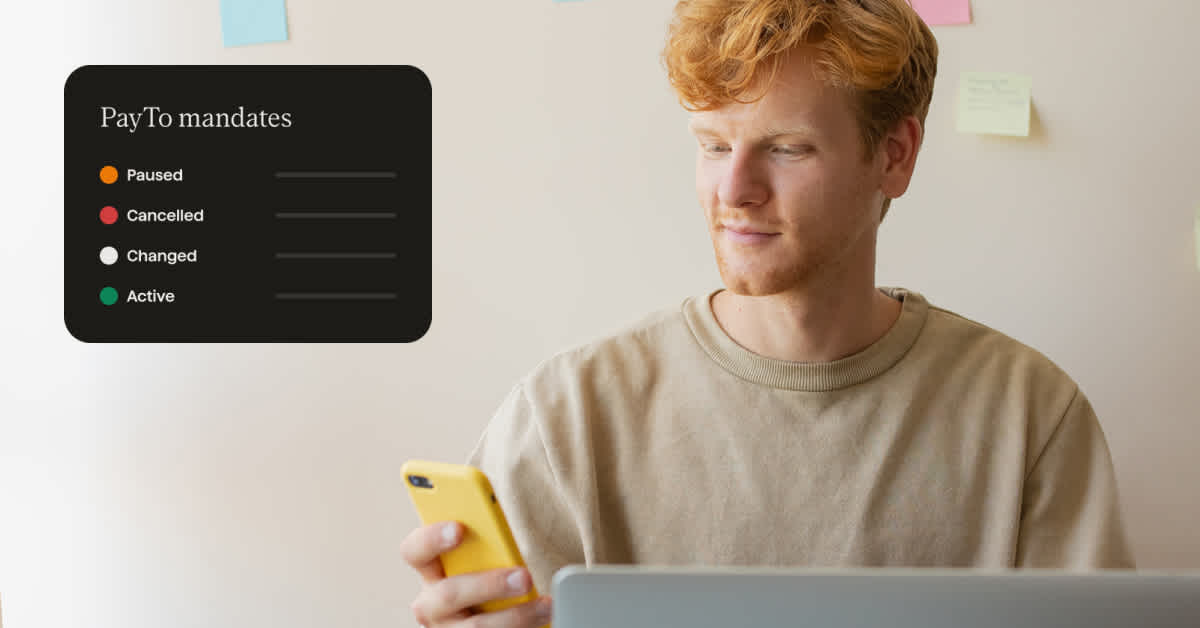

There continues to be new iterations of and features within the framework, creating more efficiencies for businesses and consumers alike – the latest of these being the ‘PayTo’ capability. In addition to the foundations of the NPP, PayTo presents a groundbreaking milestone for users of bank-to-bank direct debits, who rely on the service as a secure, cost-effective and reliable method of payment. Prior to the introduction of the NPP and its PayTo function, one of the pain points of direct debits as a payment option was the time lag between transfer and receipt. However, with the framework maturing and adoption rapidly rising, consumers and businesses alike can now rely on direct debits for its speed and efficiency to split those hefty dinner bills with friends or to settle invoices instantly, dramatically improving business cash flow!

While structurally, Australia’s NPP and open banking frameworks feature some similarities, the two operate on a very different level. The open banking framework in Australia is designed to increase competition between service providers in the financial services industry while NPP’s objective is to accelerate the speed, availability and simplicity of bank transfers. Both, however, exist to drive innovation across a range of sectors.

One of the core innovations of the NPP is PayID. PayID simplifies bank transfers by allowing account holders to link a simple identifier – mobile phone number, ABN, business name or email address – to their bank accounts. This singular ‘PayID’ enables recipients to receive funds without the need to share multiple details such as BSB, account name and account number. A confirmation step also aids to reduce payment errors, making the system seamless and secure.

As of mid-last year, five million PayIDs were registered by Australian consumers and businesses, pointing to the rapid adoption of the NPP and an increase in consumer demands for real-time payments. According to NPP Australia, the uplift in adoption is a direct result of word-of-mouth, suggesting consumers are well and truly welcoming the useful innovation.

While fast payments are a core feature of the NPP, it is only the beginning. To optimise the potential of NPP and open banking, many providers are now tying the capabilities of both offerings together to create long-awaited innovations in the FinServ sector. For example, according to a KPMG analysis, NPP and open banking could work in tandem to streamline the house-buying process by pulling data from multiple accounts for a pre-approval, managing the exchange and signing of contracts electronically and even facilitating the real-time payment of the all-important deposit. With the open access of data from open banking and the speed of the NPP, the possibilities for additional innovations are limitless. What can you envision for the future of finance with the power of NPP and open banking at the helm?

At GoCardless we have something big cooking – hint: it has to do with NPP and open banking! Our vision is to create a future for payments that will address the ongoing financial headaches that many businesses still grapple with today. Our innovations will help businesses unblock cash flow with real-time payments. Soon, the era of waiting one to three business days for a payment will be history. Businesses of all shapes and sizes will be able to access funds instantaneously and be offered the speed that’s necessary for competitive growth. Is your business ready?