Last editedDec 20203 min read

What is a balance sheet?

A balance sheet is a financial statement within a business that shows a static snapshot of the company's financial position - what it owns, what it owes and how much is invested in the business.

Also known as a 'statement of financial position', a balance sheet is one of the core financial statements within a business, alongside the profit and loss (P&L) statement, cash flow statement and aged debtor reports.

A balance sheet breaks down into three key areas:

Assets – The things you own in the business (e.g. cash, accounts receivables and any plant, equipment, vehicles and property)

Liabilities – Also referred to as 'debts', these are the things you owe other people (e.g. unpaid supplier bills and outstanding loan payments you’re due to pay)

Equity – The cash you initially invested in the company, plus any additional income you’ve made (or losses incurred) over time

As a financial statement, the balance sheet shows the current worth of the business, frozen in time on the date you run the report. As the owner or MD of a small or medium-sized business (SMB), your real world experience will be of the constant challenge of boosting your cash position, reducing debt and turning a healthy profit. The balance sheet, in combination with your P&L and cash flow statements, allows you to predict your current financial position more clearly – and take action where it’s needed. As such, a balance sheet is useful in showing whether you're able to meet your short-term financial obligations, as well as often being a required document when securing a loan or other capital.

What does a balance sheet look like? (Balance sheet example)

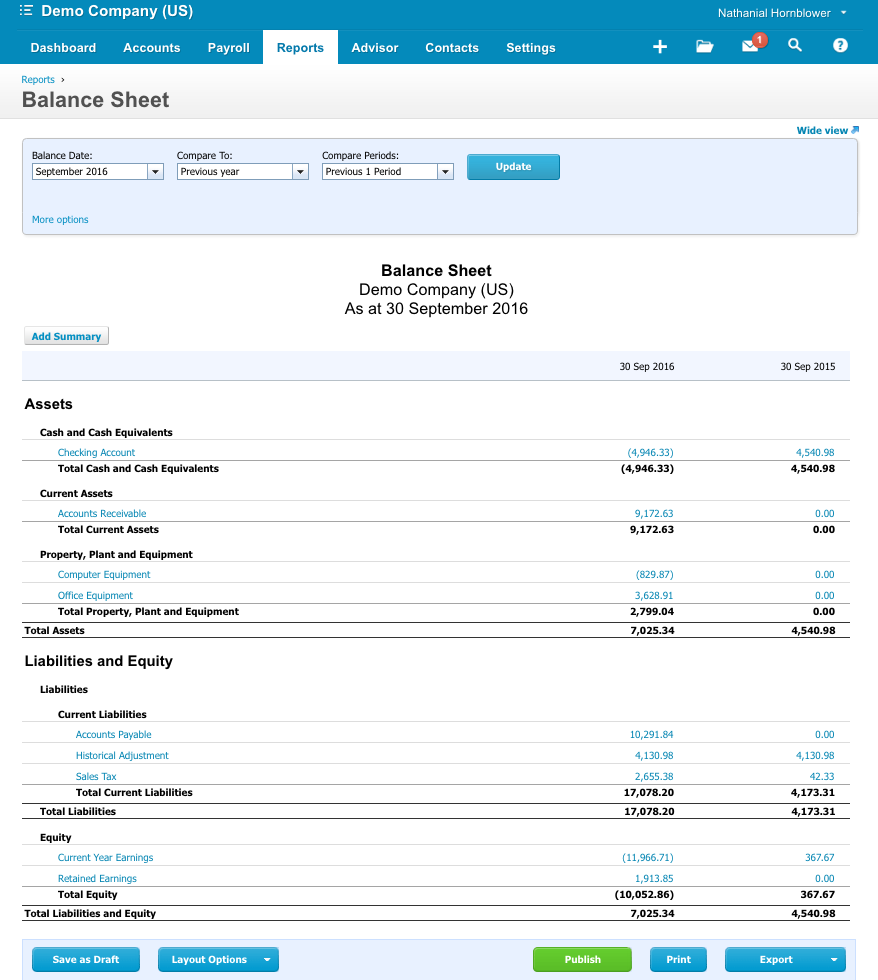

A balance sheet is broken down into the following key sections:

Assets

Current assets – The cash you have in the business

Investments – Including any bonds or long-term investments

Property, plant and equipment – All the equipment and tangible assets you own

Intangible assets – Things like your intellectual property and copyrights you own

Other assets – Any long-term assets that don’t fall into the prior categories

Liabilities

Current liabilities – Any debts you owe and must pay within a year of the balance date

Long term liabilities – Anything you will owe beyond one year of the balance date

Equity

Paid-in capital – The money invested by you and your fellow shareholders

Retained earnings – Net income, minus any dividend payments or owner drawings

Accumulated other comprehensive income – Income that doesn’t fall under the net income balance (e.g. income or losses from foreign currency or pensions liabilities)

Treasury stock – Any shares that you’ve bought back from other shareholders

The screenshot below shows a typical balance sheet in Xero.

How to build a balance sheet

If you go to the ‘Reports’ section of your accounting software, most platforms let you create a balance sheet with one click. This will show you the balances of your assets, liabilities and equity as they stand on today’s date – or change the date to look back at prior balances.

As a general rule, your aim as a business owner is to build what’s known as a ‘strong’ balance sheet. And the key to this is to manage your finances in a way that balances the two main sides of this equation – your assets and equity.

For your business to be in a healthy financial position, you need to work on the following elements of your balance sheet:

Working capital – The company’s working capital is the difference between the value of your current assets (things like cash, unpaid customer bills and your inventory) and current liabilities (bills you must pay, or other payment obligations).

Asset performance – Your asset performance measures how well you can take your operational resources (assets and equipment in the business) and use them to generate revenue and profit as a trading company. The stronger your current year earnings are, the better the company’s assets (and your management strategy) is performing.

Capitalisation structure – Managing the proportion of equity and debt in the business helps you build a robust capitalisation structure. Equity = the capital (money) invested by shareholders, while debt = any money you owe, or money that you’ve borrowed in the form of loans or other types of financing.

How to use your balance sheet

If you’re using cloud accounting software, you’ll have the benefit of up-to-date financial information and, potentially, access to real-time data in your financial statements.

By running a balance sheet report, and proactively reviewing this statement of financial position, you have the best possible financial data on which to base your day-to-day financial management and longer-term business decisions.

To build a strong company balance sheet, you must curate your finances in a way that:

Maintains a high level of capital (so you have the cash flow and working capital to trade).

Drives optimum performance and generates equity (profits).

Keeps your debts low, so you reduce the liabilities side of the balance sheet.

Working with an experienced accountant or business adviser is one way to drive the health of your balance sheet. They’ll be able to offer practical advice on maintaining the correct level of working capital, managing debt effectively and driving your long-term profitability.

With a detailed understanding of the balance sheet, you know your financial position and can get proactive in building and strengthening your key balances.

We can help

A healthy cash flow is a key factor in achieving business growth, making an efficient payment system like GoCardless a great investment. Find out how GoCardless can help you with ad hoc payments or recurring payments.