Get paid faster: Strategies for collecting money from customers

Last editedJune 20253 min read

Collecting money from customers is the lifeblood of your business, but getting paid isn't always straightforward.

From late payments and cash flow bottlenecks to awkward conversations about money, these challenges can hold you back. But late payments don’t have to be an inevitability of doing business. Here, we cover everything you need for an effective strategy to collect money from your customers, including essential invoice collection strategies, accounts receivable best practices and practical late money solutions.

Why does money collection matter to your business?

Effective cash flow management and robust invoice collection strategies are more crucial than ever for your business's growth and stability. When payments are delayed, it doesn't just affect your bottom line; it impacts your ability to operate, invest, and can even cause personal stress, not to mention the valuable time lost to chasing payments.

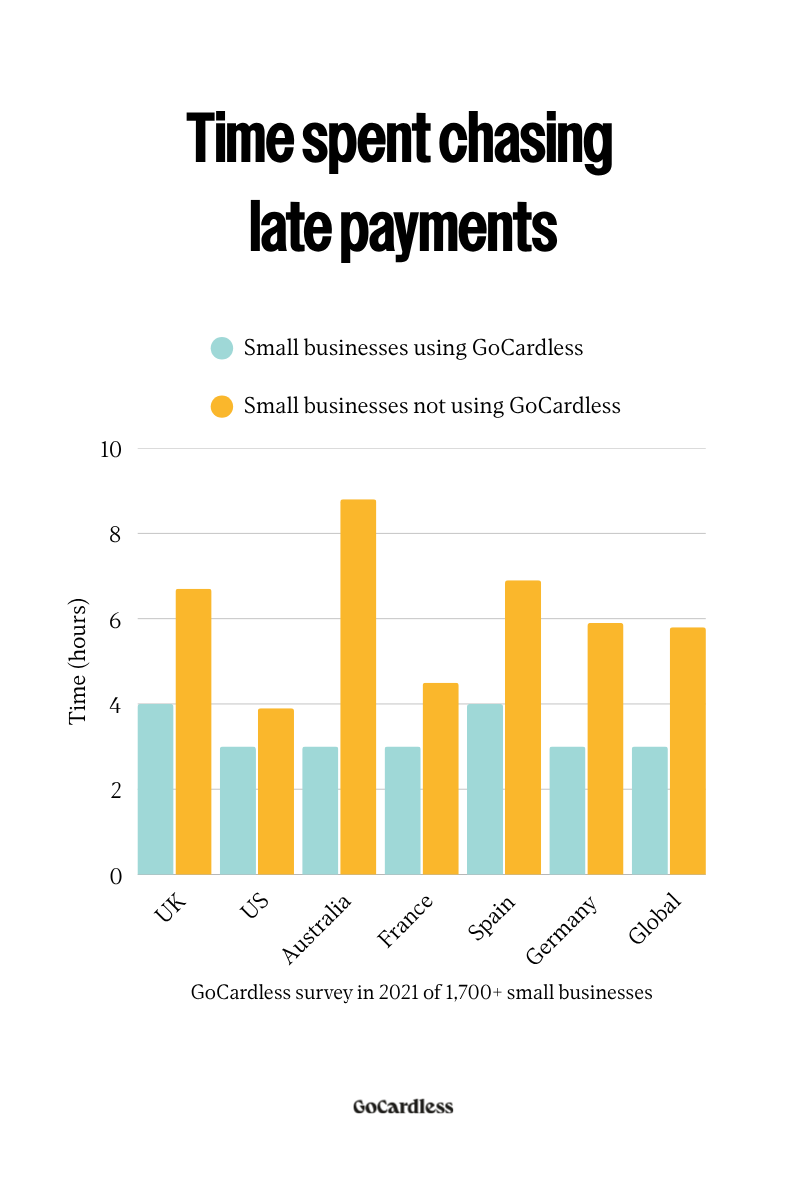

Source: GoCardless survey of 1,700+ small businesses

Our survey of Aussie small businesses found that for 43% of respondents, late payments significantly increased their personal stress.

What if a late payment turns into losing a customer? The cost to acquire a new customer can be five to 25 times more than retaining an existing one, and 30% of churn is involuntary.

What are the most common challenges businesses have when collecting money?

If your business invoices for products or services after delivery, then unpaid invoices become your accounts receivable. Chasing these late payments and handling overdue accounts costs your business more than just missing funds.

Every delayed payment isn't just a number on a spreadsheet; it's a missed chance to invest in new equipment, launch that exciting marketing campaign, plan for the growth of your business, or hire the talent you need to scale. Healthy cash flow gives you the power to negotiate better deals with suppliers, make the most of unexpected opportunities, and you can better weather unforeseen storms in an unpredictable economy.

Payments fail and are delayed for a number of reasons, from credit cards being lost, stolen or expiring to insufficient funds in an account or even payment gateway errors (the systems that process payments).

We answer some common questions on the challenges of collecting money:

How can I streamline my invoice collection?

How can I use technology and AI to collect money faster?

How do I create an effective communication strategy for collections?

How do I juggle my cash flow with customer relations and have an effective debt collection policy?

1. How can I streamline my invoice collection?

Do you spend over 8 hours a month, like other small businesses, chasing late payments?

Save time with these best invoicing practices and invoice collection strategies:

Standardise templates: Create reusable, easily editable templates. This saves time and provides customers with consistent information.

Clear payment terms: Always set and communicate explicit payment terms, such as Net 30 (30 days). Being upfront about due dates makes it easier for customers to pay..

Flexible payment options: Automate your payment methods to offer flexible money options like one-off payments, instalments, or customer money plans without extra admin. Money processing solutions like GoCardless empower you to leverage automated Direct Debit and bank payments, eliminating manual hassle.

2. How can I use technology and AI to collect money faster?

Automation is key to preventing late or failed payments. Automated money reminders using an email marketing tool can significantly encourage on-time payments. By automating emails or notifications about upcoming payments, you save time and move towards improving your cash flow.

Even with proactive measures, payments can fail. That's where late money solutions come in. You can leverage money collection software to automatically retry failed payments when customers are more likely to have funds. This approach saves you from awkward conversations and helps maintain positive customer relationship management.

3. How do I create an effective communication strategy for collections?

Preventing the hard conversations. This could be as simple as asking your customers to move to a more reliable and automated payment method so you can avoid late payments altogether. We’ve built some great email templates, ready to copy and paste, to help small businesses using GoCardless encourage their customers to make the switch.

When a payment is late, a robust strategy for effective communication is crucial:

Start early: Don’t procrastinate. When chasing an unpaid invoice, the payment is already late, and you can’t use this money to run or grow your business.

Structure conversations clearly:

One to three days late: A gentle, firm-but-friendly email nudge with the invoice attached is often enough for genuine oversights.

Seven days late: Send a follow-up email stating the invoice is outstanding, requesting payment within, say, 14 days to avoid escalation.

Twenty-one days late: Emails can be ignored, but a phone call is harder to dismiss. Prepare for potential excuses before making the call.

Thirty+ days late: If no payment or meaningful contact, consider a formal letter before action or passing the matter to a debt collection agency.

4. How do I juggle my cash flow with customer relations and have an effective debt collection policy?

You don't have to sacrifice customer relationships to maintain healthy cash flow. Customers can be late to make a payment for many genuine reasons, and a well-defined debt collection policy, approached with the right attitude, can contribute to long-term customer loyalty.

Five key elements of a fair and effective debt collection policy:

Transparent terms: When you issue an invoice, clearly state all payment terms and accepted payment methods. This prevents misunderstandings and sets expectations.

Consistent communication: Plan a system for consistent and effective communication, including automated reminders. Documenting these interactions protects your business and provides a clear history in case of disputes.

Flexible payment options: Offering flexible money options like instalment plans for overdue payments can help customers pay and bring cash back into your business, boosting customer relationship management and improving payment rates.

Clear escalation process: Define a clear process for escalating overdue accounts from initial reminders to final collection actions. Ensure this process complies with all relevant laws and regulations.

Negotiating fair money plans: It’s best to handle these conversations calmly and empathetically. Bring different options for resolutions that you’re comfortable with to the table, like different repayment plans, but be clear about your boundaries.