Why dishonour fees are unfair and ineffective

Last editedFeb 20253 min read

Collecting membership fees isn’t a glamorous part of owning a gym. But it is essential. Especially in challenging economic times, staying on top of payment collection can be the difference between your business staying afloat, or failing.

More than a quarter of Aussie SMBs estimate losing up to $6,000 from late payments each year, with one in ten saying they lose $12,000 to $30,000. 55% are concerned the number of late payments will rise in the next year.

Money talk is awkward

Does this sound familiar? 43% of SMB owners say avoiding conversations about money with customers has caused them increased stress. 29% say they’re afraid of coming across as rude and 27% say they don’t want to upset their customers.

The rewards for getting payment collection right are compelling:

31% of gym owners say that if their customers paid on time they would have more time to grow their business

30% say it would allow them to pay their suppliers sooner, and 28% say they’d invest in other areas of their business.

Why don’t customers pay on time?

As Jonathan Quieros, Owner of Dukes Gym says, “If you've offered a service and delivered, you should get paid. There's no reason why you should feel awkward about asking for what you've agreed on.” Understanding why people don’t pay on time helps identify how to collect payments.

Customers generally fall into one of four categories:

Those who want to pay but it’s hard for them to pay

Customers who want to pay and it’s easy for them to pay

Customers who don’t want to pay and it would be hard for them to pay

Customers who don’t want to pay, but it would be easy for them to pay if they wanted to

Dishonour fees are ineffective and unfair

Many payment providers are still charging members dishonour fees when payments aren’t collected on time. Some gym owners aren’t even aware this charge is being added. Dishonour fees may compel customers in category four to pay on time. But they’re less likely to have an impact on payments from customers in categories one and three.

It’s an unnecessary and antiquated approach and it’s not fair. “In good economic conditions or bad, punishing people who are already struggling financially is fundamentally wrong. Dishonour fees are not only outdated but also predatory - and there’s no reason for them to exist besides driving profits,” says Luke Fossett, General Manager, GoCardless Australia and New Zealand.

Gyms deserve to get paid, and there’s a modern approach that works

There’s no need for gym members to pay dishonour fees of up to $35 on average membership fees of $63. Modern payment platforms can increase successful payment collection without angering members.

You don’t need to collect credit card details that expire, or run up dishonour fees on customers’ accounts. With PayTo instant payments, fees can be collected directly from customers’ bank accounts. There’s real-time account verification to ensure funds are available - reducing failed payments.

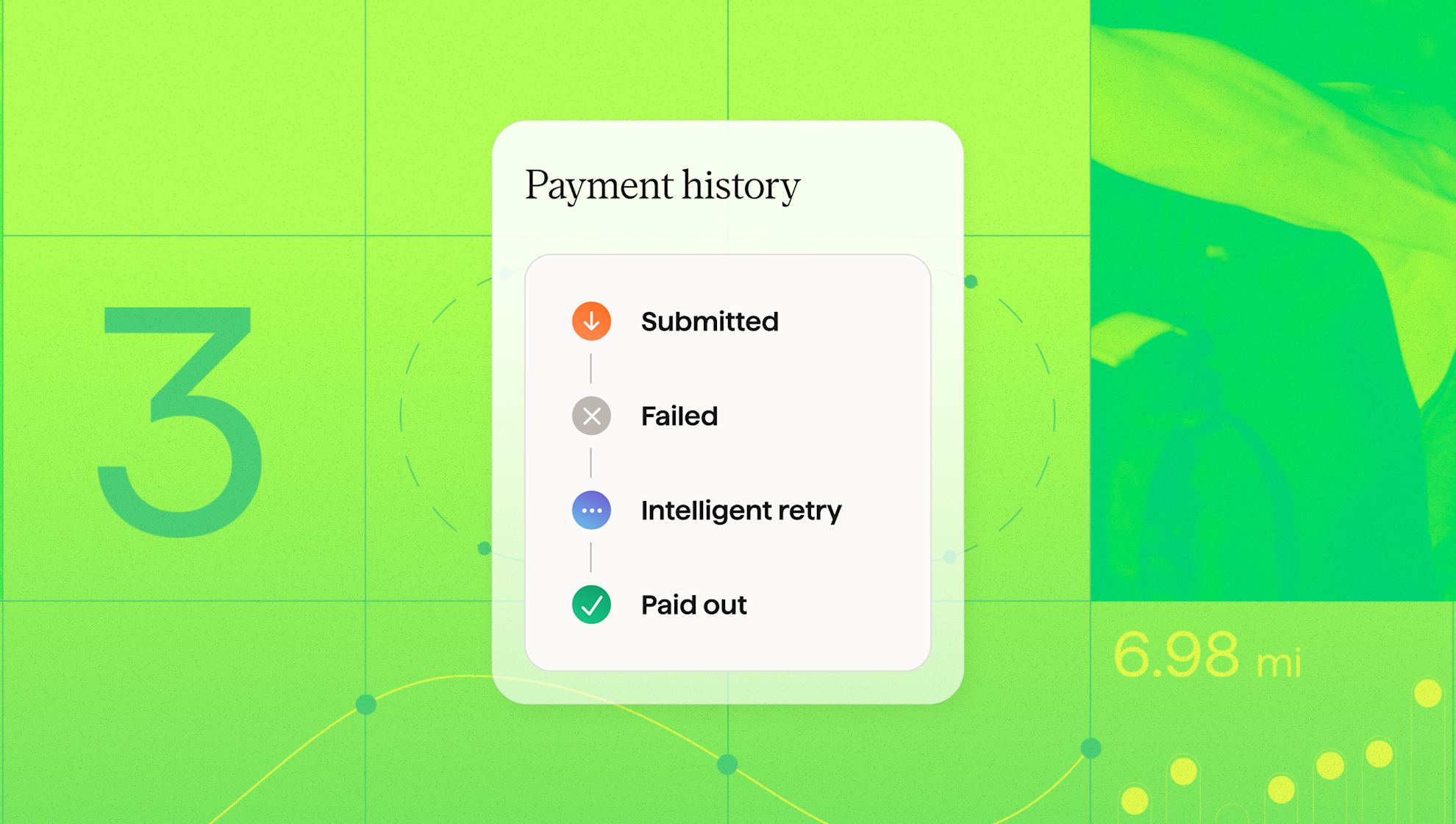

Payment platforms like GoCardless go a step further, identifying when payments are most likely to be successful and intelligently adjusting payment windows accordingly.

For example, GoCardless has identified that for gym customers:

the first, fifth and eighth days of the month are often days with the highest rate of successful payments

the 25th and tenth of the month have the highest rate of payment failures.

By using technology that better times payments, gyms can cut down on failed transactions and ease the financial pressure on their members.

How Dukes Gym eliminated dishonour fees

“We only offer one payment option and that's fortnightly Direct Debit by GoCardless,” shares Dukes Gym owner Jonathan Quieros. “The reason for that is GoCardless has full integration with our GymMaster member management platform so it makes payments a lot easier to manage.”

The two-way integration allows payment requests to be automatically generated in the CRM and sent to GoCardless for collection.

“We don't need to log into GoCardless to actually see who's paid us and who's not,” says Jonathan. “They really make it so we can focus on the bigger things and not let these little things trip us up. It's really great to see both companies working together and they’ve allowed us to take our sign-up process completely online.”

There’s a tangible impact on the bottom line too, the new approach saves the team around 20 hours a week, enabling them to spend more time on activities that increase revenue - with an upside of up to $100k.