Unlock international growth with GoCardless and Wise Business’ latest partnership

Last editedNov 20213 min read

GoCardless is excited to announce a new partnership with Wise Business, leaders in moving money around the world, that will transform the way businesses collect payments from their customers all over the world.

Our new network will be the only simple, compliant and transparent way to receive payments such as subscriptions, invoices and installments from overseas customers, all without the need to set up local entities and bank accounts, making collecting payments from customers easier than ever before.

What’s new: Don’t international payments already exist?

Until now, Australian businesses with international customers had to rely on expensive credit card transactions and hefty foreign exchange fees, made worse by the inability to establish physical bank accounts in overseas markets due to current COVID-19 circumstances. Our Australian customers can now access low-cost, convenient, multi-currency payments with their existing local bank account without being charged margin on exchange rates. GoCardless and Wise Business already offer this feature across global markets including the United Kingdom, Europe, the United States and New Zealand.

Since launching this framework, GoCardless has seen the volume of international payments across their global bank debit network increase by more than four times, demonstrating the pent-up demand to collect payments worldwide.

Most Australian businesses are using the most expensive, complex methods for international payments. Could your business benefit from more transparent, cost-effective payments?

A YouGov survey commissioned by Wise of 4835 micro and small businesses across 11 countries including Australia and New Zealand, revealed that complexity in managing multiple currencies and a lack of understanding of the true costs associated in cross border payments were the top deterrents for international expansion.

Only 23 per cent of Australian businesses could correctly identify that an international payment is made up of an exchange rate markup and an upfront fee. It is perhaps not surprising then to see expensive, non-transparent and old school payment methods 一 credit cards (55 per cent), bank transfers (57 per cent) and PayPal (64 per cent) 一 as the top three methods being used by Australian businesses.

Over half (54 per cent) of Australian businesses surveyed, said that the cost and complexity of managing international payments scuttled their international expansion plans. This has prevented these otherwise interested Australian businesses from entering a new market (25 per cent), growing their customer base (26 per cent) and buying new inventory (23 per cent).

Enabling a simple way more customers prefer to pay

Our partnership comes as businesses look to introduce more payment options that suit their customers’ preferences and facilitate international growth.

Account-to-account payments like direct debit are the widely accepted recurring payment method of choice, consistently ranked in the top three preferred payments across all use cases and countries, according to our recent consumer payment preferences 2021 report. In a global economy, cash and cheques are a thing of the past, with more than two times as many consumers having access to debit cards or bank accounts than cheques. Understanding the way customers prefer to pay is essential for businesses looking for payment partners that can support their overseas expansion. Customers want quick, easy and trustworthy payment experiences, especially when dealing with international merchants. With the GoCardless and Wise Business integration, we’ve made this possible.

What does this partnership mean for my business?

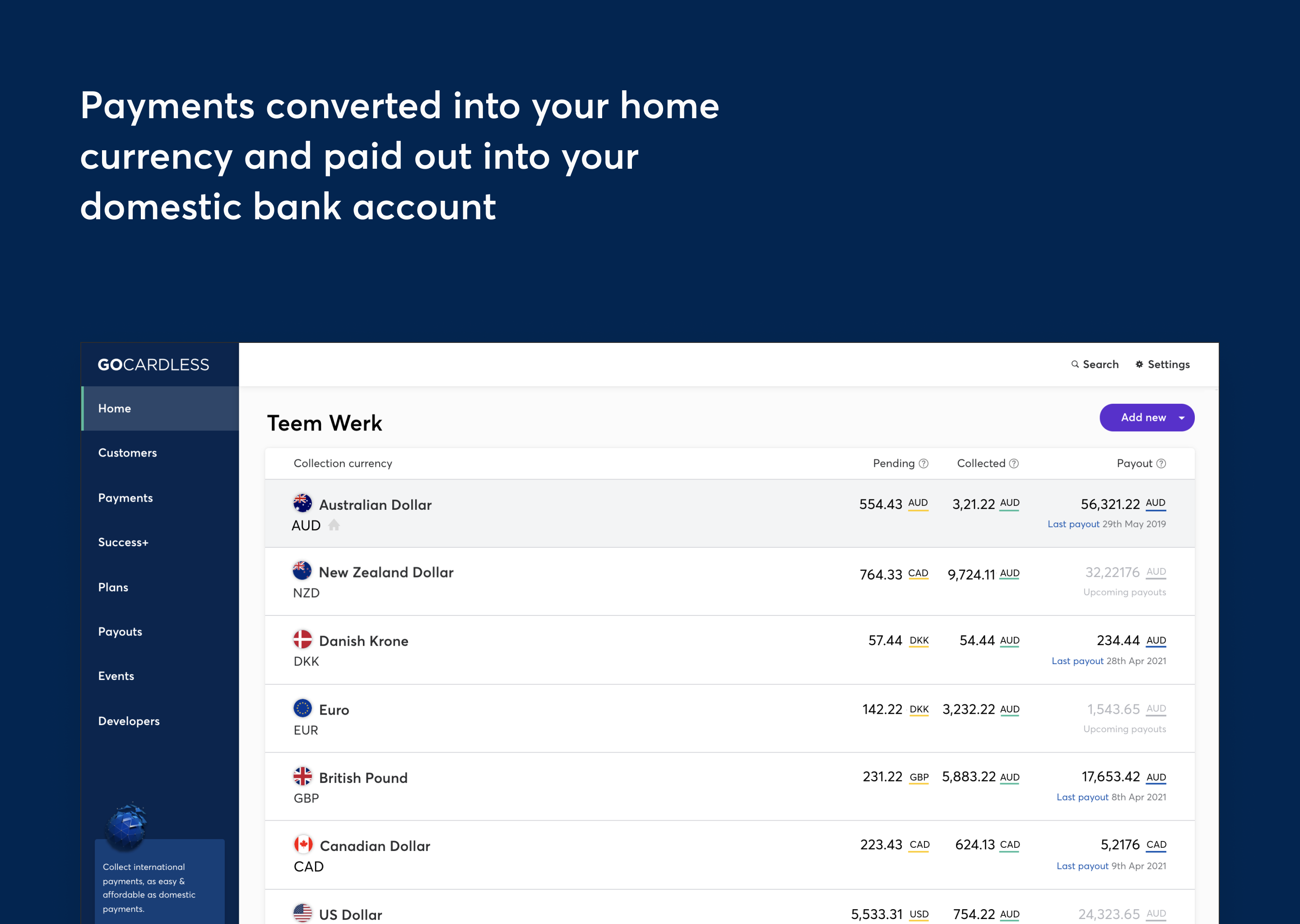

Merchants can now collect payments via multiple bank debit schemes internationally, through the GoCardless API, dashboard, or partner integrations.

This removes the pain of opening a new bank account and navigating the specific rules in every country where the business collects payments and eradicates FX fees. Businesses will be able to collect and pay out in over 30 countries worldwide and receive payments at Wise's fairest real exchange rate in GBP, USD, EUR, SEK, DKK, CAD, AUD, and NZD.

The network will be available to GoCardless customers from October 2021.

New Zealand customer Re-Leased is already experiencing the benefits of simplified international payments:

“I could see instantly that we needed to eliminate international transfers, where payments are made from customers in one country to a bank account in another. These transfers are common when you’re a start-up and you move into overseas operations, but they come with significant foreign exchange risk.

“International payments were taking between 3-5 days to land in Re-Leased’s account in New Zealand, and up to 25% of the transaction value was being taken in bank fees and FX.

"Rather than having to collect recurring payments by manual methods like bank transfer or cheque, GoCardless enables Re-Leased to collect automated international payments through Direct Debit, saving $10,000 a month of bank transfer fees,” he said.

-Sam Caulton, CFO of Re-Leased

To learn more about how GoCardless’ International Payments, powered by Wise Business can support international growth for your company, chat to one of our payments experts today.